2023 Hotel Development Cost Survey | India

Hotelivate is delighted to present the analysis and insights of the 2023 Hotel Development Cost Survey for India. This comprehensive survey showcases the results of an extensive review of the actual development costs of nearly 500 hotels, considering various positioning and locations. The survey encompasses hotels constructed between 2002 and 2022, providing valuable insights into trends and factors impacting the industry. We have relied on the HICSA Hotels of the Year Awards as an important source of data for this report. This forum has been utilized to collect and collate relevant data points associated with the hotel development cost.

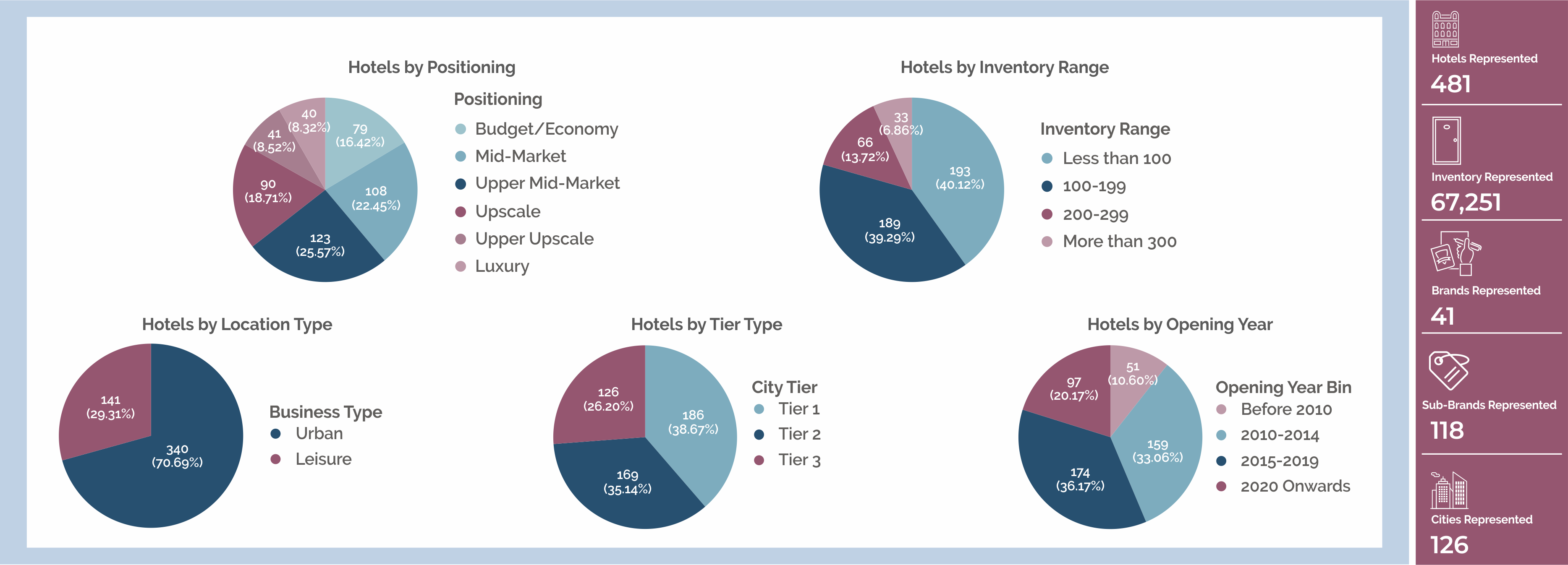

Our survey sample set consists of 481 hotels, comprising a total of 67,251 rooms, spread across 126 cities in India. This represents approximately 42% of the nation’s branded/organized hotel inventory, encompassing 41 hotel companies with 118 sub-brands. The cumulative investment for these hotels amounts to more than INR 71,000 crores.

To ensure accuracy and transparency, we acknowledge instances where the sample set profile may have influenced the survey results differently from the real-world trends. In such cases, we have provided necessary indications to offer a holistic view of the data. Additionally, this report includes qualifying conditions and the methodology employed in the meticulous analysis of the data.

We believe this survey will be instrumental in aiding stakeholders and industry professionals to make informed decisions, compare hotel development costs across different parameters, and navigate the dynamic landscape of hotel development in India.

Mid-Market and Upper Mid-Market hotels have the highest representation, accounting for approximately 48% of the total hotels surveyed. Remarkably, a significant majority of the hotels (79.41%) have an inventory of fewer than 200 rooms, indicating a prevalent preference for smaller-scale establishments.

Furthermore, the sample set exhibits a well-balanced distribution of hotels across Tier 1, Tier 2, and Tier 3 markets, ensuring a comprehensive representation of various city tiers in India. Notably, around 70% of the surveyed hotels are in urban areas, where limited seasonality and a robust demand footprint create heightened interest from both hotel operators and owners for project development.

A compelling observation is that a large majority of the hotels in the sample set commenced operations in 2010 or later years. This temporal range allows for a keen identification and analysis of recent trends, providing invaluable insights into the evolving dynamics of the Indian hotel industry.

QUALIFYING CONDITIONS

The development cost survey relies on self-reported data from respondents, and while we have taken great care to address anomalies and filter incomplete or questionable data, we have not independently verified the accuracy of each data point. Therefore, it is important to consider this aspect when interpreting the survey results.

Additionally, the survey results do not account for the effects of inflation, changes in prices of essential commodities, or currency exchange rates. Instead, the development costs reflected in the survey represent the figures as of the opening year of each hotel. Furthermore, the development costs of hotels are influenced by a multitude of unique factors specific to each project. As a result, the survey results should not be viewed in isolation but rather utilized as guidelines to facilitate comparisons across different positioning and survey parameters.

It is worth noting that not all hotels in the sample set provided complete information regarding the breakdown of their development costs or other relevant details analyzed in this report. In such cases, we have created subsets of the sample to perform the analysis, excluding responses with insufficient information to ensure the validity and accuracy of the findings.

All the information collected and analyzed for this survey has been meticulously handled by Hotelivate. Data confidentiality has been strictly upheld throughout the report, presenting survey results only in the aggregate without identifying any individual hotel, brand, or operator.

As custodians of this data, Hotelivate reserves the right to amend any or all parts of the report without prior notice. Furthermore, no information contained within this report may be reproduced or distributed in any form without proper acknowledgment and the prior written consent of Hotelivate.

By adhering to these guidelines, we maintain the integrity and credibility of the survey results, ensuring that the information presented remains valuable and trustworthy to industry stakeholders and readers.

PRESENTATION OF SURVEY RESULTS

In this report, the survey results have been presented under the following six major sections:

Section A: Overview of the Hotel Facilities

Section B: Development Cost per Key without Land

Section C: Development Cost per Key by Major Cost Categories

Section D: Development Cost per Square Foot

Section E: Construction Tenure

Section F: Interest During Construction

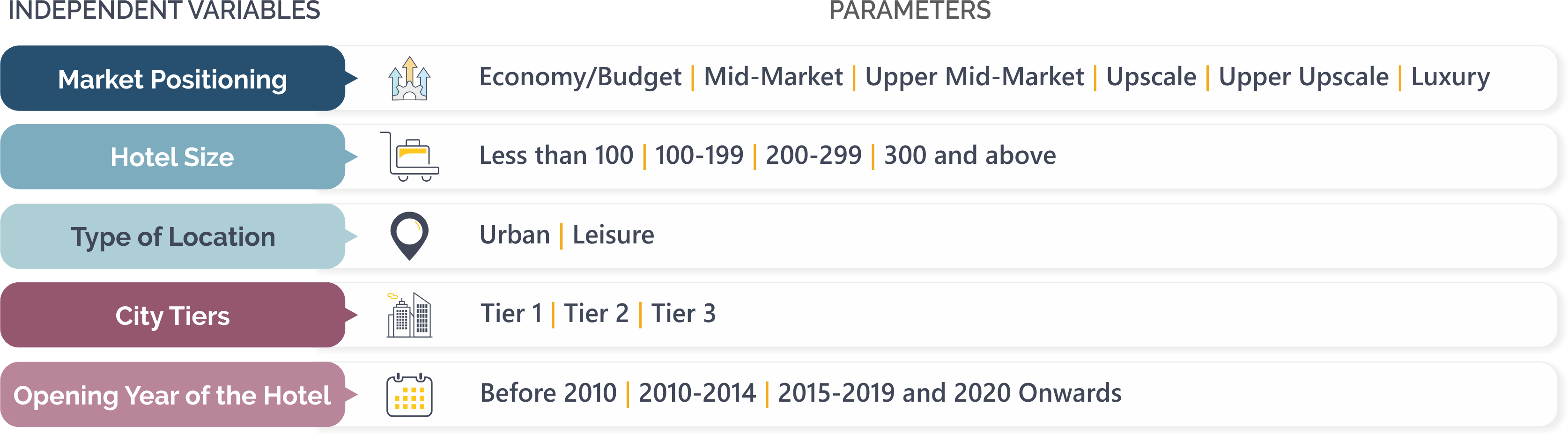

Under each section, we have performed detailed analyses using five primary independent variables, as highlighted below.

For more information, please contact Megha Tuli at [email protected] or Mihir Chalishazar at [email protected]