2024 Hotel Management Contract Survey | South Asia

Hotelivate is excited to bring to you an excerpt of the Hotel Management Contract Survey 2024 – South Asia, entailing a comprehensive review of 151 contracts/LOIs of 28 different hotel companies, representing around 27,272 rooms (~15% of the nationwide branded supply), signed in the region since 1998.

Why should you read this report?

The success of hospitality developments heavily relies on hotel branding and operations. With the growing popularity of the asset-light approach, management contracts have become integral to the hotel industry in South Asia. Hotelivate’s Management Contract Survey 2024 aims to help industry stakeholders understand key terms and provisions of typical management contracts. It provides clear definitions and analyses trends over time. Authored by hospitality experts with extensive experience in the operator selection and contract negotiation process, the report offers exclusive insights and practical guidance. Designed as a reference document for industry professionals, this survey report will enhance your understanding of both traditional and emerging topics in hotel management agreements for South Asia. Understanding the benefits and challenges can greatly assist owners and operators in streamlining the negotiation process and making mutually beneficial and informed decisions.

Key areas covered in the report include:

- Management Contract Term

- Exclusivity Area/Area of Protection

- Operator Fees

- Operator Performance Test

- Annual Budget & FF&E Reserve

- Bank Account Control

- Hotel Employees and Senior Hires

- Operator’s Investment in the Property

- Arbitration & Indemnification

- Contract Termination

In addition, the report also explores contractual and fee structures of increasingly popular models like franchise agreements, manchise contracts, and branded residences.

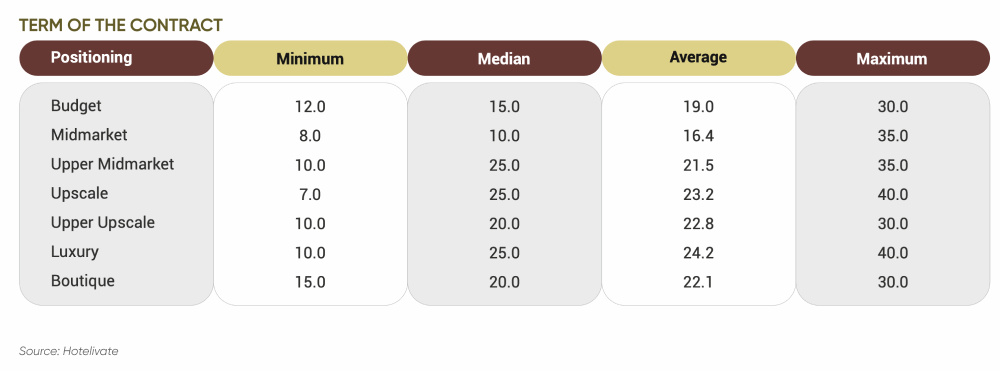

Excerpt I | Initial Term of the Agreement

The duration of the agreement is determined by an initial term, along with one or more renewal terms. The tenure of the agreement is influenced by various factors such as positioning, inventory, signing year, location, and specific commercials. In our survey sample set, the initial term ranges from 7 to 40 years, with a median of 21.5 years and an average of 21.8 years. The average initial term for the higher positioned hotels tends to be longer compared to the budget and midmarket categories. This trend likely reflects the preference of both owners and operators for greater stability and continuity, especially considering the higher investment levels associated with upscale or higher-positioned hotels. It is important to note that due to the smaller sample size of budget hotels, the data may appear slightly skewed compared to other hotel categories. Typically, the average contract length would be less than 15 years for budget hotels.

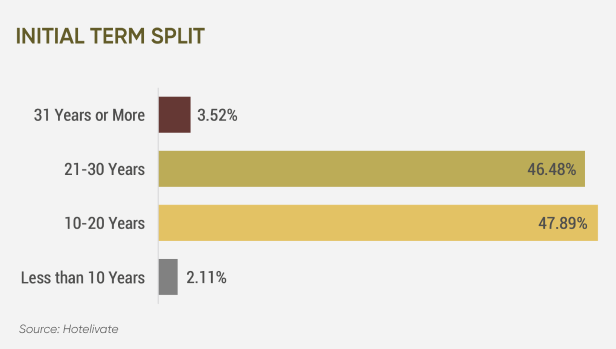

The vast majority (nearly 95%) of contracts fall within two tenure ranges: 10-20 years and 21-30 years. Within these ranges, terms of 20 and 25 years are particularly common, each representing roughly a quarter of all contracts. It is worth noting that some older contracts and contracts for luxury branded hotels have longer terms exceeding 30 years. The current focus among major hotel operators is on securing agreements between 15 and 25 years.

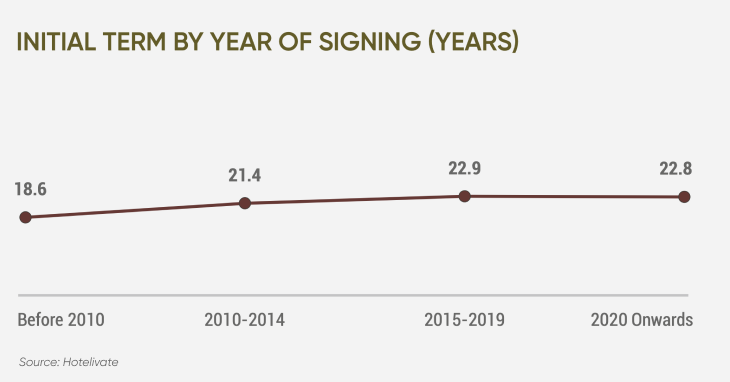

From the lens of the year of signing, the initial term has witnessed a marginal growth over the years. This increase can be attributed to several factors:

- Brand Stringency: Brands are becoming more stringent with their contract terms, with most operators aiming for a minimum term of at least 20 years.

- Growing presence in leisure locations: Leisure destinations tend to have a smaller inventory base and typically take longer to generate steady returns, prompting brands to prefer longer tenures to justify the deal’s value.

- Large Base of HNI Owners: The ownership base in South Asia continues to be skewed towards HNIs/UHNIs. Since fees are a more significant factor for these owners compared to contract length, hotel brands can offer longer initial terms in exchange for more favourable commercials in other parts of the agreement.

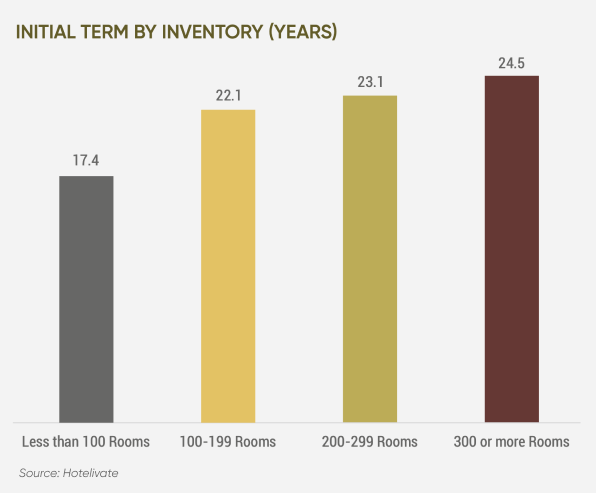

Interestingly, the average initial term tends to increase with the size of the hotel, which can be attributed to several factors:

- Higher Positioned Hotels: Larger format hotels often belong to upscale or higher positioning categories, which typically entail longer initial terms.

- Mature Real Estate Markets: Hotels with an inventory of 200 rooms or more are frequently situated in Tier 1 locations, representing mature markets where both the owner and the brand have confidence in the benefits of a longer-term association.

- High Deal Value: Due to the substantial fees generated by these large hotel projects, operators are often willing to offer more favourable terms in the contract. This can include better fee structures or even some form of equity participation, such as key money or a soft loan. In exchange for these concessions, operators typically seek a longer initial term.

Excerpt II | FF&E Reserve

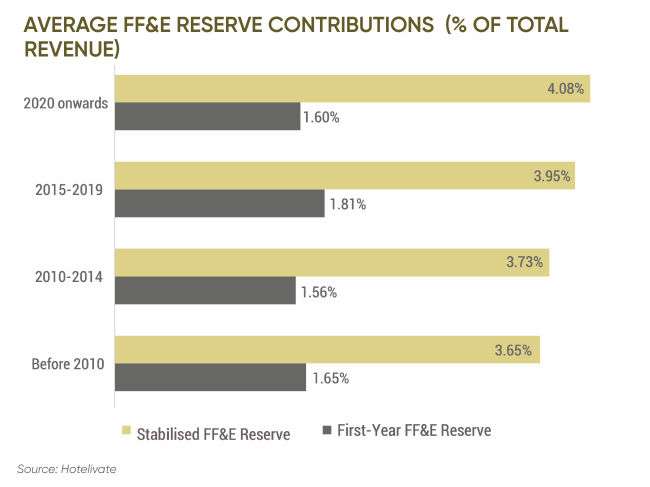

Maintaining a hotel’s condition is critical for its long-term value and guest satisfaction. This ongoing process involves periodic soft refurbishments (typically every 5-6 years), and major renovations (every 10-12 years). To ensure the ongoing upkeep of furniture, fixtures, and equipment (FF&E), owners contribute to a dedicated reserve fund for future replacements. These contributions typically range from 1.0% to 5.5% of the hotel’s total operating revenue, gradually increasing as the hotel’s performance stabilises (typically within 4-5 years). This lower initial allocation reflects the newness of the property and lower initial maintenance needs. On average, the first-year FF&E reserve has been stable over the years. However, as shown in the figure below, stabilised average FF&E reserve allocations have risen by approximately 50 basis points over recent years, reflecting a growing industry understanding of the importance of a robust reserve for long-term upkeep. Some brands are even starting to implement a further ramp-up for the reserve after 10 years to address ageing FF&E. Moreover, existing or converted hotels may require a higher initial contribution depending on their condition. It is important to distinguish FF&E expenditures from major capital expenditures, which are separately funded by the owner for asset improvements.

The FF&E reserve is usually held in a separate bank account controlled by the operator, with spending authorised according to the annual operating plan. While not a direct payment to the operator, higher FF&E reserve contributions can reduce an owner’s overall profitability.

The full version of the Hotel Management Contract Survey 2024 – South Asia is now available for purchase for INR 99,999 plus taxes or US$1,200.

Payment for the report can be done via RTGS/NEFT or an Online Transfer.

Kindly note that the report will be customised for an individual or individual & organisation.

To order your copy and for any other queries regarding the survey, please email [email protected]

For more information, please contact Manav Thadani at [email protected], Sanaya Jijina at [email protected], or Mihir Chalishazar at [email protected]