Ayodhya’s Gold Rush: Hospitality Boom in the Offing

“Ayodhya rapidly emerging as a global investment destination.” – Money Control

“Amitabh Bachchan buys 10,000 sq. ft. plot worth Rs 14.5 cr. in Ayodhya”. – The Economic Times

“Ayodhya set to get Rs 85,000 crore makeover over 10 years”. – Times of India

”Brands get on to the Ayodhya Brandwagon” – Hindu Business Line

“Ayodhya hotels earn ‘record’ Rs 20 cr. in three days” – Money Control

“Around 25 lakh devotees visited the Ram temple in Ayodhya in the past 11 days” – Times of India

“Hotel industry homes in on Ayodhya with over ₹4200 crore projects” – Hindustan Times

Ayodhya has been in the headlines in the past few months, centred around the opening of Ram Mandir. According to the Confederation of Indian Traders (CAIT), the consecration ceremony had a potential yield for business (including processions, rallies, cultural programs, and the sale of flags and banners, among others) of over ₹1 Lakh Crore (~US$ 12 billion). The ruling by the Supreme Court in 2019 had put the wheels in motion to develop the city. Ayodhya has already witnessed significant investment inflows from both central and state governments, as well as contributions from numerous donors. Additionally, the land prices around the temple have grown ten to twentyfold since the Bhoomipujan in 2020 highlighting the economic revitalisation taking place in the region.

Recent developments include the opening of Maharishi Valmiki International Airport (with a capacity of 10 million passengers per annum) and the refurbishment of the Ayodhya Dham Railway Station (with a capacity of over 1 lakh pax per day). The government plans to invest over ₹85,000 crores (~US$ 10 billion) over the next decade in the city. As outlined in the Ayodhya Masterplan 2031, this investment is aimed at a multifaceted development, including the upgradation of the infrastructure, the establishment of a spiritual university, greenfield townships (over 1,200 acres to be allotted for the development), urban forests, a convention centre, arts and craft centre and a hospitality management and training centre.

A detailed overview of the Ayodhya Masterplan 2031 and the potential of the pilgrim city was highlighted by Hotelivate in a previous article – “Ayodhya – the Pilgrim City”.

Tourism in Ayodhya

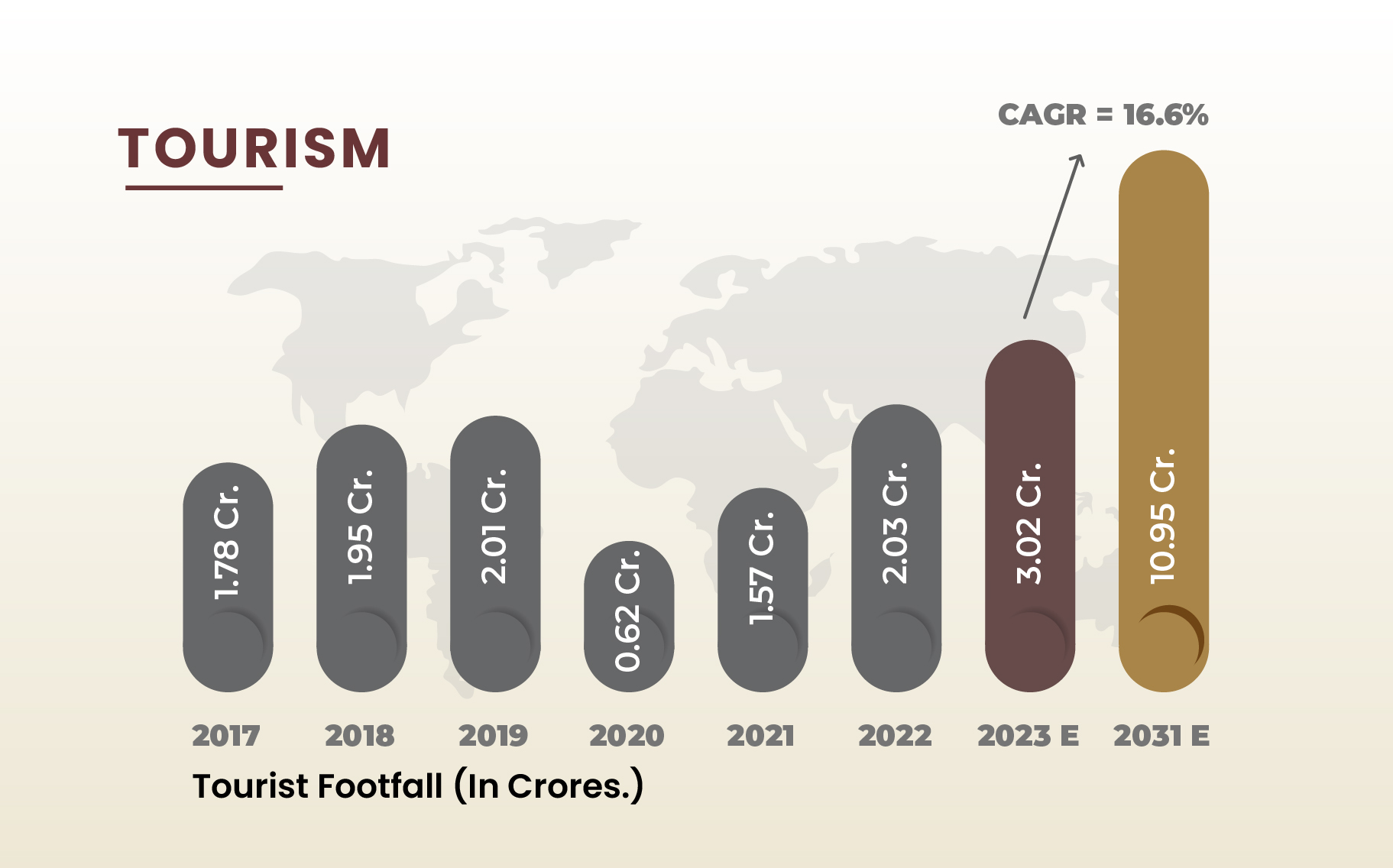

This strategic focus on developing Ayodhya aligns with the bourgeoning trend of spiritual and religious tourism. Data from the Ministry of Tourism highlights that, in 2022, these religious and spiritual hubs (including Varanasi, Rishikesh, Katra, Haridwar, Tirupati, and Dwarka) generated revenue of about ₹1.3 Lakh Crore (~US$16 billion) and witnessed footfall of 140 crore (1.4 billion). This roughly translates to one religious trip per capita per year in India. Interestingly, this footfall was not confined to mainstream destinations; lesser-known markets such as Pushkar, Vrindavan, and Sabrimala are experiencing a surge in tourism as well. Ayodhya’s tourism boom began with the annual Deeputsav celebration in 2017 and gained momentum after the Ram Temple Judgement in 2019. In 2023, over 3 crore tourists visited Ayodhya, and projections from the Ministry of Tourism anticipate about three lakh tourists per day (over 10 crore people per year) by 2031.

Figure 1: Tourist Footfall in Ayodhya (2017-2023)

Source: Ministry of Tourism / *E=Estimated

Supply Projections

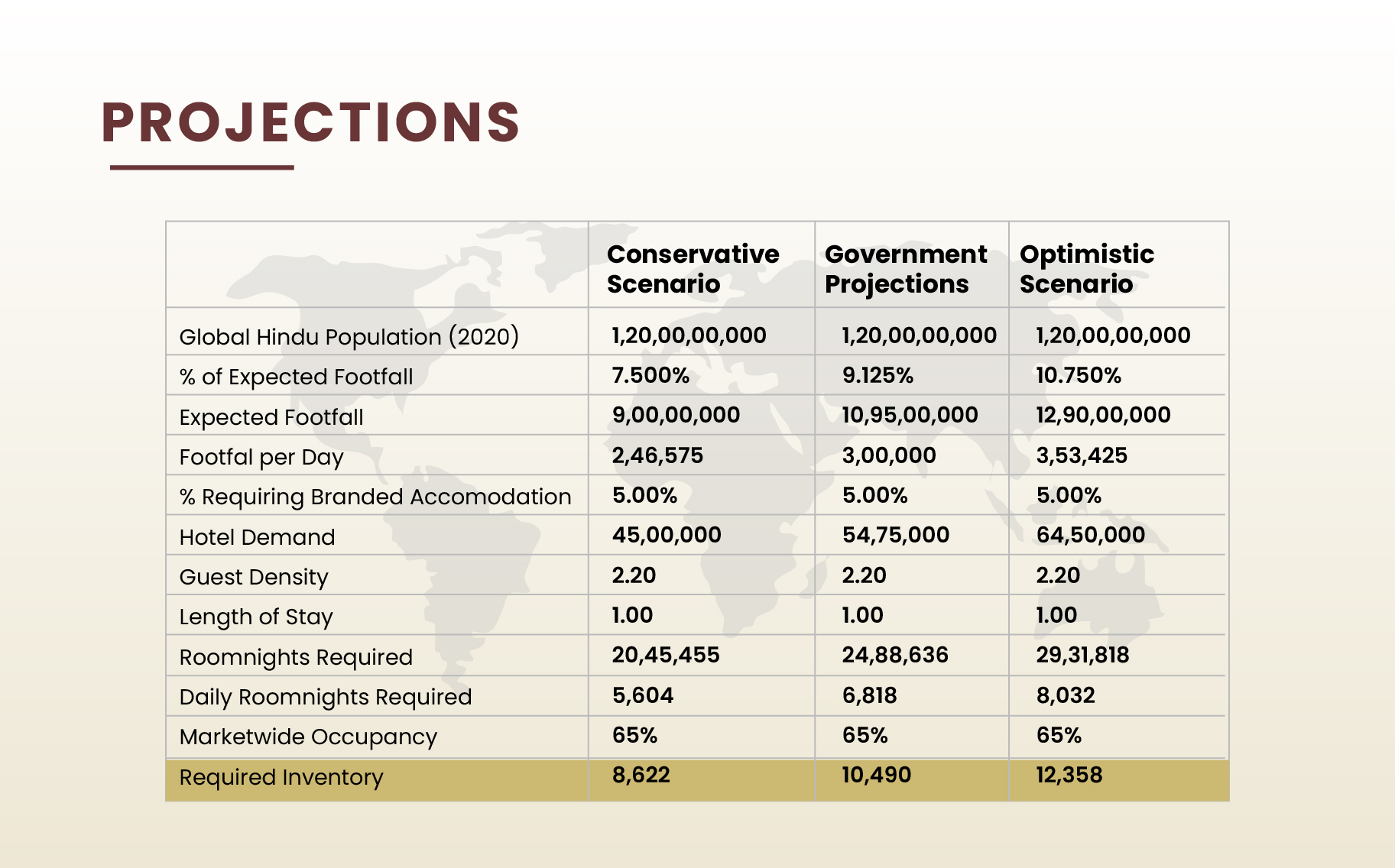

With such robust demand growth, Hotelivate has projected the hotel inventory required to cater to the market. Three scenarios have been considered – a Conservative Scenario with a projected footfall of ~2.5 lakh tourists per day; a Government Projections scenario with a projected footfall of 3.0 lakh tourists per day; and an Optimistic Scenario with a footfall of ~3.5 lakh tourists per day. Assuming that about 5% of the total footfall would opt to stay in branded hotels with an average guest density of 2.2 people per room and a length of stay of 1 night, we project that the market will require an inventory of 8,500-12,500 branded keys in the medium to long term to cater to this demand. It is pertinent to note that owing to the inherent seasonality in the market, an assumption of 65% marketwide occupancy has been taken.

Figure 2: Potential Hotel Inventory Requirements

Source: Hotelivate Research

This clearly indicates the massive opportunity for hospitality in Ayodhya. The recently opened Park Inn by Radisson Ayodhya and Clarks Inn Express Ayodhya represent the only branded supply. However, major hospitality brands, such as IHCL, Marriott, Club Mahindra, Wyndham, The Leela Palaces, Hotels and Resorts, and ITC Hotels, have expressed keen interest in Ayodhya and, some of these brands, have already signed their first hotel in the market and the rest have signed a memorandum of understanding and are in the process of negotiating the agreement. Furthermore, the government taking into account this supply-demand mismatch has been auctioning off plots, with an ambitious goal of eventually establishing over four hundred hotels.

Development Considerations

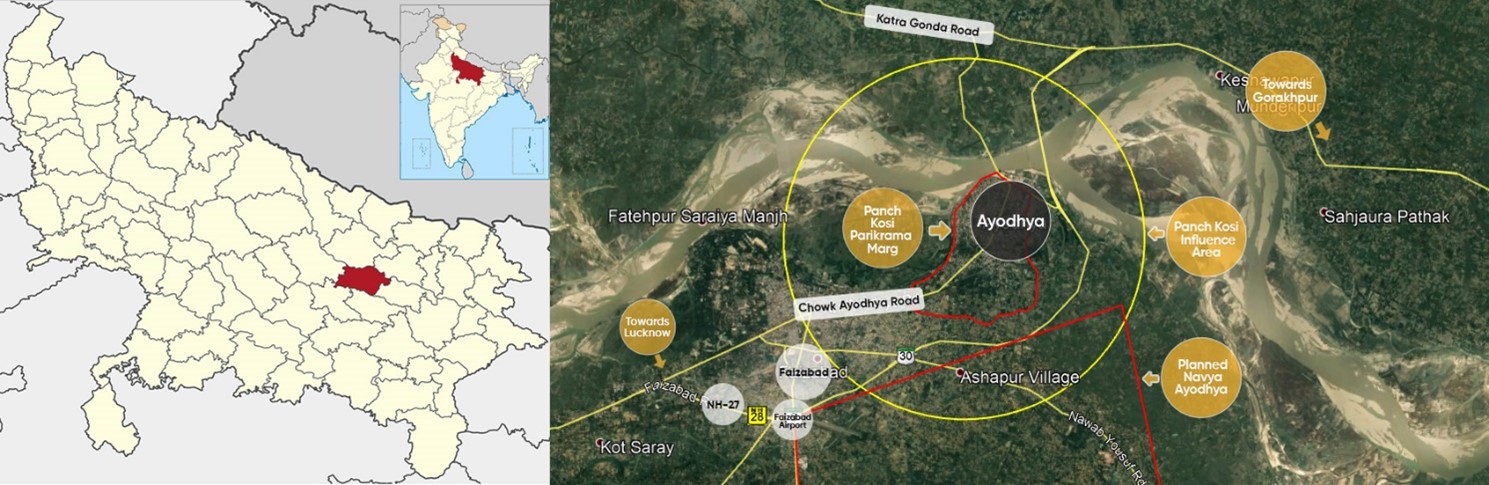

For hotel developers and brands exploring the Ayodhya opportunity, it is important to note that the Chaurasi Kosi perimeter, delineated around the temple, imposes specific restrictions on hospitality establishments, mandating vegetarian offerings and an alcohol-free environment. In contrast, surrounding areas, including the Ayodhya Cantonment area and the Gonda district north of the Saryu River, do not have such restrictions, and present alternate options for hotel developers or brands who view these restrictions as challenges. Recognizing the demographic of Ayodhya’s visitors, characterized by families and groups, hotel developers should offer slightly larger room sizes to comfortably accommodate three guests. Another noteworthy trend which is common in other religious and spiritual destinations is the utilisation of hotel banquet spaces for ceremonies, havans, and rituals. These ceremonies are expected to become commonplace and present a significant business opportunity for hotels.

Figure 3: Major Demand Generators and Locales

Source: Hotelivate Research

Conclusion

The latent potential of this historic city, coupled with the momentum generated by recent developments, sets the stage for a remarkable chapter in Ayodhya’s storied history—one defined by growth, prosperity, and a reinvigorated sense of identity. The city’s potential to become a global religious centre akin to Vatican City and Mecca is apparent. Prudent investment, focused development, and strategic growth initiatives will play pivotal roles in realizing the opportunities that lie ahead, particularly for the tourism and hospitality sectors. The story of Ayodhya, propelled by the Ram Mandir, is indeed one to watch.

For more information, please contact Mihir Chalishazar at [email protected] or Manav Thadani at [email protected]