The New Kid on the Block in the UAE’s Hospitality Landscape

“Home away from Home”: the age-old promise of hotels and hotel brands has now found a place in the value proposition of actual homes. With Airbnb spearheading a global sharing economy revolution, the holiday home space has grown exponentially. Before we discuss this exciting, new look for hospitality, allow us to get the jargon out of the way. For the purposes of this article, the terms ‘holiday home’ and ‘vacation rental’ are interchangeable and refer to the same type of asset; a residential development that is let out by the homeowner to guests for varying periods of time, typically longer than a few nights but shorter than a whole year. Our research in the United Arab Emirates (UAE) market, particularly Dubai, has revealed this to be a rapidly expanding, highly competitive niche of hospitality.

UAE and Vacation Rentals: A Match Made in Heaven

It is well-known that the UAE represents one of the friendliest nations in the world for foreign investors and foreign direct investments. In fact, the country has taken numerous steps, including special types of visas, to further incentivize foreign investors. In conjunction with a consistently growing economy and residential supply, the vacation rental market was primed to be unleashed. Previously, foreign investors would invest in a home or two due to frequent travel and relatively relaxed regulations surrounding the deployment of liquid capital. These homes were only secondary for their owners and would remain vacant for many months in the year. In 2015, Dubai legalised Holiday Homes and the resultant proliferation of the industry can only be described in one word: explosive.

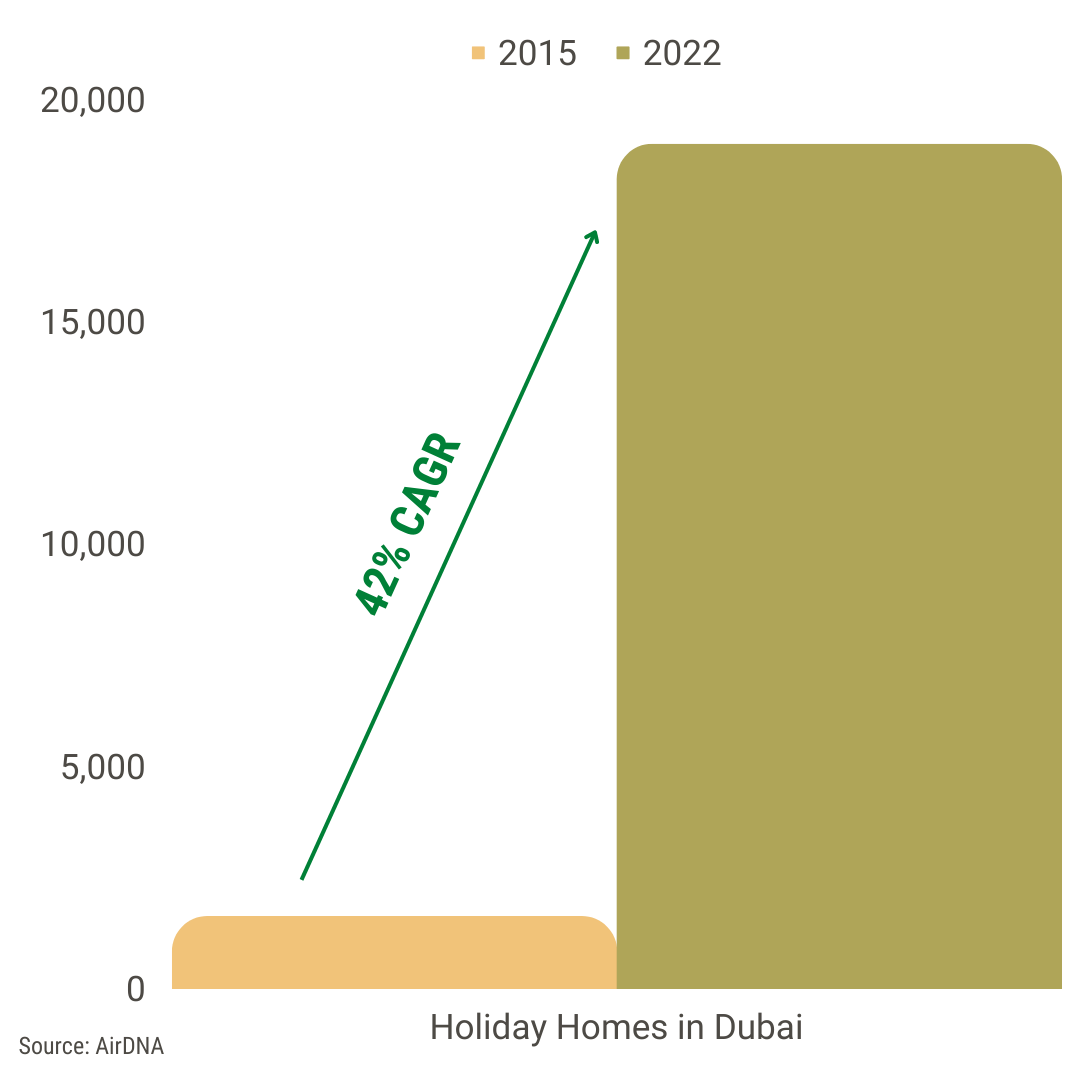

Back in 2015, AirDNA’s database (which tracks all holiday home listings on Airbnb and VRBO) would have revealed a total number of 1,641 vacation rental units in Dubai. Today, that number has crossed 19,000 and is set to continue growing with Statista estimating that the UAE will have approximately 2.2 million vacation rental users by 2026.

Are Vacation Rentals Extended-Stay Products?

Featuring larger living spaces, multiple bedrooms, and full-fledged kitchens, holiday homes are perfect options for the global segment of extended-stay travellers. While vacation rentals are, by no means, purely extended-stay products, a large part of their value proposition is derived from their price point compared to traditional hotels and serviced apartments. To elaborate, the limited service and facilities allow owners to charge lower rates than a traditional hotel or serviced apartment. However, this is a value proposition that becomes difficult to maintain if a holiday home’s business mix is modified to be largely transient. If holiday homes were to be aggressively marketed and sold by the night, the cost of operations would see an increase with commensurate damage to the price-point value proposition.

Moreover, if a holiday home would like to consciously replicate a traditional hotel’s business mix and the average length of stay, they would also be compared, on all fronts, to a hotel or serviced apartment. The “home” factor, which simultaneously acts as an experience and a licence to limit services and facilities, would lose significant bargaining power. This would lead to an unnecessary entrance into a highly competitive hotel market and a stream of negative feedback and complaints. As such, the ideal holiday home operation would function with ‘short lets’ as the base business with only opportunistic capture of transient business. As a result, the Vacation Rentals market, globally, is part of the larger Extended-Stay Industry. As per the Global Serviced Apartment Industry Report (GSAIR) 2021, there are over 102,177 Branded Extended-Stay products in the Middle East across 900 locations while the unorganised and unbranded Extended-Stay supply is significantly larger.

Vacation Rental Benefits for Customers

In the course of understanding the UAE’s vacation rental market, one pertinent question comes to mind: in the saturated hotel market of Dubai, with hotels available at every price point, why is there such a strong demand for and growth of vacation rentals? To answer this question, it is crucial to examine the benefits that holiday homes provide to travellers.

The Vacation Rentals Competitive Landscape

Over the course of our research, we found it useful to divide the Vacation Rentals Competitive Landscape into five broad buckets:

1) Vacation Rental Management Companies

Vacation rental management companies, while relatively new in Asia Pacific and Middle East, are popular in Europe and America. Globally, increasingly frequent private equity investments along with mergers and acquisitions are signalling the progression of the vacation rental space towards an organised industry. The largest global companies such as Awaze, Interhome Group, and Vacasa, all rely on acquisition-led growth alongside organic expansion. The growing inventories of these companies liken them to global hotel brands and features of hotel brands like loyalty programs will eventually find their way into the space. For now, most companies remain restricted to a few geographies as the rules and regulations around holiday homes can vary greatly across borders. Due to this, companies, short of any acquisitions, experience muted growth as they continue to capture units within the confines of a region.

2) Vacation Rental Aggregators

This bucket is comprised of Airbnb and other companies that provide aggregation services. While Airbnb is undoubtedly the king of the hill in terms of size and scale, the holiday home aggregator has faced and continues to face, many challenges. These challenges range from legal disputes to genuine safety concerns for guests. A platform with the scale of Airbnb is destined to have unpleasant users looking to exploit the model. The company actively introduces checks and measures to ensure legal compliance, healthy living spaces, guest safety, and so forth.

VRBO (Vacation Rentals by Owner) is the largest direct competitor to Airbnb which deploys a near identical model. Interestingly, the other companies falling into this bucket have taken note of Airbnb’s challenges and have narrowed their focus to one or more issues to offer as differentiators. For example, complaints of discrimination against LGBTQ guests have been addressed by misterbnb, a vacation rental platform that only features vetted, LGBTQ friendly homes and owners. Plum Guide and Travel Staytion have stringent checklists which are used to audit homes, ensuring that only products and owners of a certain calibre are featured on their website.

3) Traditional Hotels and Serviced Apartments

The global collection of hotel and serviced apartment brands are the members of this bucket. Marriott International, Wyndham Hotels & Resorts, Hyatt, Hilton, IHG, The Ascott Limited, to name a few, are all members of this category. Characterised by strict brand standards, global distribution muscle, powerful loyalty programs, relatively standardised products and a high degree of service and hospitality expertise, the value proposition for these products is in stark contrast to vacation rentals. As mentioned above, while vacation rentals may capture some transient business, they would be grossly misaligned in their strategy to aspire to be primary competitors for traditional hotels and serviced apartments. However, there is an undeniable demand overlap between the two accommodation options and, even if they remain secondary competitors for perpetuity, it is important to qualify this category in the overall ecosystem. Hotel companies have also jumped onto the vacation rental hype train with Accor’s onefinestay and Marriott’s Homes & Villas. In 2018, Wyndham Worldwide sold its European vacation rental business, Wyndham Destination Network, to private equity firm Platinum Equity for US$1.3 billion.

4) Long-term Rentals

On the one hand, vacation rentals compete with traditional hotels and serviced apartments for transient and extended-stay business. On the other hand, they offer a higher degree of service and convenience than your traditional long-term lease. To this end, long-term leases exist as a tertiary competitor for vacation rentals. While customers are not likely to actively compare a vacation rental with a long-term lease, the market’s going long-term rental rates do affect the pricing strategy and revenue management for vacation rentals. Homeowners’ return expectations and certain customers’ willingness to pay are, to a degree, affected by the alternative of a long-term rental.

5) Facilitators

The wide array of generic online travel agents (OTAs), metasearch engines, property management systems, revenue management tools, and so forth, comprise this final bucket. These companies do not compete with the other groups but act as facilitators to the overall ecosystem with services such as distribution, inventory management, pricing optimisation, and so forth.

TL:DR

Our focus for this article was to set the stage and provide an overview of vacation rentals, their value proposition, and competitive landscape in the UAE market. To quickly recap:

- The terms ‘holiday home’ and ‘vacation rental’ are interchangeable and refer to the same type of asset; a residential development that is let out by the homeowner to guests for varying periods of time, typically longer than a few nights but shorter than a whole year.

- Back in 2015, AirDNA’s database (which tracks all holiday home listings on Airbnb and VRBO) would have revealed a total number of 1,641 vacation rental units in Dubai. Today, that number has crossed 19,000.

- Short-term rentals are the price-point sweet spot for vacation rentals. As a result, not only are vacation rentals part of the larger Extended-Stay industry, but they also compete with both, transient hotels, and providers of vanilla long-term leases.

- Vacation Rentals offer their customers many benefits including authentic unique experiences, cheaper accommodation, exclusivity and privacy, convenience as compared to the formalities involved with a vanilla long-term lease, among others.

- From a branded, organised standpoint, the vacation rental competitive landscape can be divided into five buckets: Vacation Rental Management Companies, Vacation Rental Aggregators, Traditional Hotels and Serviced Apartments, Long-Term Rentals, and Facilitators.

In the next article, we will take an in-depth look at vacation rental management companies the services they offer, and the typical contract terms that they employ.

Having completed over 2000 advisory assignments over 25 years in South & South East Asia, the hospitality consulting team at Hotelivate has recently been busy offering its Strategic Advisory services to clients in the UAE & Oman. Recently concluded assignments include a 5-year growth strategy for a listed hotel company in Abu Dhabi, Revenue Optimisation strategy for a prominent hotel & real estate ownership organisation in Dubai, a luxury resort contract negotiation in Ras Al Khaima, a UAE country entry strategy for a conglomerate from South Asia and a high-end, experiential resort development Feasibility Study in Oman. Hotelivate is actively working towards offering all its services across the GCC region in the months ahead.

For more information, please contact Kush Anand at [email protected]