The Supply Narrative in 2023-24

From phenomenal recovery to record-breaking performances, the story of the hospitality industry in India over the past 24 months has been pathbreaking. This strong showing has attracted interest from across all sectors. Fuelled by robust demand, the supply side has also experienced significant growth. This article analyses hotel signings and openings during the fiscal year 2023/24. (Note: numbers and data points have been rounded for readability)

Signings Galore: India finding its niche in Asia Pacific

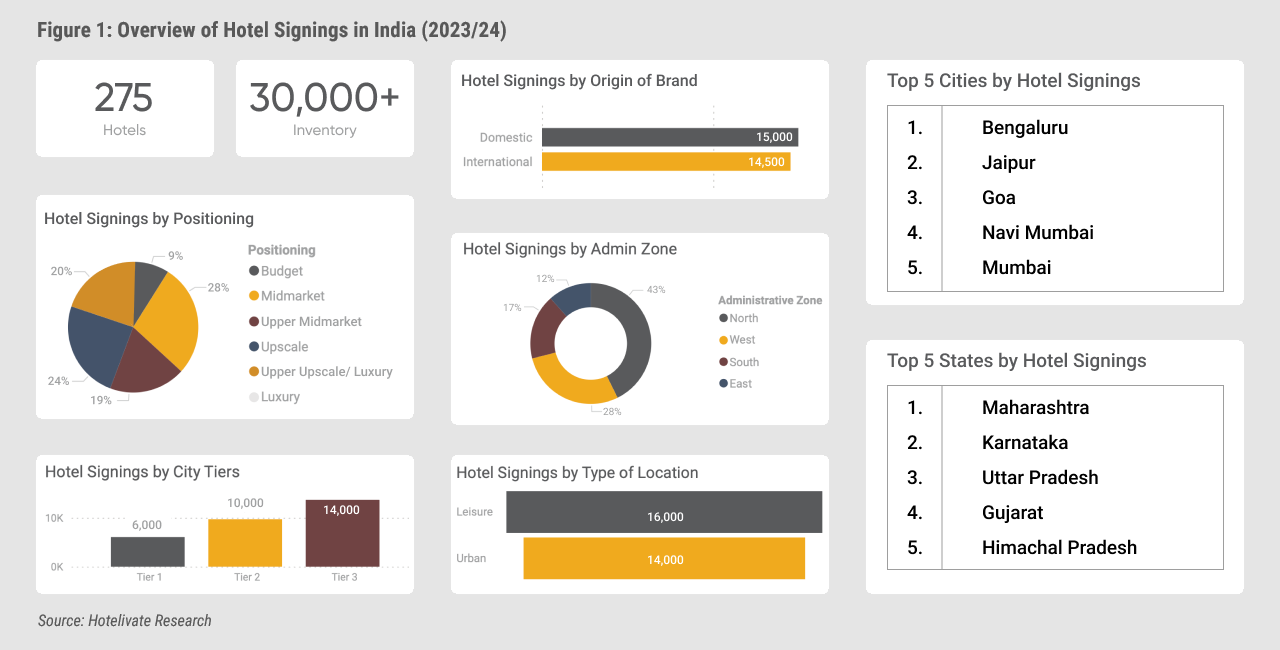

Over 30,000 hotel rooms were signed across 128 Indian cities during 2023/24. Key takeaways include:

- Tier 3 Cities Lead Growth: Fuelled by new market opportunities, Tier 3 cities captured the most significant share of signings, exceeding 14,000 rooms. Land scarcity and prohibitive land prices limited signings in Tier 1 cities, which saw only about 6,000 rooms signed. That being said, there are a lot more Tier 3 destinations compared to Tier 1 destinations; therefore, this trend should be expected.

- Leisure Focus Continues: Leisure destinations remained a priority, with nearly 16,000 rooms signed compared to 14,000 in urban locations, reflecting the continued growth of leisure tourism.

- Balanced Operator Mix: Signings were nearly equally divided between Indian-origin and international hotel operators.

- Positioning Mix: Midmarket hotels comprised the largest segment (28%), followed by upscale (24%) positioned hotels. Notably, upper upscale/luxury hotels represented 20% of the rooms signed across the country.

- Regional Distribution: North India led in signings (43%), followed by West (28%), South (17%), and East (12%).

- Quarterly Trends: Q4 2023/24 witnessed the highest activity with over 10,000 keys signed, while Q3 saw the least (under 4,000 keys) due to the festive period.

- Top States & Cities by Rooms Signed: Maharashtra, Karnataka, Uttar Pradesh, Gujarat, and Himachal Pradesh (each with over 2,000 keys) were the top five states by signed rooms. Bengaluru, Jaipur, Goa, Navi Mumbai, and Mumbai (each with at least a 1,000 keys) were the top five cities.

From Plans to Reality: Analysing Hotel Openings and Conversions

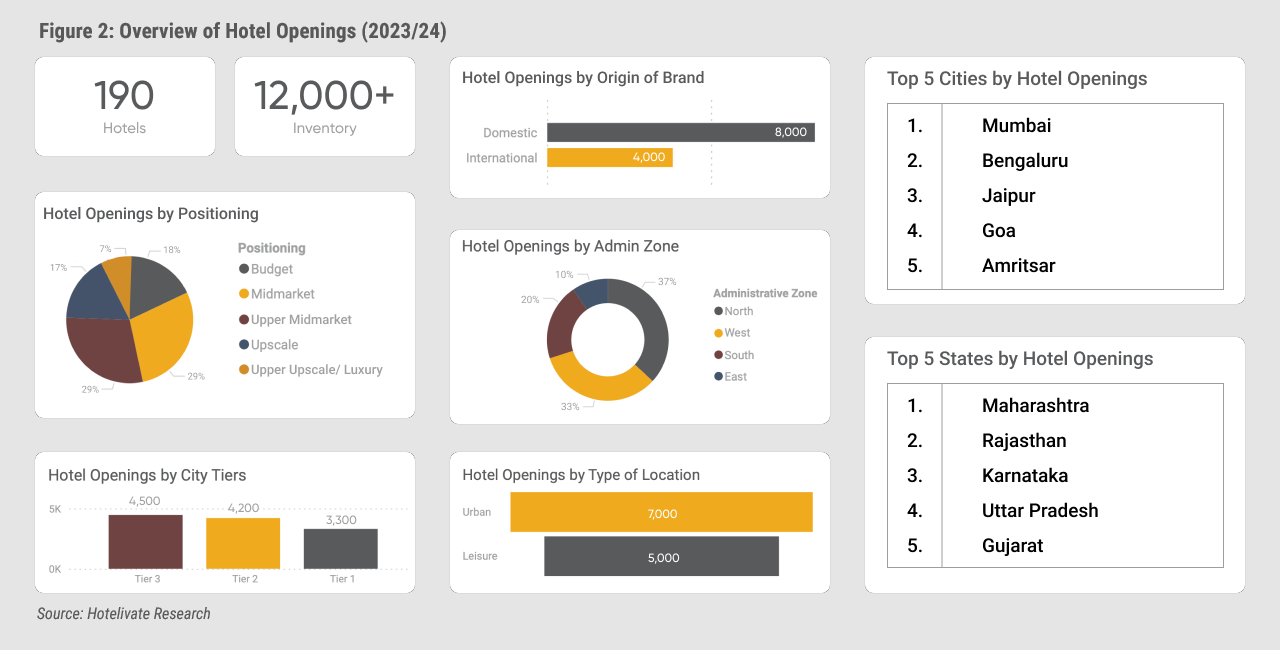

About 190 hotels opened with over 12,000 keys in 113 cities during 2023/24. Here are the key takeaways:

- Tier 2 & 3 Cities Lead Growth: Tier 2 and 3 cities saw significant growth in inventory, with around 4,500 and 4,200 keys opening in each category respectively. Around 3,300 rooms opened in Tier 1 cities, led by Mumbai followed by Bengaluru.

- Midmarket & Upper Midmarket Dominate: Midmarket and upper midmarket hotels had the highest number of openings (29% each), followed by budget (18%) and upscale hotels (17%). Interestingly, upper upscale/luxury represented a small share (~7%) of the openings in the country.

- Quarterly Trends: Both Q2 and Q4 of 2023/24 saw the opening of about 4,000 keys.

- Domestic Operators Take Lead: Indian operators had more hotels opening (around 8,000 keys) than international operators (~4,000 rooms).

- Regional Distribution Mirrors Signings: North India led in openings (37%), followed by West (33%), South (20%), and East (10%), in line with signing trends.

- Urban vs. Leisure Split: Urban locations saw 7,000 keys open compared to 5,000 keys in leisure locations.

- Top Performing States & Cities: Maharashtra, Rajasthan, Karnataka, Uttar Pradesh, and Gujarat (each with nearly 1,000 keys) were the top five states by opened rooms. Mumbai, Bengaluru, Goa, Jaipur (each with at least 700 rooms), and Amritsar were the top five cities.

The Indian hotel industry’s strong performance is fueling a robust development pipeline and overall supply growth. This supply increase is supported by infrastructure development, improved connectivity, a manufacturing push, and the broader positive outlook for the Indian economy; however, caution is warranted. Over the past decade (2013/14 to 2022/23), hotel supply has grown at a 5.6% CAGR, compared to the last year (2023/24) which had a growth of 7.5%. This rapid expansion could lead to supply pressure, in a few overheated markets. Therefore, thorough market research and feasibility analysis have become even more crucial to ensure sound investments and healthy returns.

For more information, please contact Mihir Chalishazar at [email protected]