Top Hotel Deals – Feb & March 2021 – Issue 3

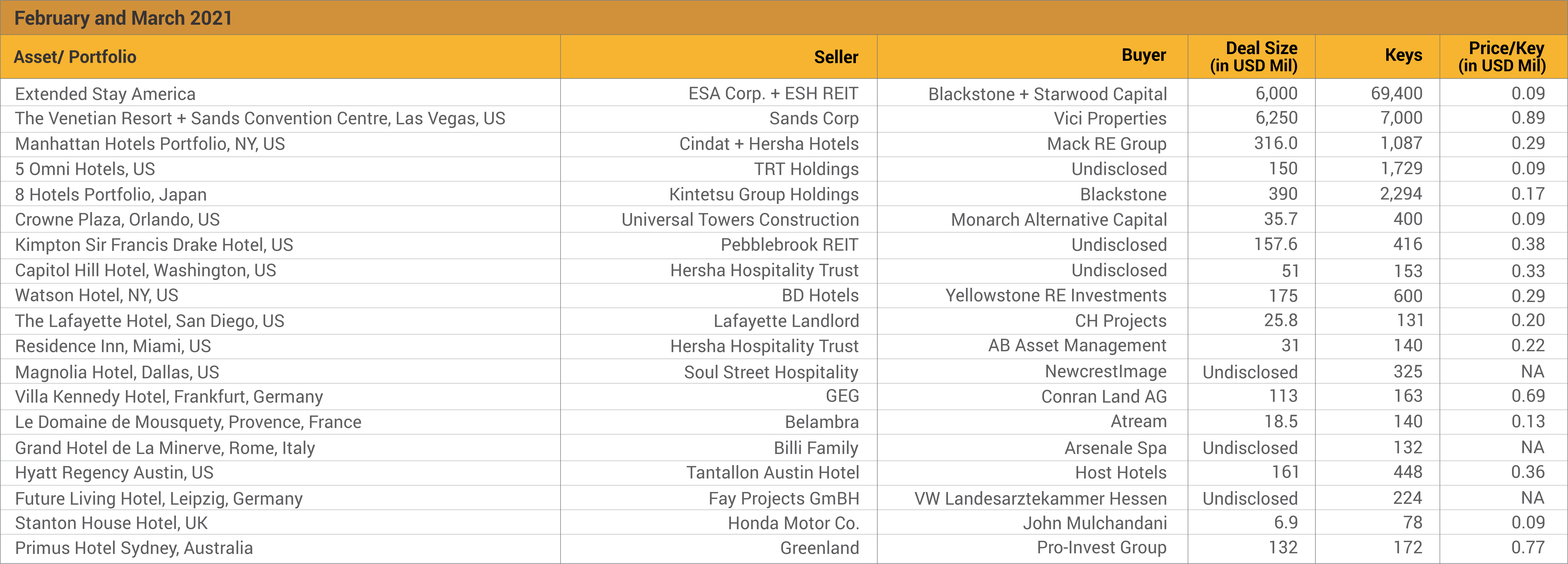

The months of February and March 2021 witnessed high transaction dollar volume due to two mega transactions totalling $12.5B in the United States. These are being seen as bright spots in an otherwise bleeding hospitality industry. Distress deals seem to be happening quietly wherever loan defaults and foreclosures have made the pain rather unbearable. Additionally, a portfolio deal in Japan and multiple smaller hotel transactions across continental Europe signal the continued attractiveness of travel industry in the eyes of global investment community.

Key Highlights

- Sale of Extended Stay America – Extended Stay America is a midscale hotel chain focusing on lodging for long-stay guests (7 days or more). ESA has an asset-heavy constitution and owns and operates 557 hotel properties in 40 states, comprising 61,900 rooms with an additional 7,500 under franchise or management contracts. The business outperformed the market last year with an average occupancy of 74% and is being viewed as a relatively resilient sub-section of the hospitality industry. The USD6 billion deal values the company at 11.2 times its adjusted EBITDA for 2019.

- Sale of The Venetian Resort & Sands Convention Centre, Las Vegas – Las Vegas Sands Corp. is set to offload all real estate assets associated with The Venetian Resort Las Vegas and The Sands Expo and Convention Center in Las Vegas for USD4 billion to Vici Properties. This deal represents a 6.25% cap rate on 2019 EBITDA. Additionally, Apollo Global Management will acquire the operations of The Venetian for USD2.25 billion. The Venetian, located on the Las Vegas Strip, has three luxury hotel towers with gaming, entertainment, shopping, and dining. The resort includes more than 7,000 all-suite rooms, 225,000 square feet of gaming space, and 2.3 million square feet of meeting space.

- Manhattan Hotels Portfolio, New York – Developer took control of Mack Real Estate Group a seven-property Manhattan hotel portfolio after it foreclosed on the owners. At USD 315.8 million, the deal represents a massive 60% discount on the 2016 valuation of USD816.3 million. The seven hotels are located in Times Square, Chelsea, Herald Square, and the Financial District operating under the Holiday Inn, Hampton Inn, and Candlewood Suites brands.

- Sale of Omni Hotels, US – London & Regional properties is to acquire the hotels, which include five Omni-branded properties in Austin and Dallas totalling 1,729 keys. The new owner will transition the hotels out of the Omni system later this year.

- Sale of 8 Hotels across Japan – It’s not often that a transaction involving 2,300 rooms is announced in Osaka and Kyoto. Japanese railway company Kintetsu has entered into a sale and leaseback arrangement with Blackstone to extract valuable equity support from these assets. The branding and operations of the assets shall remain unchanged which suggests that Blackstone is eyeing profits from the deal purely on the back of improved macro-economic conditions.

About Hotelivate Transactions Advisory – Specialists in BUY-SIDE and SELL-SIDE activities for hotel assets; as well as financing arrangements via debt and equity capital for hotel real estate. We work with institutional investors, private sellers, buyers, and lenders to jointly discover the ‘value-buys’ or ‘smart-sells’ for hotel buyers and sellers respectively.

Please write to [email protected] to discuss your commercial proposition.

Current Exclusive Sell-side Mandates:

- 400 rooms branded hotel in Mumbai

- 150 rooms branded upscale hotel in Ahmedabad

- 300 rooms branded luxury resort in Jaipur

- 70 rooms branded luxury resort in Rajasthan

- 90 rooms midscale resort project in Rajasthan

- 150 rooms branded resort in Goa

- 50 rooms branded resort in Goa

- 50 rooms branded upper midscale hotel in Noida

- Boutique luxury resort in Uttarakhand

Current Exclusive Buy-side Mandates:

- Resorts in leisure locations – 100 rooms and above

- Resorts in leisure locations – 60 rooms and above

- Wellness oriented resort – hills of North India

Note: The source of these news items are major publications, websites, and corporate announcements. While attempts are made to cross verify each news through multiple sources; Hotelivate does not claim responsibility for the authenticity or accuracy of the external information assembled in this publication.