Untamed Wonders: An insight into India’s Wildlife Tourism Potential

Into the wild:

India showcases a remarkably diverse range of geographical landscapes that house a rich tapestry of wildlife. The country boasts of 566 Wildlife Sanctuaries and 104 National Parks that are teeming with a variety of flora and fauna. Predictably, most of these wildlife hotspots are located in remote parts of the country and their potential as a destination for tourism is only just being realised. An ever-increasing network of national highways, investments in infrastructure development and a keen interest in the protection and regulation of wildlife by the Indian Government is creating the framework necessary to catapult wildlife tourism across the country.

Historically, hotels and resorts located close to forest reserves catered only to a small niche of wildlife enthusiasts, a large part of which came from international markets. With the advent of the pandemic, and the search for off-beat, unconventional leisure locations, the demand for hotels in wildlife centric locations went up dramatically. Notably, this trend did not die down with the end of the pandemic. Wildlife destinations have become a distinguished segment for tourism within India and continue to captivate the interest of leisure travellers across the country.

Riding the wave:

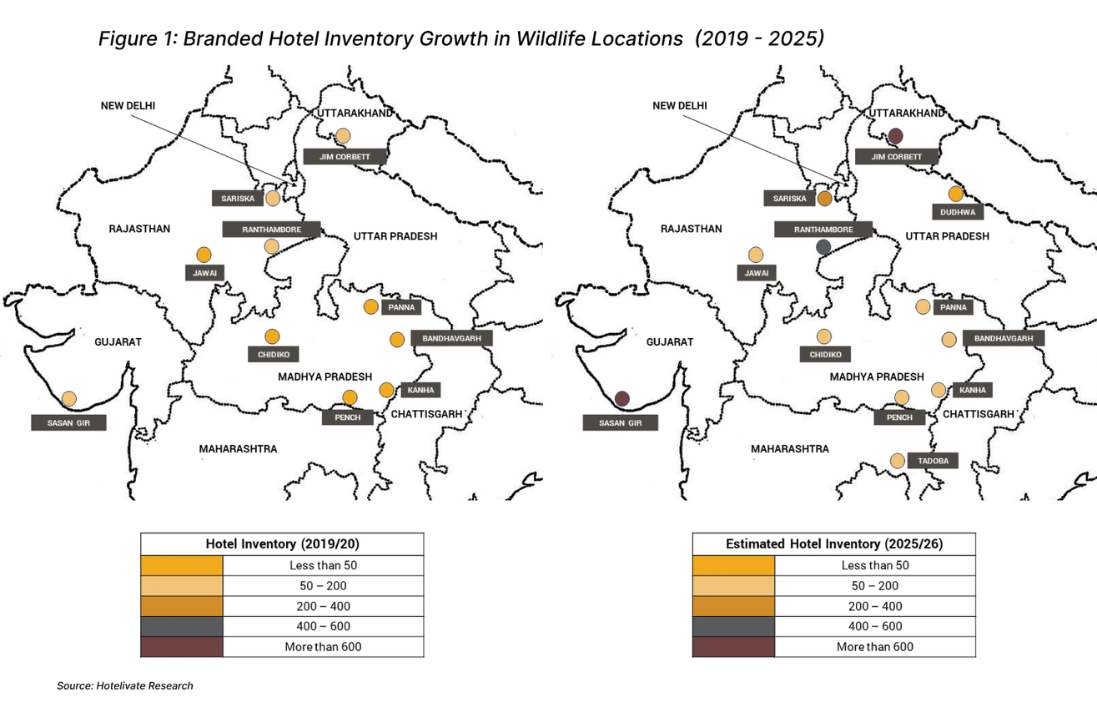

Hotel brands have not been oblivious to this trend. All wildlife locations combined, at the start of 2022, there were 1,139 branded hotel rooms available for accommodation. By 2025 this number is expected to reach 2,793 rooms. This implies an exponential ~145% growth in four years (at a CAGR of ~25%). Furthermore, this expansion isn’t restricted to Indian brands alone and includes international players like IHG, Marriott International, Radisson Hotel Group and Wyndham.

The growth in hotel room supply has been highest at wildlife reserves like Ranthambore, Sariska, Jim Corbett and Sasan Gir, all of which are within 4-6 hours driving time from major cities like New Delhi and Ahmedabad via newly built high-speed expressways. Other locations that witnessed comparatively lower growth in supply, being slightly more tedious to access, include National Parks in Central India, including Bandhavgarh, Kanha, Pench and Tadoba; and Jawai and Kumbhalgarh in Rajasthan. A few locations that had almost no supply historically and now have hotels under construction include Dudhwa National Park and Chidikho Wildlife Sanctuary.

Analysing the existing supply further led us to the observation that the average inventory size of hotels in these micro-markets is significantly lower than other parts of the country. Of the 44 branded hotels that exist in all these markets combined, the average inventory size was 35 keys with the median of the sample set being 29 keys. This makes it abundantly clear that the historically modest demand base ensued that hotel companies chose to focus on low inventory, luxury developments, which commanded a rate premium to compensate for its limited inventory. This trend is expected to reverse in coming years; looking at the proposed supply pipeline, the average inventory number is projected to grow to 45 keys by 2025.

A little something for everyone:

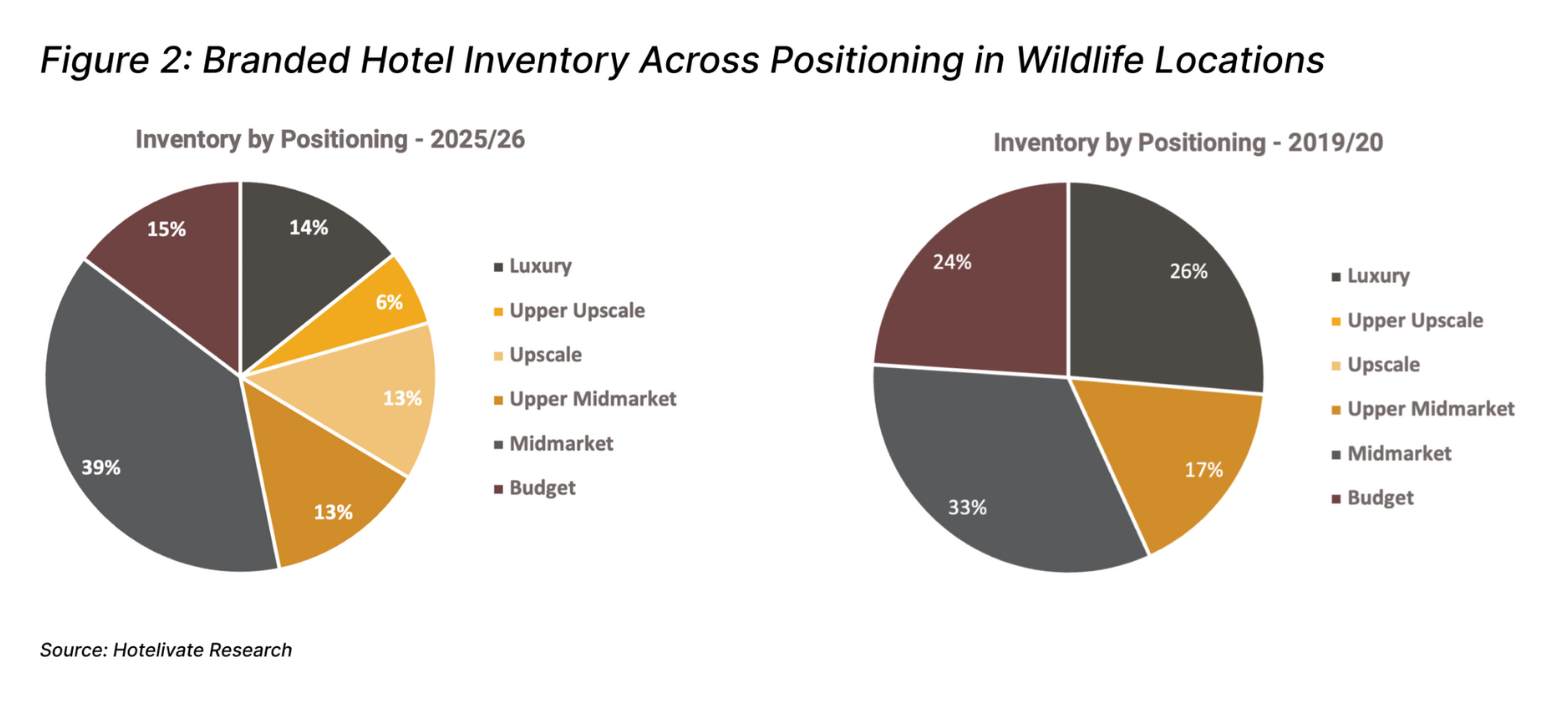

Looking at the data set below, another noteworthy transition can be seen in the distribution of hotel inventory across the positioning chart. In 2019, the hospitality market in wildlife locations comprised of luxury hotels (26% of total inventory) and all other hotels belonged to the Upper Midmarket, Midmarket and Budget positioning. By 2025/26, based on the pipeline of proposed supply, the market will be far more diversified in terms of positioning, with luxury hotels capturing a comparatively lower share of the market inventory (14%). Upscale and Upper Upscale hotels, which didn’t exist in the market previously, would have grown to capture almost 20% of the market’s inventory, while Upper Midmarket, Midmarket and Budget hotels will account for the remaining 65% (dropping marginally from 76% in 2019/20). This is a clear indication that moving forward, hotels will cater to a much wider price spectrum, offering travellers an accommodation option across varying price points.

An Upward Performance Trajectory:

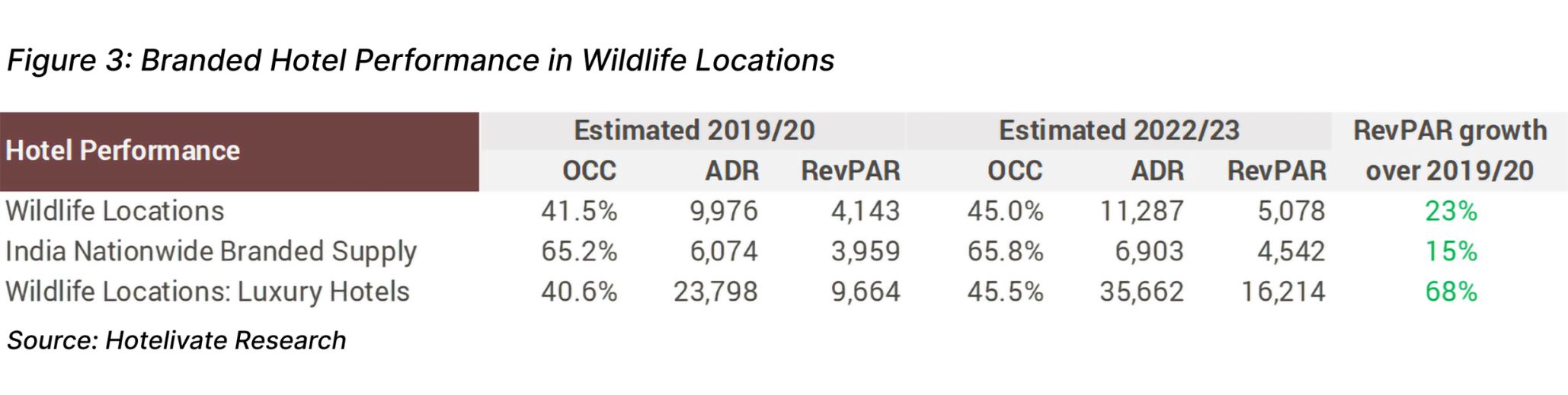

Having examined all of the above aspects, we decided to measure how hotel performance in wildlife centric destinations has varied between 2019 and 2023. It is widely known that the hospitality industry in India witnessed elevated levels of growth, with hotels achieving record highs in 2023. Interestingly however, when looking at the hotels considered in the wildlife cities dataset, the RevPAR growth over 2019 was 23% (7% CAGR between 2019 and 2023) while the nationwide growth in RevPAR for the same period was 15%. Now with all the positive commentary about wildlife tourism in the post-covid environment, one would have expected hotel performance to be off the charts. Truth be told, it actually was. Since the markets’ inventory grew by ~64% between 2019 and 2023, many of the newly opened hotels were still ramping up in terms of performance, creating a drag effect on the marketwide Occupancy and ADR. In contrast, hotels in the luxury segment, which had already built their presence over many years of operations, saw an exponential RevPAR expansion of 68% over 2019.

A word of caution:

As wildlife destinations witness a sharp increase in tourist footfalls, the imperative role of conserving these natural habitats becomes paramount. Authorities need to be overtly cognizant of the fact that the ecology of these regions must be protected from rampant urbanization. Measures need to be put in place that help conserve the habitat that enables wildlife to flourish. This could include setting visitor limits, educating tourists about the importance of conservation, and encouraging practices that minimize disturbance to wildlife. Similarly, hotels should be designed to promote sustainability, wildlife conservation, and cultural integration. Use of eco-friendly materials and design principles, energy efficiency, low-intensity lighting, and soundproofing of public areas like restaurants and meeting rooms, can be used as tools to negate the impact of hotel developments in these locations.

The Future Perspective:

In the past year, Hotelivate has conducted multiple feasibility studies for proposed hotel developments in wildlife-centric areas, and this trend is expected to endure as Wildlife Tourism carves out a segment for itself in the Indian travel landscape. In addition to existing wildlife hotspots, many more sanctuaries and reserves, that currently exist in remote parts of the country, will eventually come under the purview of tourism activity. The strategic focus of the Indian government on tourism, and the continual enhancement of road infrastructure collectively contribute to the promising trajectory of growth in this segment.

For more information, please contact Nabeel Ahmed at [email protected]