The Hotel Volatility Index 2018

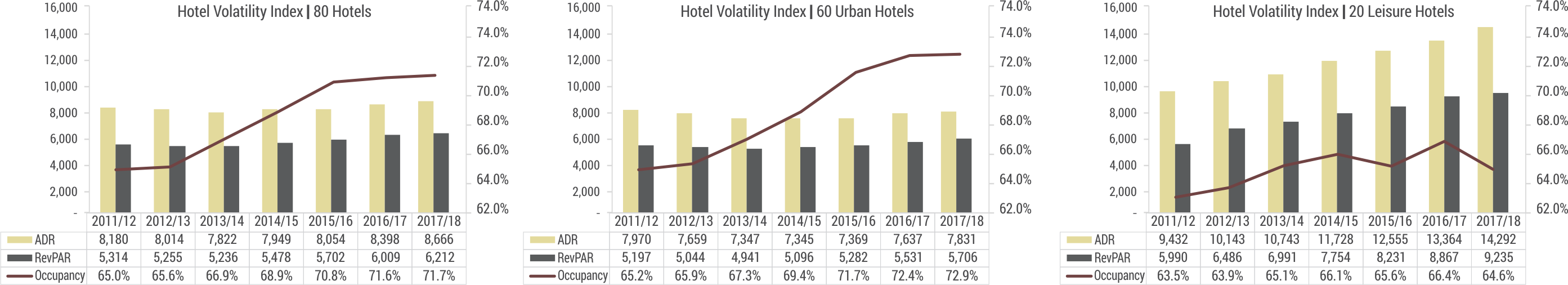

L ast year, we launched The Hotel Volatility Index (HVI) that tracks the performance of 80 well-established, stabilised hotels – 60 urban and 20 leisure properties – across positioning that have been operational since 2011 or earlier in the country. Together, these 80 hotels represent nearly 17,000 rooms in 21 different cities in India. The HVI provides a reliable performance benchmark, as it enables a like-to-like comparison of the same base of stabilised hotels year-on-year, irrespective of the new supply coming in. An improvement or a decline in the performance of the HVI can thus, serve as an important indicator of whether demand is robust or flattening out. Figure 01, below, illustrates the occupancy, average rate and RevPAR performance of the 80 hotels between 2011/12 and 2017/18, further categorised by location.

Figure 01: Hotel Volatility Index – Urban and Leisure Locations

Source: Industry Sources and Hotelivate Research

The past year marked the third consecutive fiscal of the current upcycle, and we were hoping to see a significant rate enhancement after having consistently nudged the industry to recognise the favourable ongoing demand-supply equation. Unfortunately, the needle still hasn’t moved on that front, and the index registered only a 3.2% increase in average rate over 2016/17 while occupancy remained stable. That said, if we look at the last five years, average rate improved by 10.8% and occupancy rose by 4.8 percentage points over that recorded in 2013/14. This points towards a healthy demand situation that is enabling existing hotels to retain or increase occupancy (and even rate) despite the influx of new rooms. However, one must do more to capitalise on the current upcycle and improve performance. More sophisticated revenue management strategies need to be adopted that look beyond just historical hotel data and competitor rates. Accurate demand assessment is critical, and technology can play a very important role here.

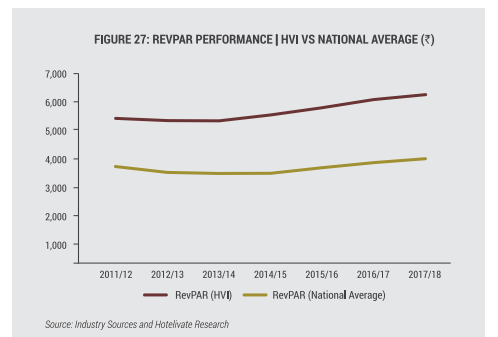

Comparing the performance of the index to the national average in Figure 02, we note that the RevPAR of these 80 stabilised hotels (INR 6,212) was 62% higher than that of the All-India sample set (INR 3,837) in 2017/18, further validating our argument for using this index as a performance benchmark. When new hotels open, they temporarily skew the market metrics by pulling down the occupancy and/or average rate. So, comparing your stabilised hotel’s performance to a competitive set that includes a mix of similar-positioned new as well as older hotels can be very misleading and result in false optimism. We, therefore, recommend any hotel that has been operational for five years or more to use this index as an additional point of reference, apart from the customised local competitive set, to assess its performance; this dual standard of evaluation will offer a hotel owner a more rounded perspective of the operator’s managing abilities.

Figure 02: RevPAR Performance – HVI vs National Average (INR)

Source: Industry Sources and Hotelivate Research

Also, it is interesting that leisure hotels continue to outperform their urban counterparts, recording a RevPAR premium of 61.8% in 2017/18, mainly on the back of higher average rates. At INR 14,292, the average rate of leisure hotels in the index was nearly twice that of the urban hotels (INR 7,831), growing by 7% over the previous year. Moreover, this base of 20 stabilised properties consistently recorded an occupancy of around 65% or more in the last five years, offering strong evidence of steady demand for such hotels in India. The increasing purchasing power of the domestic traveller and the rising inbound leisure travel bodes well for hotels operating in this segment. Add to this low development costs (for instance, the cost of developing a low-rise, villa-style resort in a get-away leisure location is lower than the development cost of a high-rise hotel of the same brand with basements in an urban location) and a larger variety of destinations to choose from, with relatively low barriers to entry in comparison to major cities, leisure hotels undoubtedly present a viable business opportunity. We have been trying to draw the attention of the industry towards this sector and are happy to report that we are seeing a lot more interest in it recently. The number of feasibilities we perform in leisure locations has gone up significantly, and the notion that such properties are rarely profitable finally seems to be changing.

In closing, we believe that the HVI provides an accurate gauge of the country’s hotel industry performance over time. When viewed alongside the nationwide statistics, it is apparent that the established hotels have grown or sustained their occupancies even during the last down cycle (that ended in 2015/16), a testament to the inherent strength of the sector and its continuing potential to grow. Thus, there is no reason why the pace of growth cannot be faster and average rates cannot be commensurate to the product and service offered. After all, the hotel industry is cyclical in nature, and the present upcycle will not last indefinitely.