2019 India Hotel Manpower Study© – Synopsis

The Indian hospitality sector has been witnessing a steady growth in rooms supply, with 1,28,163 rooms operational in the branded segment in 2017/18 – this represents a 7.5% increase over the previous year and a CAGR of 11.4% since 2008/09. In the next five years, Hotelivate anticipates a little over 35,000 rooms to be developed, growing the existing base by 28% and taking the total rooms supply to 1,63,733. In an industry where each hotel company is looking for opportunities to outperform the other, the rise in

According to a study conducted by WorldatWork in 2018, India maintains the largest salary increase budget of all countries surveyed, with an average historical budget increase of 10% and the projections for 2019 remain steady at that level. It is also prudent to mention that various market reports are suggesting a global economic slowdown, and India is likely to see the glimpse of its shadow. Thus, in order to support a positive and robust year for the hotel industry, we would like to share a note of caution that requires further deliberation by industry stakeholders and leaders:

- “Uberisation of services”, or in simple terms, outsourcing, is worthy of contemplation across hotel departments (front and back of the house).

- Budgeting a conservative Payroll cost and implementing stronger cost control measures will be helpful to the business.

- Performance measurement tools and long-term incentive plans will require greater enhancement and consideration.

- Leaders and key stakeholders of hotel companies should lay greater emphasis on cost of attrition and the impact of cost of re-training of skilled resources on the annual budget.

The 2019 India Hotel Manpower Study© surveys 204 hotels across 68 cities and several domestic and international hotel chains, providing a detailed analysis of payroll cost, employee productivity, room to manpower ratio and annual attrition percentages across key parameters. The study endeavours to serve as a one-stop credible guide for hotel investors, owners, developers, operators and professional advisors, seeking an in-depth insight into payroll cost structure and related statistics. This pioneering research will assist upcoming hotels to plan their manning and payroll budgets, while enabling existing hotels to review theirs; thus, supporting you to manage your businesses better.

The specific objectives of the study include:

1. Understanding the structure/definition of payroll cost as interpreted by various participating domestic and international hotel companies.

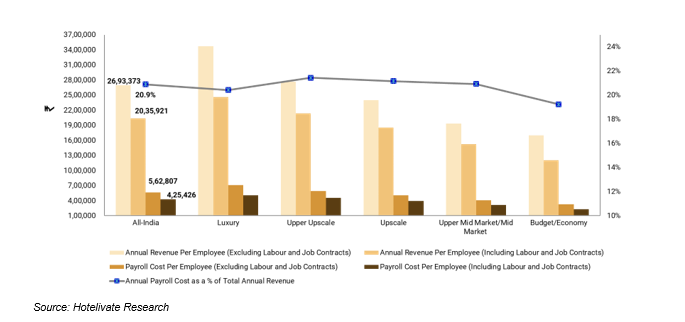

2. Analysing Annual Revenue and Annual Payroll Cost

– Annual Payroll Cost as % of Total Annual Revenue

– Annual Revenue per Employee

– Annual Payroll Cost per Employee

– Annual Payroll Cost per Occupied Room

– Annual Payroll Cost per Available Room

Figure 1: Excerpt from 2019 India Hotel Manpower Study© – Payroll Cost and Revenue Analysis (Jan-Dec 2018): All-India Average and Hotel Market Positioning

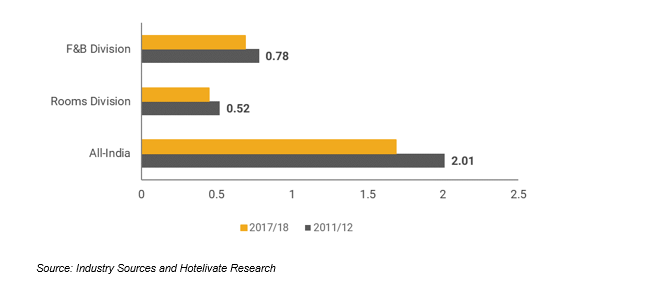

3. Analysing Productivity Statistics for Rooms and Food & Beverage (F&B) Departments

Rooms Division

– Rooms’ Revenue as a % of Annual Revenue

– Rooms’ Payroll Cost as a % of Annual Rooms’ Revenue

– Annual Rooms’ Revenue per Hotel Employee

F&B Division

– F&B Revenue as a % of Annual Revenue

– F&B Payroll Cost as a % of Annual F&B Revenue

– Annual F&B Revenue per Hotel Employee

4. Analysing Room to Manpower Ratio

– Average Manpower Levels that Indian Hotels Currently Operate At

– Average Manpower Levels Across Hotel Market Positioning in India

– Average Manpower Levels by City Classification

– Average Manpower Levels by Number of Rooms

Figure 2: Excerpt from 2019 India Hotel Manpower Study© – Comparison of Manpower Ratios Across Rooms and F&B Divisions (2011/12 and 2017/18): All-India Average

5. Analysing Annual Employee Attrition

– Attrition Percentage at an All-India Level

– Attrition Percentage Across Hotel Market Positioning in India

– Attrition Percentage Across Seven Major Hotel Markets

To serve specific requirements, Hotelivate Executive Search can also prepare paid research reports[1] such as:

– 2019 India Hotel Manpower Study© by Hotel Market Positioning

– 2019 India Hotel Manpower Study© by Nine Major Indian Cities which include Bengaluru, Chennai, Goa, Hyderabad, Jaipur, Kolkata, Mumbai, New Delhi-NCR, Pune

– 2019 India Hotel Manpower Study© focussing on Payroll Cost and Revenue Analysis

– 2019 India Hotel Manpower Study© focussing on Employee Productivity Statistics

– 2019 India Hotel Manpower Study© focussing on Manpower Ratios & Employee Attrition%

– Customised reports comparing an Individual Hotel/Chain’s payroll cost and revenue data to that of a Defined Competitive Set’s aggregate

*With critical analysis and editorial contributions from Juie Mobar, Director – Special Projects, Hotelivate

**For more information and/or pricing, please contact [email protected]

[1] Please note that Hotelivate reserves the right to withdraw a publication at any given point in time without prior intimation if it finds the data inadequate for a meaningful representation.