Hotel Management Contracts in India: The Game is Changing

C hange is inevitable, and more so in an industry as dynamic as hospitality. Market performance, lending environment, number of players, owner and operator objectives, costs and margins, and customer profile are all changing almost constantly, and so are hotel management contracts that have evolved remarkably in India in the past decade. Once an operator stronghold, hotel management agreements had little to no room for negotiations, leaving an inexperienced owner (with no expert advice) with a sub optimal contract. However, the game is now changing! Today’s more experienced and perceptive owner is demanding higher returns for lower fees from operators, who are at present in much larger numbers than in the past, increasing the competition and offering the owner more choice. Additionally, owners are showing their might, with many of them developing a portfolio of hotels as against just stand-alone properties. Understandably, operators are more than willing to sweeten the deal in such cases, since it is easier to negotiate with one party for a larger number of hotels than with different parties for each of their properties. Also, the nature of hotel ownership is changing today, with a growing number of institutional investors assuming a more dominant role than HNIs and family holdings – mainly attributable to the industry upcycle, relaxation of FDI norms in the sector and more widespread development of lower-positioned assets that are easier to transact. This new breed of owners has a clear exit strategy in mind, as against retaining legacy assets, and thus, expects management companies to have skin in the game. This may take the form of equity participation, key money, an operator loan or a more robust performance-based compensation structure.

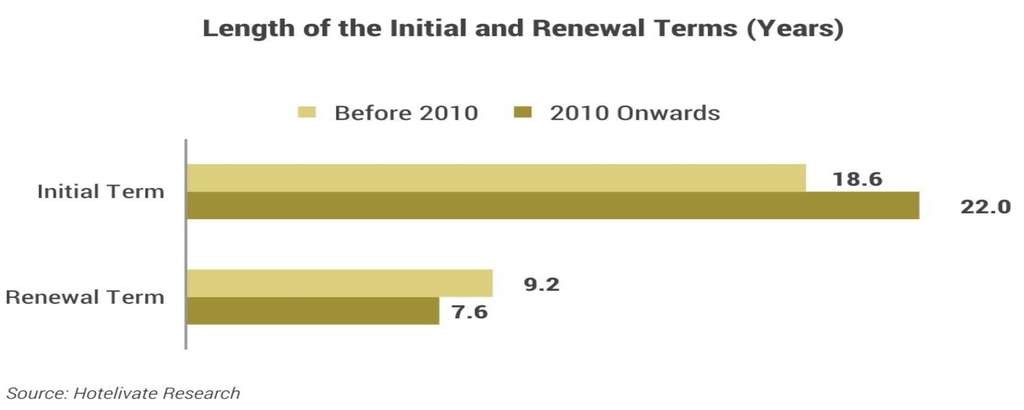

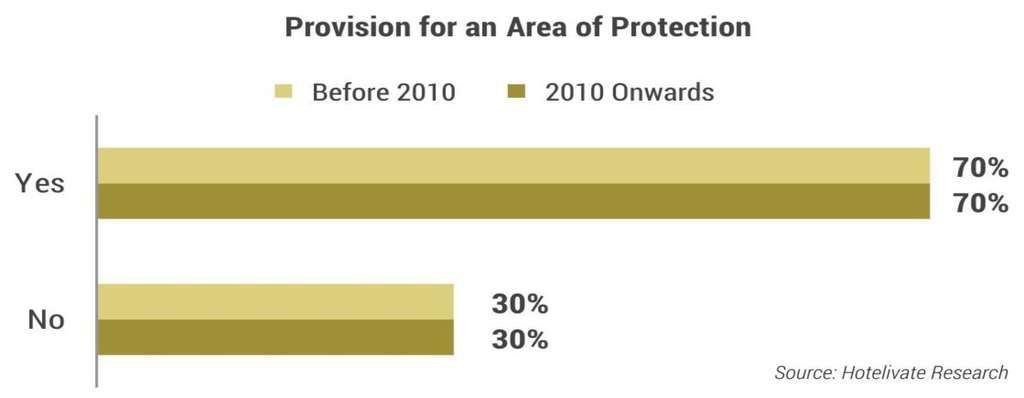

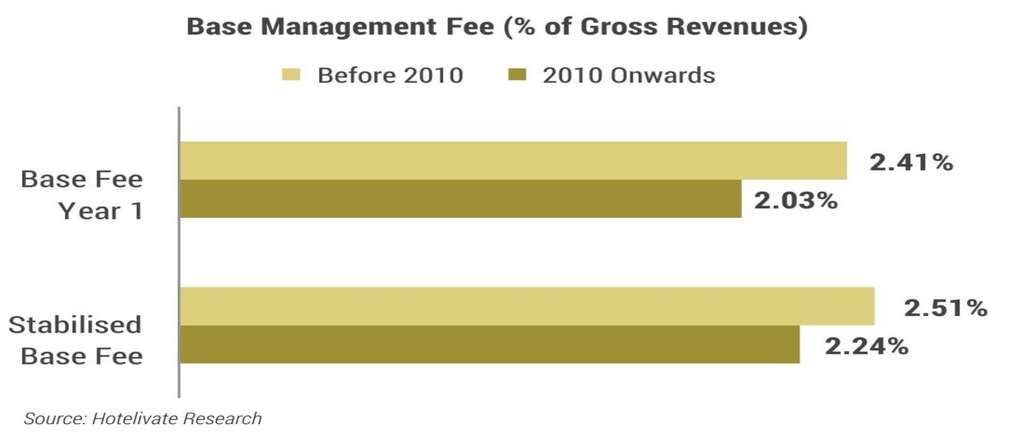

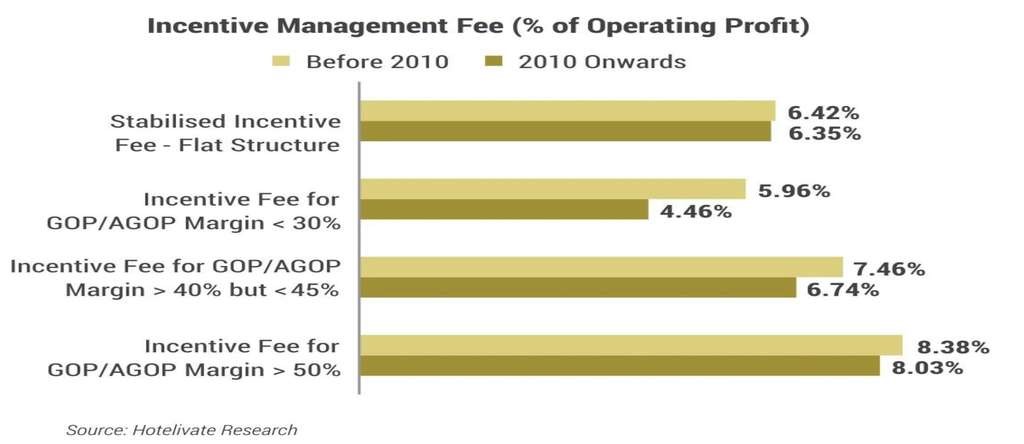

The Hotelivate team has two decades of experience in negotiating hotel management contracts in the country. Drawing upon that experience, we have highlighted select key terms and depicted the way they have changed since 2010. While the charts show the sample set averages, we have shared additional insights alongside to make the reader aware of the many ways in which the terms are changing – beyond what just meets the eye.

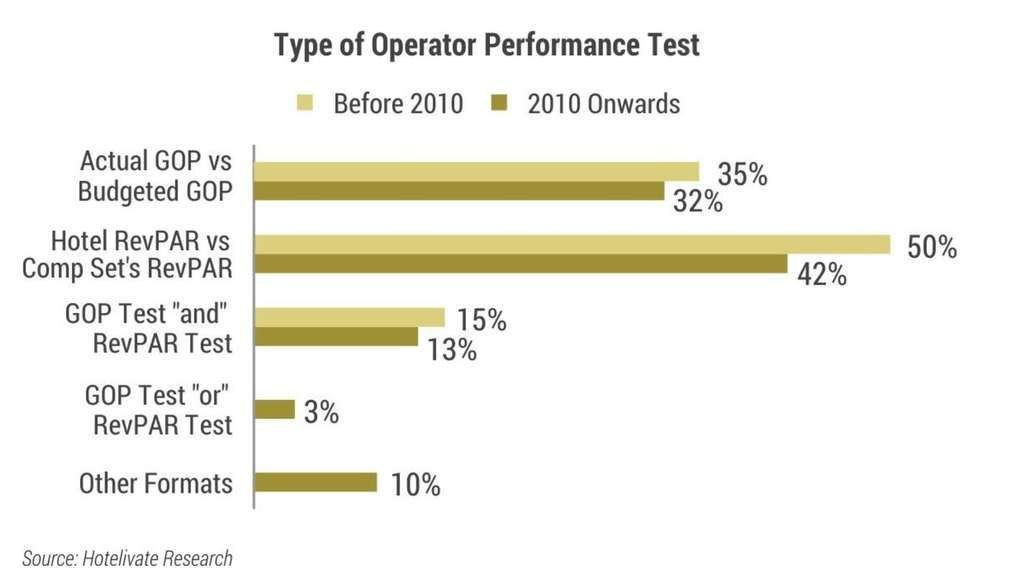

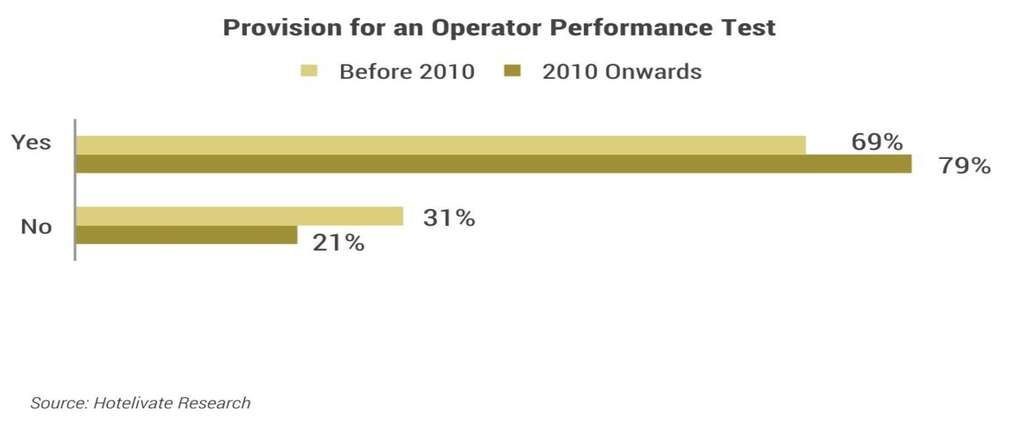

An operator performance test is more prevalent in management contracts signed in or after 2010, with it commencing typically in Year 4 or 5 for new properties and Year 1 in case of conversion assets. Notorious for not being as effective as it looks, the performance test clause is often drafted in a manner that it is nearly impossible to terminate the operator based on poor performance. Thus, owners and their advisors are finding ways in which the test can be made more robust and fairer to both sides. For instance, while the test period is commonly two consecutive years, we find that a period of two out of every three consecutive years or three out of every five consecutive years is also being agreed upon. Additionally, higher test thresholds are being demanded (greater than 90%), and instances of operators agreeing to GOP “or” RevPAR-based tests, where failure on “either” account could give rise to owner’s right to terminate (if left uncured) are increasing. Other customised test formats such as achieving certain EBITDA levels during the test period can also be found.

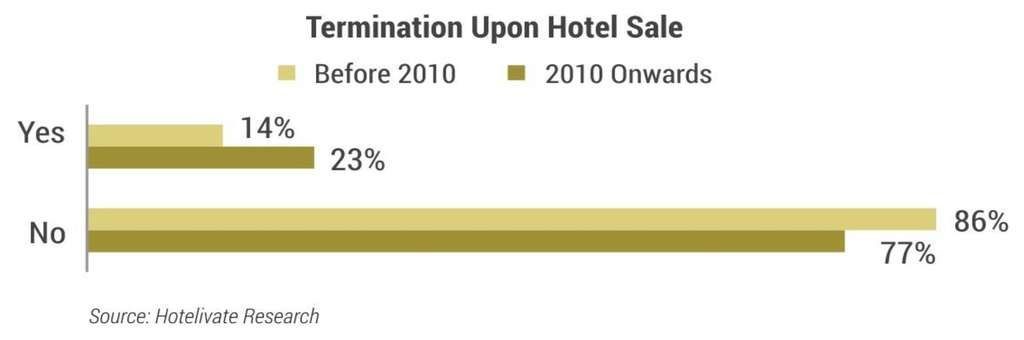

Contracts that allow the owner to terminate upon hotel sale to a third party are more frequent now than prior to 2010, though it always attracts a severance/termination fee that is payable by the owner. Nonetheless, owners still try and include this provision in the contract as the sale is a lot easier when the asset is unencumbered by a management contract. Moreover, an incompetent operator can be terminated sooner than possible under the typical performance test clause.

Besides the key commercial clauses discussed above, a hotel management contract comprises several other critical aspects that need scrutiny prior to signing. For instance, the technical services fee, which has not undergone a significant change over the years in terms of the absolute monetary amount charged by the operator, is now time-bound. We are seeing more and more contracts stipulating a period ranging from 36-48 months for the technical services to be rendered. Beyond this duration, there is an additional fee payable by the owner to the operator. Moreover, if an operator is making an equity contribution by way of offering key money, the length of the initial term and the management fees charged tend to be toward the higher-end of the spectrum. Not to forget the myriad of fees and charges associated with shared services or chain services – all of which are non-negotiable and can be revised at the operator’s discretion. Though most brands now mention the fees for marketing, select reservation services and the loyalty program contribution in the contract, these are just the tip of the iceberg.

Hence, the significance of the owner getting expert advice or guidance before signing a hotel management contract cannot be overemphasised. Over the past two decades, we have seen many owner-operator relationships sour or fail only because not enough care was taken prior to entering the association. As we are asset managing a greater number of properties today, we find that aligning the expectations and financial objectives of both parties is challenging, and an equitable and fair management agreement can go a long way in making the operation of the hotel smoother.

Note: Around 70 hotel management contracts signed between 2003 and 2018 were reviewed by Hotelivate. These contracts represent all market positioning and hotels of different scales – less than 100 rooms to between 300-500 rooms. Also, Hotelivate would like to qualify that all the management contract terms and trends depicted here are broadly indicative in nature, and can vary depending on factors such as location, project profile, operator and investor type.

For more information, please contact Manav Thadani at [email protected] or Juie Mobar at [email protected]