Experience Economy and Consumer Experience

Emergence of Boutique & Lifestyle Hotels

Boutique & Lifestyle Hotels in India

Even though, this concept is relatively nascent in India; it has gained a lot of attention in the past few years. Leisure tourism contributes over 90% of the total business across India. (India Annual Report 2022, WTTC). After the onset of the pandemic, not only have popular domestic destinations seen an increase in footfall, but tourists have also started exploring lesser-known locations in the country. Furthermore, millennials (~34% of the country’s population), one of the key customer segments for these hotels, have seen an increase in their disposable income. Currently, this space has independent brands, who have been operating for about five to ten years, such as Niraamaya, Tree of Life, Rosakue and Postcard. Additionally, established players are entering the market with a variety of brands such as the Tribute Portfolio by Marriott; SeleQtions by IHCL; Stori’i and Mementos by ITC Hotels; Radisson RED, Radisson Individuals and Radisson Individual Retreats by Radisson Hotel Group; and Hyatt Centric and Unbound Collection by Hyatt, to name a few. About 5,000 rooms (~8% of the branded proposed supply) in the next five years are being developed in the boutique/lifestyle space.

Due to the unique nature of the Indian market, there are certain key facets which need to be considered while developing these assets. The Indian consumer has a set standard of expectations, irrespective of positioning, which tends to affect the brand architecture of the company. Therefore, these boutique and lifestyle hotels need to offer a set of differentiators to stand out of the crowd. Social media and Brand website are key resources which can be used to educate the consumers. Product, services, localization, and experiential offerings would act as the intangible unique selling points (USPs). Beyond this, the brand needs to offer a few tangible differentiators. For example, SLS Hotels by Accor have a giant metallic duck at the poolside. These small attributes and elements can help stand out from the crowd and capture a larger share of the market.

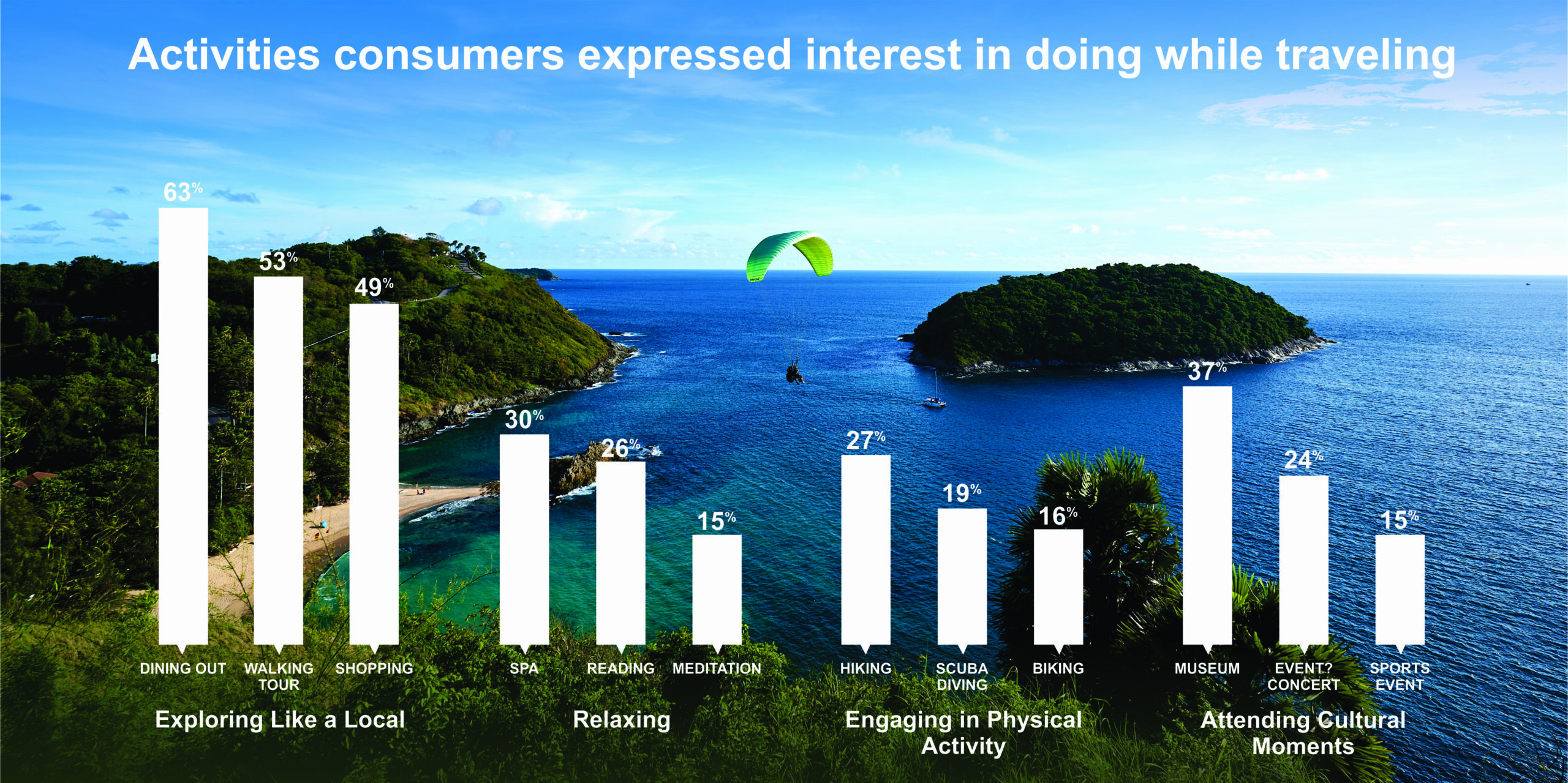

Additionally, these hotels need to incorporate certain elements to maximize the consumer experience. Since, most of the target clientele is leisure oriented, these hotels need to incorporate a variety of recreational facilities and outdoor activities. Along with recreational offerings, the hotel needs to offer a set of local experiences which allow the guest to interact with the community and understand the culture. The product and services need to keep in mind offerings for both kids and aged people. Since many of these hotels will be in leisure locations, the hotels will face certain challenges in terms of procurement. These hotels would tend to offer a relatively smaller menu; at the same time, the brand needs to ensure varied food and beverage offerings to please the palate of the guest. Especially in India where food and beverage are an important component of the guest experience. Additionally, sustainability is becoming an essential element for these hotels.

It is clear that these boutique/lifestyle hotels represent an interesting opportunity in a market like India. The growing leisure and domestic footprint along with the rising significance of experiences for the consumers will ensure strong growth of the market. While the brands need subtle tweaking to appeal better to the Indian consumer and capture a larger market share, boutique/lifestyle hotels are likely to become a significant part of the Indian hospitality industry.

For more information, please contact Mihir Chalishazar at [email protected]