How Can India Increase its Share of Inbound Leisure?

In association with

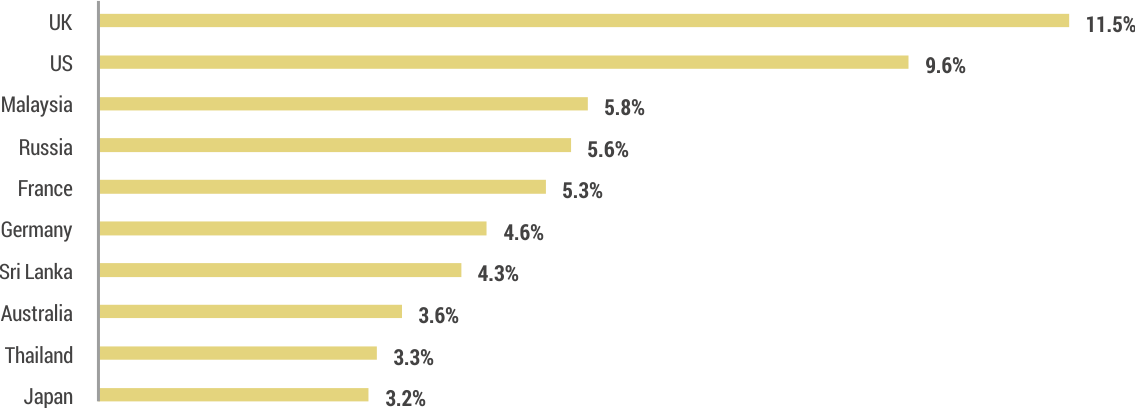

I ndia received over 10 million international tourists (excl. NRIs) in 2017, but how many of them travelled for leisure? Based on an in-depth research and analysis by CAPA, it turns out that only 2.5-3 million tourists visit India each year for the purpose of a holiday, with the USA and UK contributing a major chunk of the total (Figure 1). For a country this size, which has rich and diverse tourist offerings, the figure is dismally low. To offer some perspective, Thailand received 35 million tourists, predominantly in the leisure segment, in 2017 and Singapore, a city-state, received around 17 million inbound tourists that year. Our focus on leisure tourism can be better understood when one considers its economic benefits. Leisure travellers usually have longer durations of stay. They also tend to access more facilities and services related to accommodation, food, transportation and recreational activities and engage more with the local community than business travellers; thus, resulting in a wider induced economic impact.

FIGURE 1: SHARE OF TOP 10 SOURCE MARKETS FOR LEISURE FOREIGN TOURIST ARRIVALS TO INDIA – 2016

Note: Inbound leisure travel from Malaysia may be lower than what is shown above, possibly due to VFR traffic (visiting friends and relatives) being incorrectly reported as leisure.

Source: CAPA India Research and Analysis

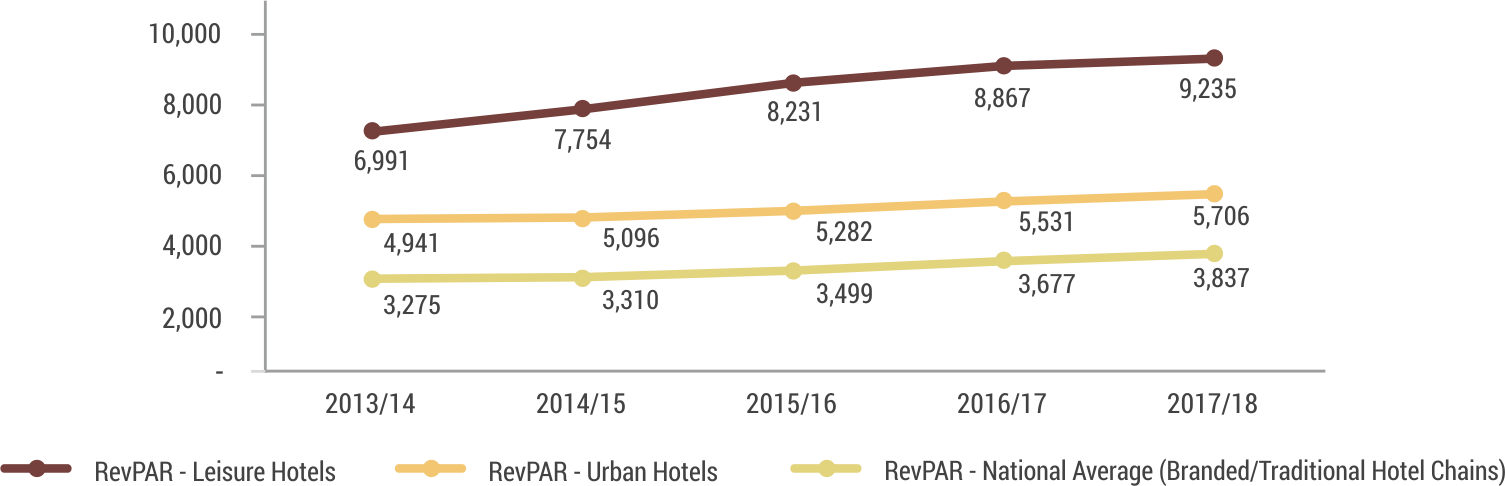

In the hotel industry, leisure properties continued to outperform their urban counterparts in 2017/18 largely as a result of steady demand and higher average rates. Figure 2, compares the RevPAR performance of 20 stabilised branded leisure properties with that of 60 stabilised branded urban properties in India over a five-year period. The RevPAR of INR9,235 clocked in 2017/18 by the leisure sub-set was 1.6 times that of the urban sample and 2.4 times the national average. The strong year-on-year performance of the former clearly points towards a healthy demand for such hotels in the country, making investment in leisure properties perceivably more viable than previously thought. The peaks and troughs in demand in leisure locations is smoothening with creative promotions, social events, corporate off-sites, MICE and group travel serving as fillers. Moreover, the low reliance of leisure hotels on RFPs from corporates that are relatively more sensitive to economic and trade conditions, make them less vulnerable to price wars.

FIGURE 2: PERFORMANCE OF LEISURE HOTELS VS URBAN HOTELS (BRANDED/TRADITIONAL CHAINS) IN INDIA – 2013/14 TO 2017/18

Source: Hotelivate Research

So, how can India increase its share of inbound leisure? CAPA makes the following recommendations:

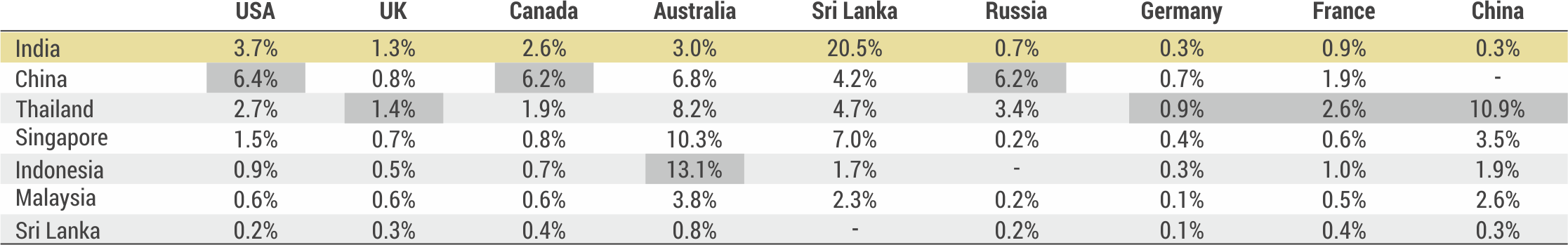

Capture a larger share of outbound leisure traffic from mature source markets than investing scarce resources in emerging source markets. In comparison to its peer set in the Asia Pacific, India has a low market share even in its top 10 source markets.

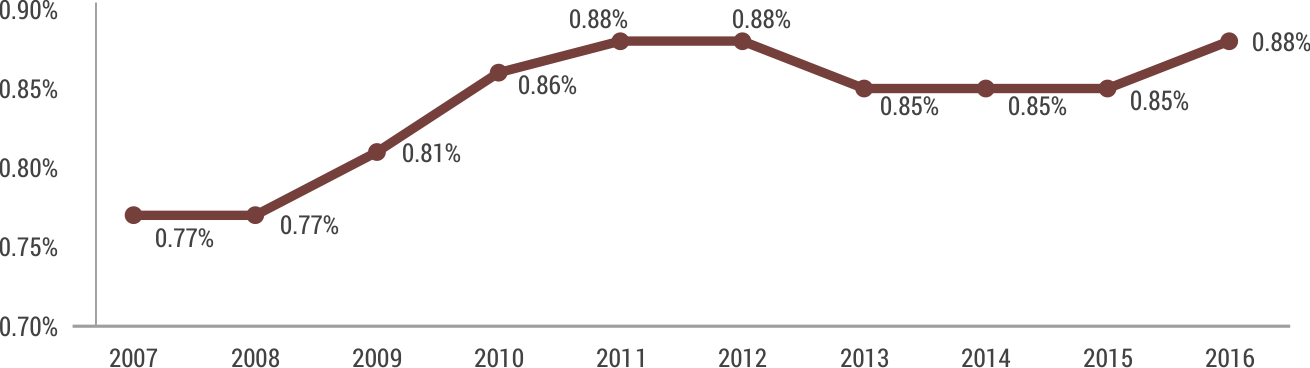

At an individual market level, India’s share of outbound traffic from its 10 largest source markets ranges from 0.3% in Germany and China to 3.7% in the USA. The country’s low market share has declined further in recent years for outbound travel from Sri Lanka, China, the UK, France, Japan and Canada even as China’s share in these markets has been growing.

FIGURE 3: INDIA’S MARKET SHARE IN ITS TOP 10 SOURCE MARKETS (OVERALL) – 2007 TO 2016

Source: CAPA India Research and Analysis

FIGURE 4: INDIA’S VS PEER SET’S SHARE OF OUTBOUND TRAVEL FROM INDIA’S LEADING SOURCE MARKETS (OVERALL) – 2016

Source: CAPA India Research and Analysis, UNWTO

- Participate more in the Chinese outbound travel phenomenon. China leads the world in terms of international outbound travellers as well as international tourism spend. However, India currently receives fewer Chinese visitors than even Sri Lanka and Maldives (that are way smaller), despite being a similar length of haul from China.

- Make reaching India easier and more cost-effective for tourists. Around 98% of leisure tourists arrive into India by air, and so direct connectivity and availability of seats is paramount. At present, for most of the priority markets for leisure tourism to India, the majority of traffic still flows through an intermediate hub, especially from long-haul markets like the USA, Canada and Australia.

- Establish greater connectivity to develop short-haul leisure markets. Around 61% of India’s foreign tourists are from long-haul destinations (more than six hours). This is in clear contrast to leading tourist destinations in the world, like France, Spain, USA, China and Italy, which receive their largest share of visitor traffic from their neighbours (short- and medium-haul markets –under three hours and between three-to-six hours, respectively). Distance makes travel to India not only more expensive, but also less suitable for short, spontaneous breaks. Also, India ends up competing with a greater number of destinations of a similar haul and cost.

- International expansion by Indian carriers. While the primary focus of home-based airlines is to increase point-to-point traffic, as the networks of these airlines increase, there will be more connecting traffic via India (e.g. between London and Sydney), creating more incremental visits and encouraging transiting passengers to return in the future.

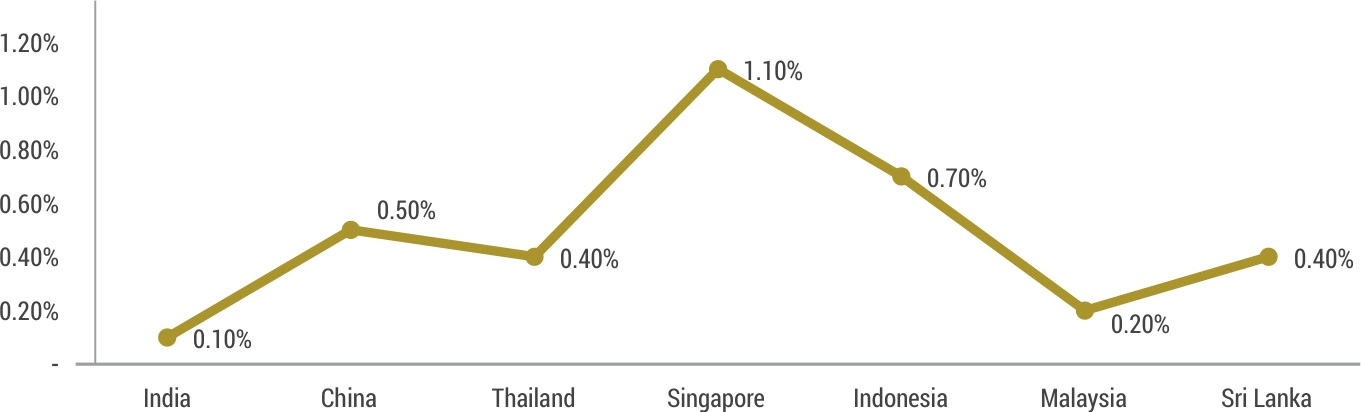

- Increase government spending on tourism as a percentage of its GDP. In 2017, the Indian government’s collective travel and tourism spending as a share of its GDP was just 0.1% despite the sector’s total contribution to GDP of 9.4%. Comparing this statistic to that of peer countries, one can see that India ranks the lowest.

FIGURE 5: GOVERNMENT’S COLLECTIVE SPENDING ON TRAVEL & TOURISM AS PERCENTAGE OF THE COUNTRY’S GDP – 2017

Source: CAPA India Research and Analysis, WTTC

- India needs to attract a higher share of millennial leisure travellers. While India has a backpacker market, it needs to reorient itself to promote high value youth leisure tourism. Youthtravel is one of the fastest growing and most dynamic markets of global tourism. According to UNWTO’s 2016 report on youth travel, young travellers spend more of their budget in local communities, have longer durations of stay, are a great source of word-of-mouth marketing (especially via social media) and tend to be more resilient to economic problems.

- Effective destination marketing and promotion. The Incredible India campaign needs to develop continually with vigour, and ways to gauge its true effectiveness need to be determined. Moreover, states must align their tourism marketing and promotion with the national campaign.

- A well-defined tourism policy/strategy document. Other leading tourist destinations studied by CAPA have a well-defined tourism policy focussing on overseas promotion, government and industry collaboration, infrastructure improvements and reduced regulations. These countries do not govern tourism as a separate ministry; rather, they manage it as a department under the ministry responsible for trade development. The department is supported by advisory boards and an inter-ministerial group to aid collaboration between the tourism department, other government offices and the industry.

In conclusion, we observe that leisure travel to India has huge potential (be it pure leisure or “bleisure” that combines business with leisure), and the country is just scratching the surface at the moment. To this extent, the tourism industry (including hotels) needs to collectively plan and commit resources to attract leisure tourists to the country. The diversity of India’s leisure offerings should be better communicated, and the subsequent growth of this segment should be adequately supported and sustained. We must aim at making India a “must-visit and easy-to-discover” destination!

For more information, please contact Manav Thadani at [email protected] or Juie Mobar at [email protected]