Sizing Up Indian Hospitality

The Hospitality Industry has gone through an almost cinematic fall and resurgence in the last few years. Global projections were turned on their heads by geopolitical crises and the pandemic taking centre stage. Amidst this uncertainty, Hotelivate took up the challenge to assess where the industry stands today and predict its future in India. In particular, we looked at the size of the hotel market in terms of supply and the number of employees within it. Historically, as consultants we have tracked this since 1995 through our annual Trends and Opportunities report and only focussed on the branded hotel segment. However, the branded hotel segment represents only a fractional portion of all accommodation, and it is important to understand the larger picture so all stakeholders, including the government, investors, consultants and others can have a better understanding of the larger picture.

Hotelivate’s latest analysis reveals a robust count of 2.48 million lodging rooms currently operational in India as of June 2024.

When discussing the total inventory of accommodations in the country, the picture appears quite hazy. Recognising this gap, Hotelivate undertook a comprehensive market sizing exercise with inputs from well-known OTAs and industry experts. After estimating the total number of rooms across the country, our next natural step was to gauge the industry’s potential employment impact. Using this dual lens helped us understand the industry’s economic contribution and chart where we’ll be in the hospitality landscape a decade from now.

Hotelivate’s latest figures reveal that India’s hospitality industry supports a formidable workforce of 2.3 million as of June 2024, translating to 0.94 employees per lodging room nationwide.

The Supply Story

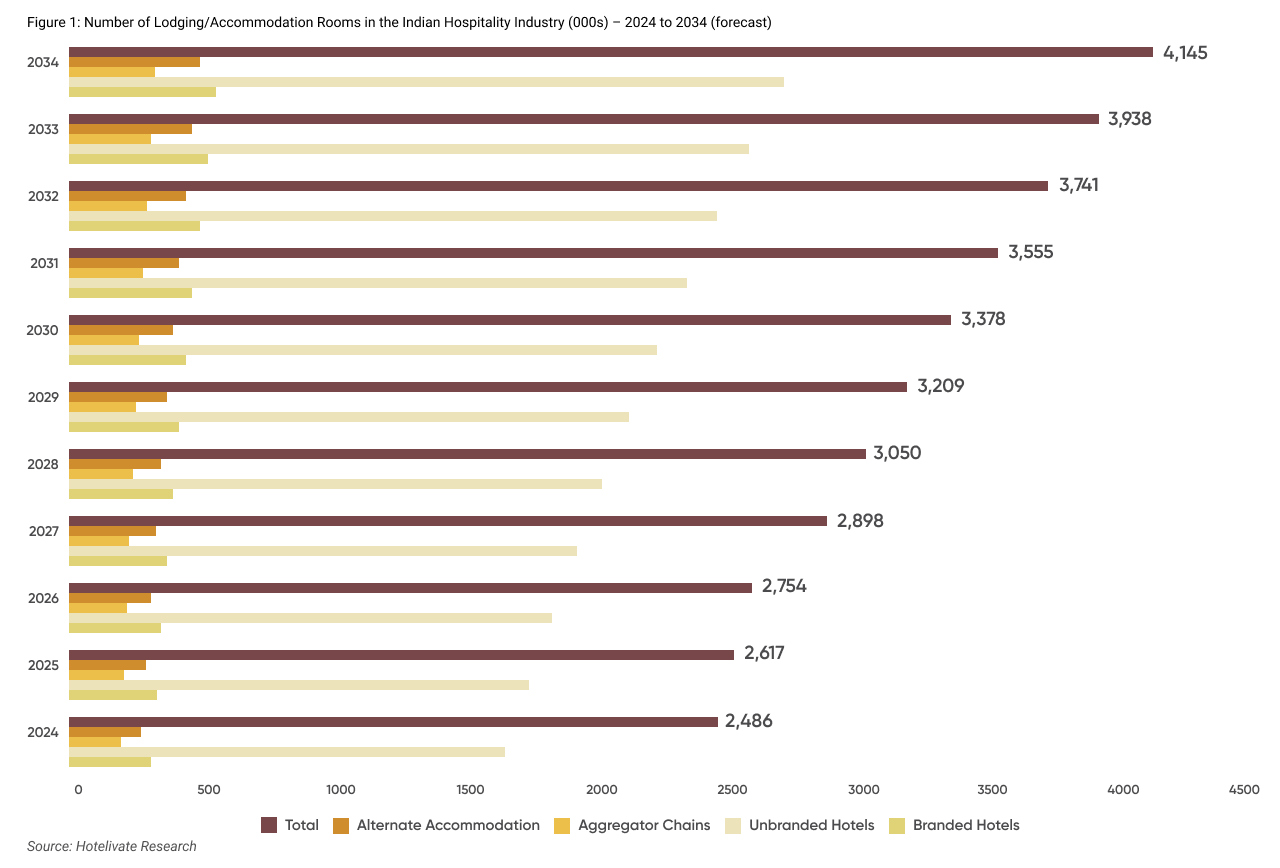

Hotelivate’s latest analysis reveals a robust count of 2.48 million lodging rooms currently operational in India as of June 2024. This figure spans across a diverse spectrum, encompassing branded hotels, aggregator giants like OYO, FabHotels, and Treebo, independent establishments, and various alternative accommodations such as guesthouses and homestays. Looking ahead, projections indicate a steady ascent, with the room count expected to climb to 3.1 million by 2029 and surge further to 4.1 million by 2034. Initially poised to reach 3.3 million by 2024 based on pre-pandemic forecasts, the hospitality sector encountered setbacks during the Covid-19 crisis, notably impacting unbranded and aggregator segments, where closures approximated 15% of room capacity. Despite these challenges, the branded sector demonstrated resilience in the last two years, marked by a resurgence in new signings and openings. With tourism on the rebound and market dynamics improving, the industry anticipates not only a swift recovery to pre-pandemic levels by 2025 but also sustained growth throughout the coming decade.

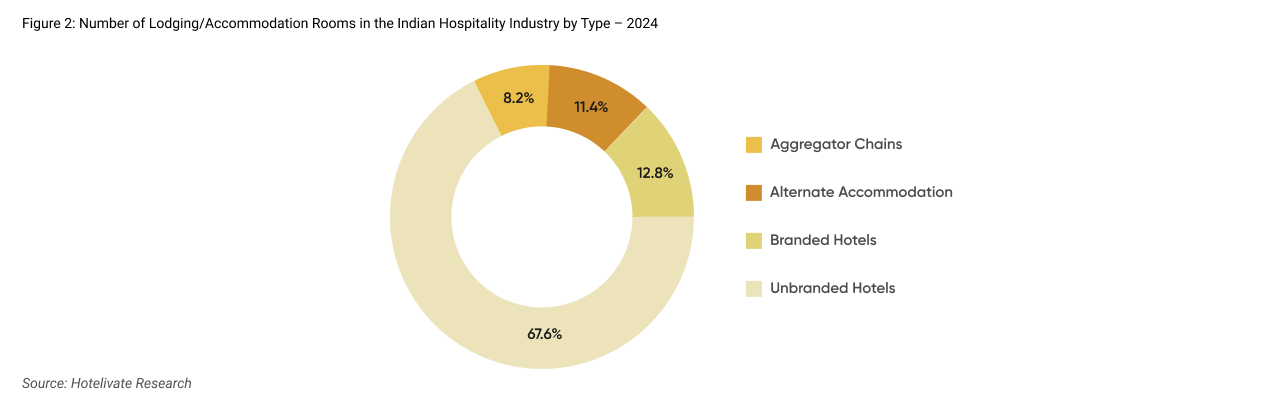

“Unbranded Hotels currently make up more than two-thirds of the country’s total lodging supply and are projected to maintain this dominant position for the next decade”

The independent/unbranded segment possesses a commanding 68% share of India’s lodging landscape, underscoring its dominant presence in the market. Meanwhile, the branded hotels sector has swiftly emerged as the second largest, buoyed by increasing investments and heightened interest from both domestic and international brands, particularly in tier II and tier III cities. Simultaneously, the alternate accommodation sector, bolstered by the rising popularity of homestays alongside a robust base of guesthouses, has solidified its position as a significant player in the market. Notably, aggregator chains have maintained a stable market share over the past half-decade, with new openings counterbalancing closures incurred during the tumultuous pandemic period.

The People Story

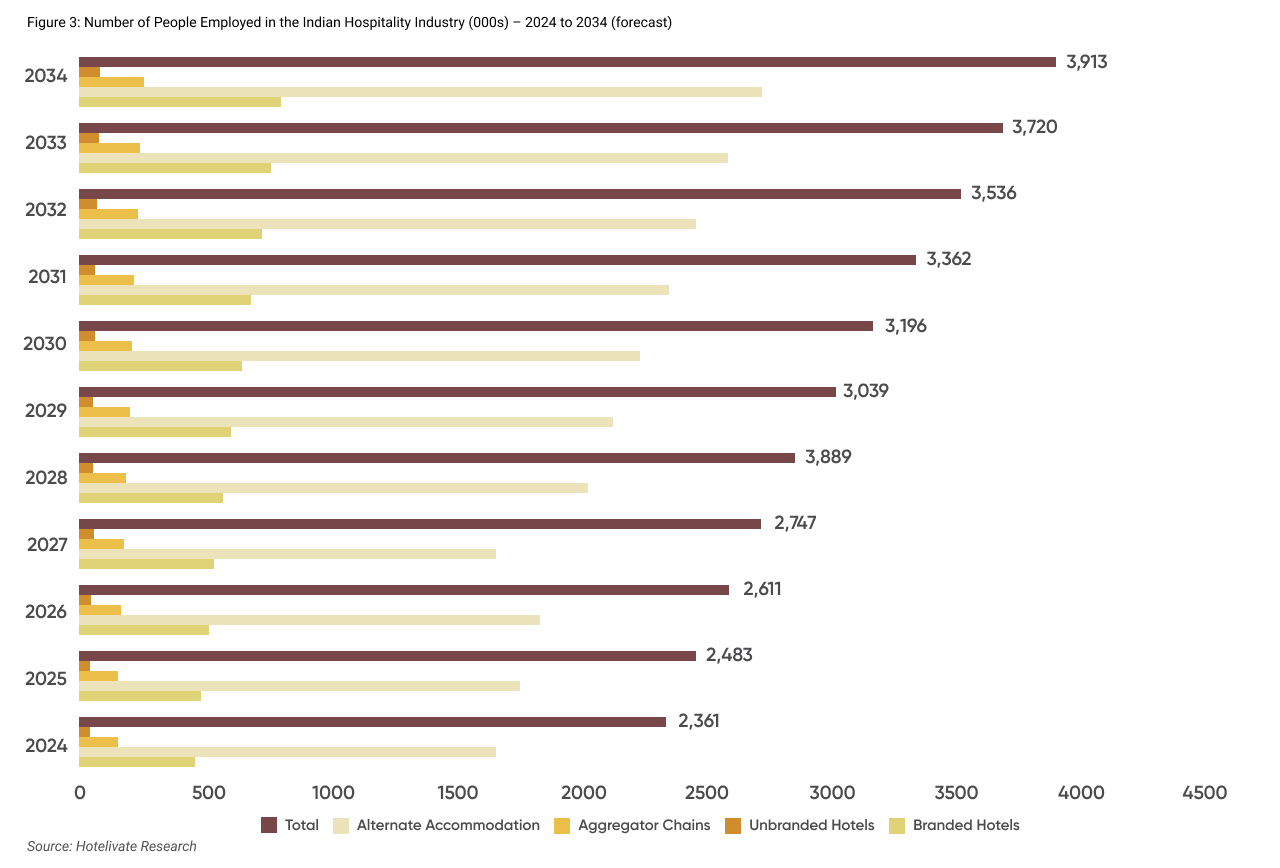

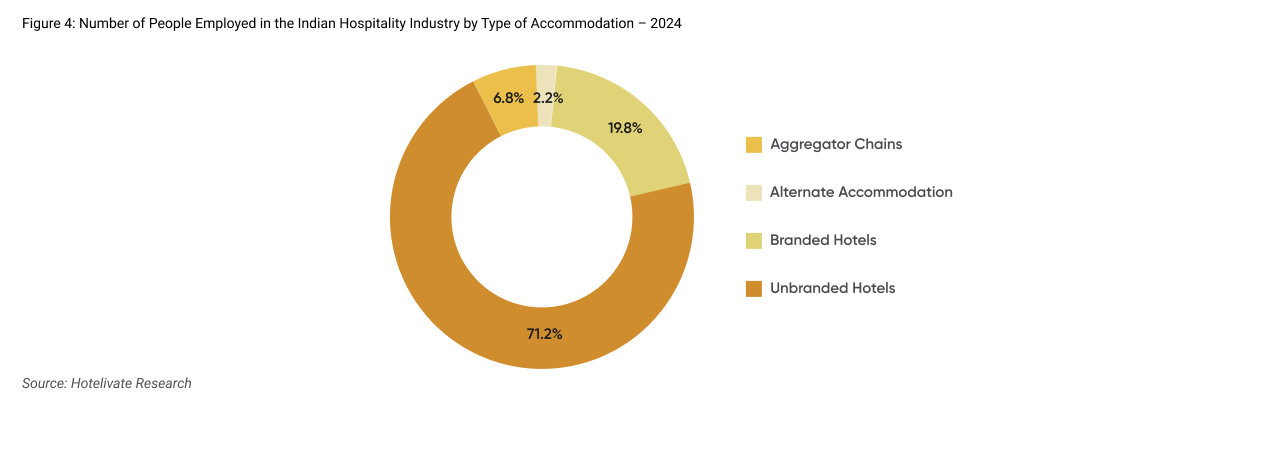

Hotelivate’s latest figures reveal that India’s hospitality industry supports a formidable workforce of 2.3 million as of June 2024, translating to 0.94 employees per lodging room nationwide. Despite pandemic disruptions in 2019, when the sector sustained 2.4 million jobs, the industry remains a vital contributor to India’s employment landscape. WTTC underscores this impact, noting that India’s broader Travel & Tourism sector directly employed 37.21 million people in 2023, with hotels accounting for a substantial 6.21%.

Looking ahead, we anticipate robust growth in hospitality employment, climbing to 3.0 million by 2029 and further to 3.9 million by 2034. With unbranded hotels leading the charge due to their sheer number, despite the low employee-to-room ratio.

The hospitality industry is multifaceted with various parallels other than hotels. Even with the addition of 1.5 million jobs in the next decade, we believe this is a conservative estimate for the hospitality industry as the industry is likely to see growth in employment from ancillary facilities such as clubs, restaurants, dhabas, clubhouses, banquet halls, and various other infrastructure that is being established in large volumes across the country. These ancillary facilities may employ individuals not accounted for in these estimations. Therefore, although the current projected growth in employment is 1.5 million jobs, the actual number added may be much higher than this estimation.

“Although the current projected growth in employment is 1.5 million jobs, the actual number added may be much higher than this estimation”

Conclusion

Hotelivate’s latest analysis reveals India’s hospitality industry bouncing back strongly as of mid-2024. Despite setbacks from global crises, the sector has currently seen growth in the branded hotel supply in the last few years. Employment continues to grow in the sector, led by branded hotel supply due to the sheer volume of these accommodations in the country. With investments surging, particularly in tier II and III cities, and a resurgence in new openings, the industry will experience sustained growth in the decade ahead. This sets the stage for a thriving hospitality sector poised to capitalise on growing tourism and solidifying its essential role in the Indian economic landscape.

HOTELIVATE METHODOLOGY

Hotel Supply: We tracked close to 1,400 hospitality markets in the country and based on data from various credible sources, we established the known supply for each of these under branded hotel chains, aggregator chains, unbranded hotels and alternate accommodation. For proposed supply, based on our database for branded supply and prevailing trends in the industry, we applied corresponding growth rates for each category of accommodation. Apart from this actual data, we looked at the CAGR by positioning for the past ten years and then, using a combination of both, forecasted room inventory from 2025 to 2034.

Employment: For calculating the total number of employees, we first filtered the hotels/properties by market positioning and accommodation type, and then, based on the prevalent industry standards for the organised segment (as presented in the India Hotel Manpower Survey by Hotelivate) and reliable estimates for the unorganised sector, we applied a room-to-employee ratio as presented below to arrive at 2.3 million employees in 2024. For proposed supply, based on our projections for supply growth, we calculated the number of people likely to be employed by the hospitality industry in the following years.

For more information, please contact Harinya Sreenivas at [email protected] or Manav Thadani at [email protected]