Sports Tourism: The Middle East Playbook

Sports has become closely intertwined with travel and hospitality, especially with the rise of experiential travel in recent years. For many, sports events are a bucket list item, and this has significantly boosted their popularity. Major sporting events can act as powerful catalysts for tourism development, benefiting destination branding, infrastructure, and providing economic and social advantages.

The UN estimates that sports tourism accounted for 10% of global sports expenditure in 2023. According to the World Economic Forum, sports tourism in the Middle East is expected to grow by 8.7%, compared to just 3.3% globally.

While this trend is gaining traction worldwide, no region has embraced it as strongly as the Middle East. Recently, Saudi Arabia was named the host of the 2034 FIFA World Cup, making it the second Middle Eastern country to take on the role. Additionally, Saudi Arabia and Qatar in addition to countries like India and Indonesia are seen as strong contenders for the 2036 Summer Olympics, further underscoring the Middle East’s growing status as a global sports hub. In recent years, Dubai has become a key venue for major events, including the immensely popular Indian Premier League cricket tournament. The region is also central to Formula 1, with Bahrain hosting the season opener, Abu Dhabi holding the finale, and races taking place in Jeddah and Lusail in 2024.

Saudi Arabia is further enhancing its sports profile by entering the tennis market, with the country hosting the Six Kings exhibition match in October 2024, with a record prize pool of $6 million. The Middle East has also emerged as a major player in professional golf, with LIV Golf partnering with the Saudi Arabian Government.

Given this rapid transformation and major investment, it’s worth examining why the region is so eager to host these major sporting events, the strategies it is using to attract global sports fans, and the potential challenges it may face along the way.

Why Play the Game?

At the recently concluded Summer Olympics in Paris, records were broken not only on the field but also in the stands, as 6 million visitors gathered across France to support their teams. The Men’s and Women’s basketball tournament at the 2024 Paris Olympics drew an astonishing 1.07 million spectators.

The demand from sports fans has been steadily increasing in recent years, with more sports coming into the spotlight and attracting growing audiences. The Tour de France alone draws nearly 12 million spectators annually. Similarly, the Football, Rugby, and Cricket World Cups attract between 1 to 4 million people to support their teams. Even six months before the Olympics, flight searches to France during the games period had already surged by 25%.

The economic impact of major sporting events on the hospitality industry is evident. During the 2016 Rio Olympics, hotel revenues soared, with ADRs increasing by 199.2%, occupancy rising by 26.6%, and RevPAR jumping by 278.6%. London, which has a higher historical performance base, saw an 80% increase in RevPAR during the 2012 Olympics. Similarly, the Super Bowl boosted the US nationwide ADR by 6.8% year-on-year and RevPAR by 3.9% during the so-called “Super Weekend.” Hotels in Southern Nevada, for instance, averaged a rate of $768 per night for that weekend.

The economic advantages of being a sports hub go beyond just the events themselves, leading to long-term positive effects, particularly in the travel and hospitality industries. This explains why the Middle East is keen to tap into this growing demand, positioning itself as the go-to for global sporting events.

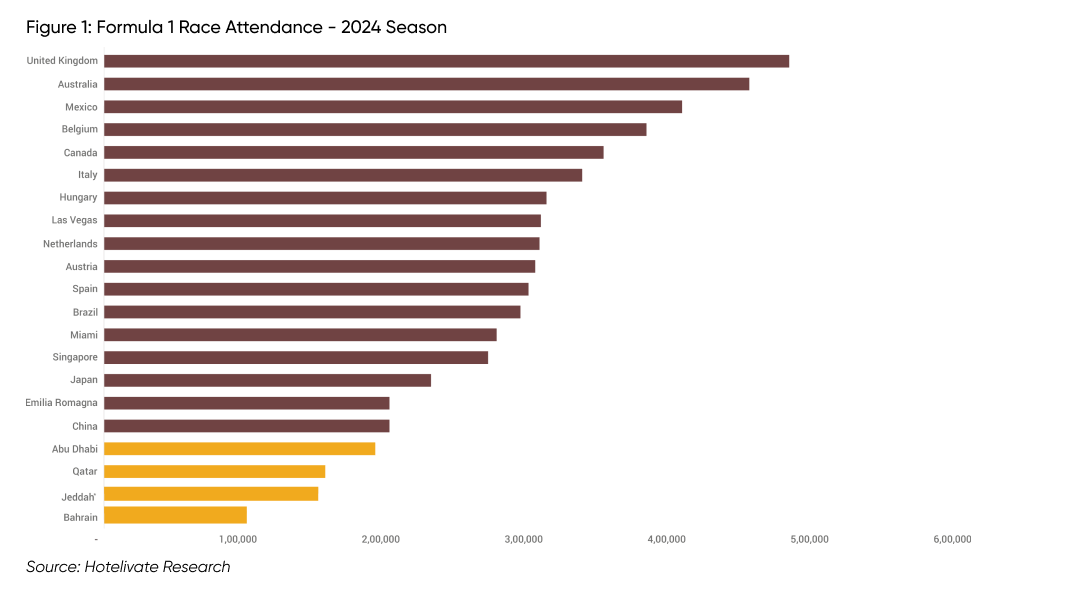

Trackside records

Formula One’s cumulative attendance reached a record of 6 million in 2024. While races in the Middle East currently have the lowest attendance compared to iconic events like the Silverstone or Monaco Grand Prix, this trend is expected to change due to the region’s growing sports tourism. Reflecting this rise in popularity, Saudi Arabia has announced plans to build a second racetrack in Qiddiya City, with an investment of over US $480 million.

Investing in the Big Leagues

Sports have often served as a catalyst for infrastructure development in various regions. The prospect of hosting a major sporting event motivates the creation of sporting villages and even entire cities. As shown below, the lead-up to the Summer Olympics saw an increase in hotel supply, even in cities like London and Tokyo, which were already considered saturated markets.

The rise in sports tourism aligns with the Middle Eastern countries’ ongoing efforts to diversify from an oil-based economy, with a strong focus on tourism as part of this transition. As demonstrated by recent sporting events, governments and sovereign wealth funds have backed these efforts with significant investment. Under Saudi Arabia’s Vision 2030, the Public Investment Fund has committed over $6.3 billion since 2021 to develop sports infrastructure. Similarly, Qatar’s urban landscape was transformed in the lead-up to the 2022 FIFA World Cup, with infrastructure development integrated into the country’s National Development Strategy (2018–2022). The World Cup acted as a catalyst for the creation of transportation networks, hospitality districts, and even entire cities. These developments complement larger projects like Qiddiya City in Riyadh, which, as part of Vision 2030, will include 45 sporting facilities in its first phase. Similar initiatives are underway in other mega-projects such as Diriyah, Al Ula, and NEOM.

The anticipated economic benefits of hosting major sporting events have also prompted the governments to offer incentives for sports organisations to bring events to the region. The 2022 World Cup set new standards for “smart stadium” development, with governments increasing incentives to encourage private sector investments in sports infrastructure, complementing robust public sector funding.

Beyond infrastructure, Middle Eastern sovereign wealth funds have also invested in sports teams to attract them to the region. For instance, the Saudi Public Investment Fund and the Qatar Sports Investment Authority hold stakes in the Newcastle United Football Club and the Paris Saint-Germain Football Club respectively. Additionally, the privatisation of major clubs in the Saudi Pro-Football League, has brought international football stars like Cristiano Ronaldo and Neymar Jr. to the region.

The opportunities for the travel and hospitality industry are immense. Many hospitality companies – local and international – recognise the impact of sports on their businesses and are forging partnerships with major sporting events to build a loyal following. The growth of hospitality services within sporting arenas, as seen during the Paris Olympics, presents additional opportunities for the hospitality sector. With visitor spending expected to reach record levels in 2024, it’s clear that wherever the games go, hospitality should follow.

Potential Fouls & Penalties

As global sports audiences continue to grow, governments worldwide are eager to capitalise on this demand. Major hotel projects are already underway for the 2028 Los Angeles Olympics and the 2032 Brisbane Olympics, and many countries, are vying for the opportunity to host the 2036 Games. The race to secure these high-profile events is intense, as nations recognise their potential for economic benefits and global visibility. However, while hosting a mega-sporting event can significantly boost the economy, especially the tourism sector, it also comes with several challenges.

These events now typically require billions in capital investment and demand extensive infrastructure to accommodate, transport, and secure hundreds of thousands of visitors, along with other stakeholders. Investment of this scale comes with significant risk. After the 1994 World Cup in the United States, host cities experienced net economic losses instead of the anticipated gains. Similarly, the 2004 Athens Olympics cost Greece at least 3.4% of its GDP.

Once a city wins the bid to host a major sporting event, it often adds roads, enhances airports, and constructs new rail lines to accommodate the influx of people which, in the long-term demand significant maintenance costs. In the rush to create modern venues and “megacities,” many locations have struggled to maintain occupancy and usage once the events ended. The 2014 Sochi Winter Olympics serves as a cautionary tale in this regard. The city saw newly built hotels and sports facilities underperform, partly due to geopolitical tensions and lack of long-term visitor interest. The challenge lies in ensuring that infrastructure is designed with a long-term vision, capable of supporting sustained tourism and economic activity. To avoid overbuilding, Qatar’s FIFA World Cup developments incorporated design solutions like stadiums with adjustable capacities and facilities that could be completely dismantled after the event.

Moreover, the rapid development seen in places like the Middle East and other emerging nations eager to capitalise on the sports tourism boom often comes with significant human and environmental costs. Large-scale construction projects can strain local resources, disrupt communities, and damage the environment if not carefully managed. For these developments to be truly sustainable, they must balance growth with the protection of people and natural resources. Ensuring a careful balance between development and sustainability will be crucial to ensuring that sports tourism delivers long-lasting benefits without causing long-term harm.

The Final Score

The growing intersection between sports, travel, and hospitality is reshaping global tourism dynamics, with the Middle East emerging as a key player in this evolution. The region’s substantial investments in infrastructure, sports events, and partnerships reflect its strategic aim to diversify its economy and cement its status as a global sports hub. While the economic and social advantages of hosting major sporting events are clear, challenges remain—particularly around sustainability, infrastructure longevity, and the management of rapid development. The success of these ventures will depend on balancing short-term gains with long-term planning, ensuring that sports tourism remains a driver of growth without compromising the environment or local communities. As the demand for sports-related travel continues to rise, the Middle East’s ability to navigate these complexities will determine its future as a premier destination for sports tourism.

For more information, please contact Harinya Sreenivas at [email protected]