The 2024 Indian Hospitality Trends & Opportunities Report

HOT!!! Handle with Care!

Such a simple, yet effective message displayed on your daily Take-Away Coffee cup, isn’t it? It cautions you about the temperature of its contents, while advising you to be watchful of the way you manage them. No confusing, long drawn disclaimers peppered with opinions and caveats. Uncomplicated, straight and clear! HOT… Handle with Care. That’s it!

The 2023/24 Trends & Opportunities Report for the Indian Hospitality Industry shares the spirit of this very same message. The fiscal year (April 2023 – March 2024) had two clear, yet distinct memos for you. The industry is Fiery HOT! However, this is precisely why what we do from here on must be handled with the utmost care. The branded and organised hotel sector in India closed with a nationwide occupancy of 67.5% (the highest in a decade), with an ADR of ₹8,055 (the highest – EVER) and a consequent RevPAR of ₹5,439 (marginally shy of the lifetime high achieved in 2007/08). As is common knowledge, the percentage of Upscale-to-Luxury hotels made up a larger portion of the existing supply in 2007/08, as compared to this past fiscal, thus making the blended ADR of 2023/24 that much more praise-worthy. That being said, it is perhaps noteworthy that given the Rupee’s decline compared to the US Dollar over the past several years, the nationwide ADR is still shy of US$100 (US$97 in 2023/24), which is considerably lower than the lifetime high ADR of US$199 achieved by the sector in 2007/08, when viewed in US Dollar terms.

The nationwide branded inventory breached 1,80,000 rooms last fiscal, with Upscale-to-Luxury representing 39% of operating rooms, while Mid-to-Upper Midscale contributed 45%, and the remaining 16% were Budget & Economy category Hotels. The 5-year-CAGR of available room nights was 6.6%, while compounded growth of occupied room nights was 7.2% in the same period. Consequently, RevPAR CAGR for the past half-decade stood at 7.8%, reflecting a healthy state of affairs.

Overall, 2023/24 offered most markets the opportunity to break ceilings and cross barriers like never before. However, a few words of caution are warranted. Some of the nation’s best known leisure destinations did not receive the much-awaited inbound traffic in measures that were being expected. (We maintain that the Indian government could have done a much better job of marketing India globally. The fact that international inbound travellers did not cross the 2019 level is in itself revealing.) Meanwhile, domestic outbound was robust and many-a-traveller weighed the option of holidaying in Thailand, Sri Lanka, UAE or Turkey as an alternative to Goa, Udaipur, etc. Airfares also remained relatively palatable for these foreign destinations while domestic fares weren’t economical. Leisure hotels, having pushed their ADRs on the back of recent performances, witnessed some softening of demand. As we publish this report, 2024/25 has further played witness to Goa taking a beating, for instance. Lest we be left suddenly ‘high & dry’, it may be prudent to look at demand trends more carefully from here on.

On another note, while business travel related room night demand remained robust in most markets across India, corporate FIT is shying away from RFP negotiated rates. While the initial reaction was that this has allowed hotels to charge higher tariffs, it has also enabled the business traveller to seek ‘best available rates’ in the open market, moving away from the pre-pandemic philosophy of patronising hotels/brands that had pre-negotiated rates with companies. It would be wise to view this development as a double-edged sword.

The industry continues to perform well. With half of fiscal 2024/25 gone, there is overall growth over a phenomenal 2023/24 already, with the expectedly stronger winter months ahead. However, in most markets, growth has tapered, and in some it has indeed declined. Yes, the industry is still HOT. However, at the cost of repetition, we strongly urge you to handle recent developments with the utmost care.…

2023/24 shattered records, and 2024/25 is already demonstrating further growth compared to the previous fiscal year, at least on a blended, nationwide basis. While the overall narrative indicates that 2024/25 is showing growth compared to 2023/24 on a national level, it is important to note that this growth has understandably moderated, and some markets are beginning to show signs of negative growth.

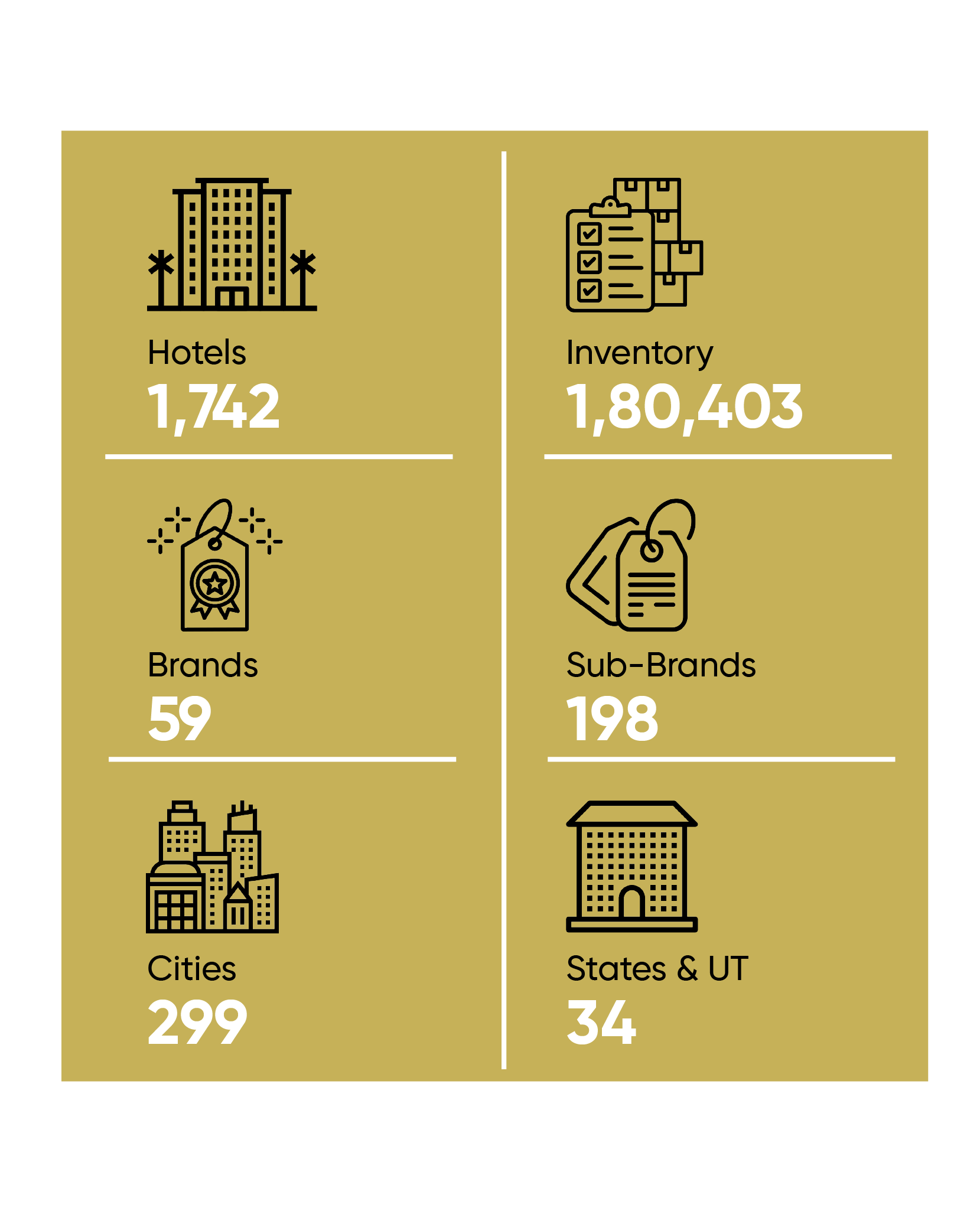

Hotelivate, a comprehensive hospitality consulting firm offering specialised services to clients across Asia Pacific and the Middle East, is proud to present The 2024 Indian Hospitality Trends & Opportunities Report, our 27th edition. The current participation base of 1,742 hotels with a total inventory of 1,80,403 rooms offers a comprehensive coverage of India’s branded hospitality landscape enabling better and more incisive analyses of national trends, performance of major hotel markets, and demand and supply forecasts than any other survey of a similar nature.

The results of our survey and analyses have been presented at an All-India level, by star category, by administrative zones, by city tiers and with a focus on the 20 major hotel markets, indicating the best and the worst performers and identifying reasons for the same.

Furthermore, a detailed review of the existing and future supply has been conducted at the macro and micro level to facilitate a better understanding of the growth in the number of branded rooms in the country across positioning. We have also offered additional insights within various sub-sections of this report for those seeking a deeper analysis of the demand-supply dynamics as well as future trends and opportunities in a rapidly evolving marketplace.

This year’s report introduces a new section on markets of interest, spotlighting several additional towns and cities beyond the top 20 markets that have attracted the attention of hotel developers and operators over the past year.

Preceding the results of the survey, we have provided a brief review of the Indian economy and an overview of the tourism sector. In particular, we have focused on details which have a direct bearing on the health of the Indian Hotel Industry.

For more information, please contact Achin Khanna at [email protected] or Shreya Gopinath at [email protected]