The Hotel Volatility Index 2024

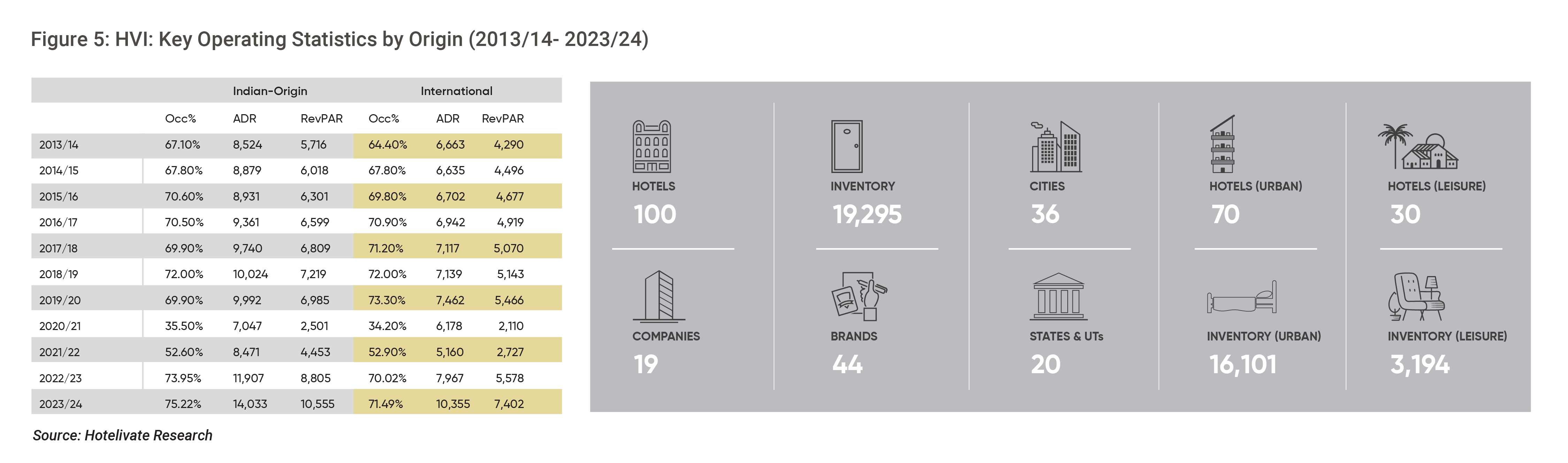

The Hotel Volatility Index (HVI), now in its seventh year is released as part of Hotelivate’s 2024 Indian Hospitality Trends and Opportunities. We have often noticed that the performance statistics of a market can often be skewed by the opening of new hotels, which may not have fully stabilised and can lower occupancy, average rate, or both. This is particularly true for rapidly emerging hotel markets like India. To better understand the performance of established assets, we selected a base of 100 hotels that have been operational since 2012 or earlier, serving as a reliable index for equitable year-over-year benchmarking across India. The Hotel Volatility Index (HVI) can provide an accurate measure of the country’s hotel industry.

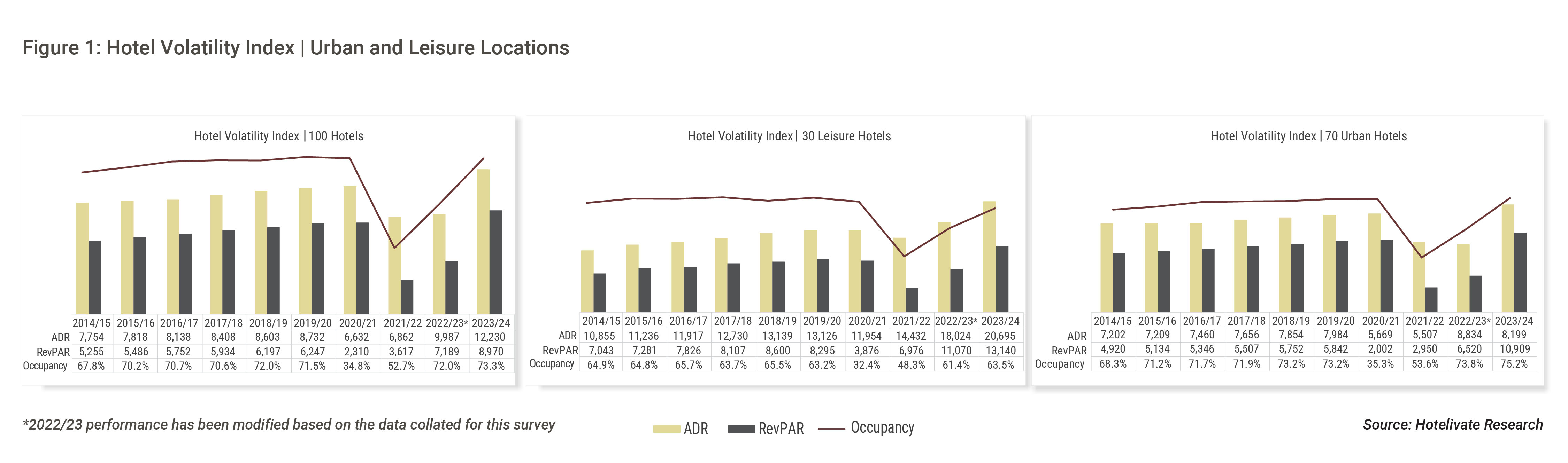

Figure 1 below illustrates the occupancy, average rate, and RevPAR performance of the 100 hotels between 2014/15 and 2023/24, further categorised by the type of location.

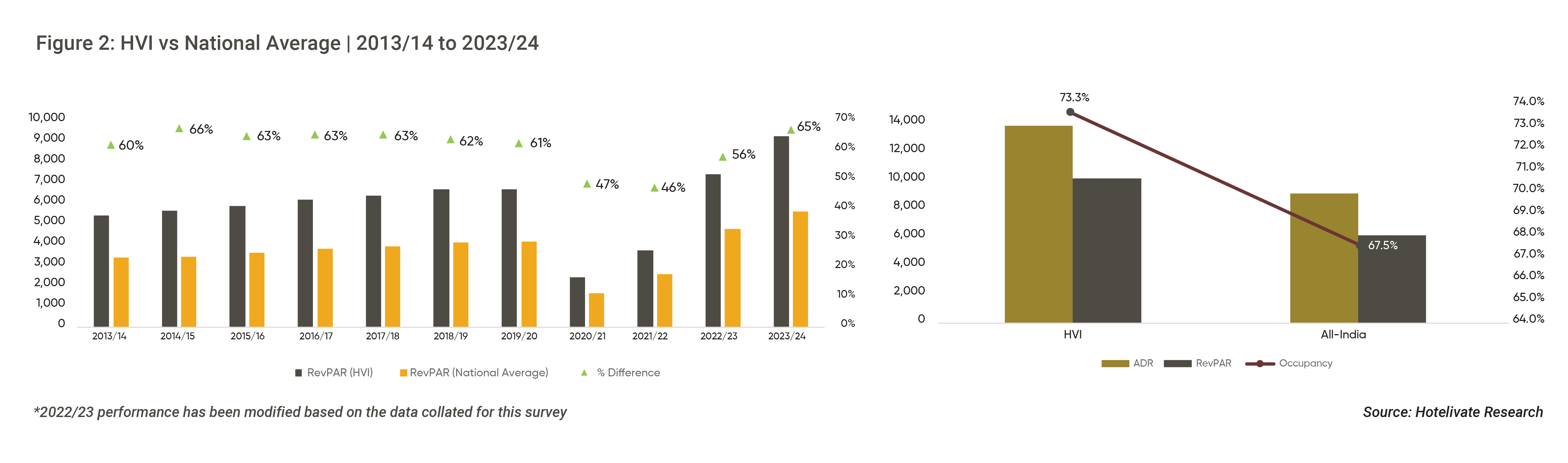

The HVI hotels significantly outperformed the nationwide hotel average, with a RevPAR premium of 65% (Figure 2). A closer analysis of occupancy and average rate reveals that HVI hotels achieved an occupancy of 73.3% (compared to the nationwide average of 67.5%) and an average rate of ₹12,230 (compared to the nationwide average of ₹8,055).

Additionally, comparing the performance of urban hotels to leisure hotels (Figure 1) reveals some interesting insights. Despite having a 16% higher occupancy rate, urban hotels continue to lag behind leisure hotels, which have a RevPAR premium of 60%. This is primarily due to the fact that RevPAR growth between 2022/23 and 2023/24 was predominantly driven by average rate increases. This trend has further widened the performance gap between leisure and urban hotels on a year-over-year basis.

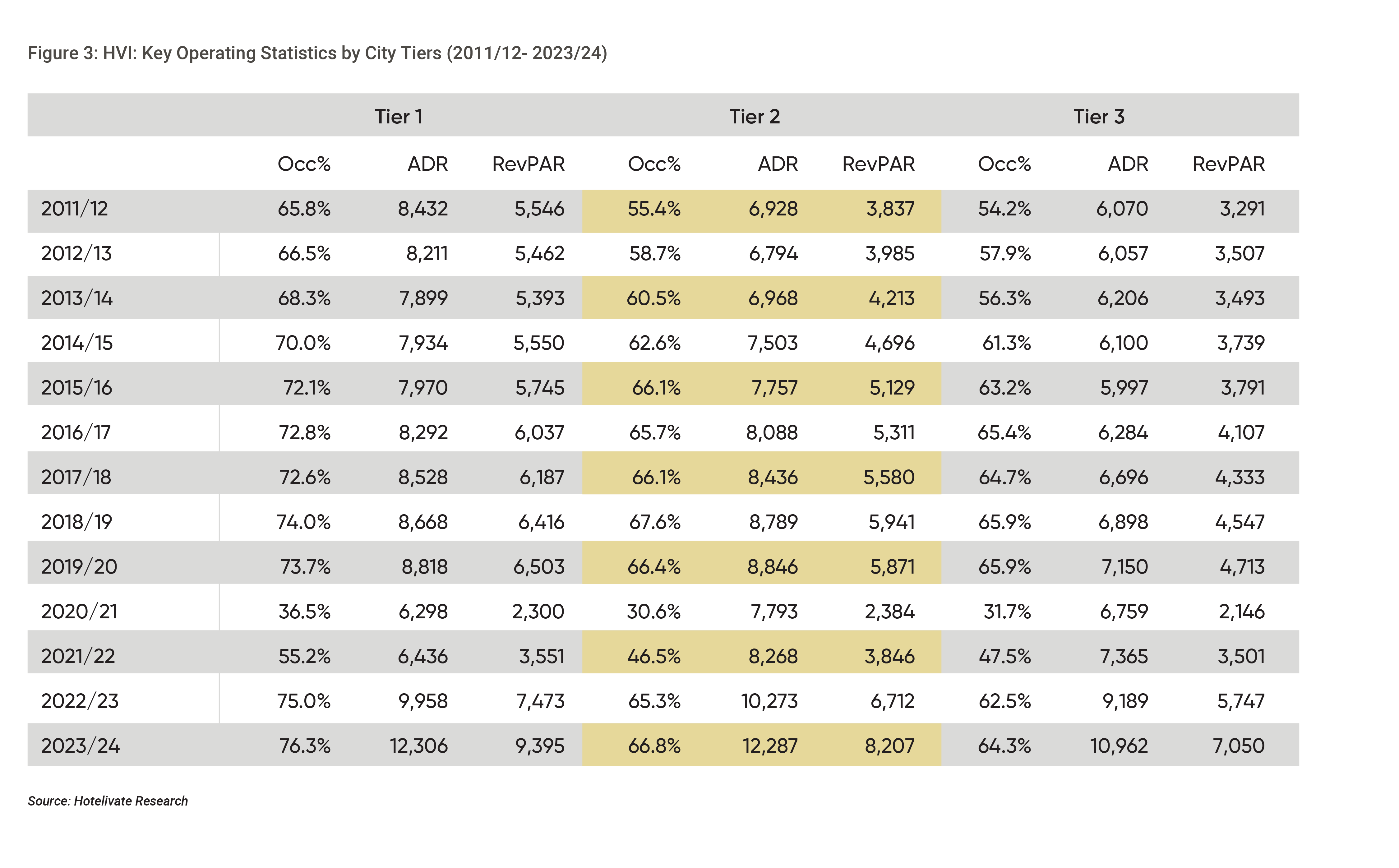

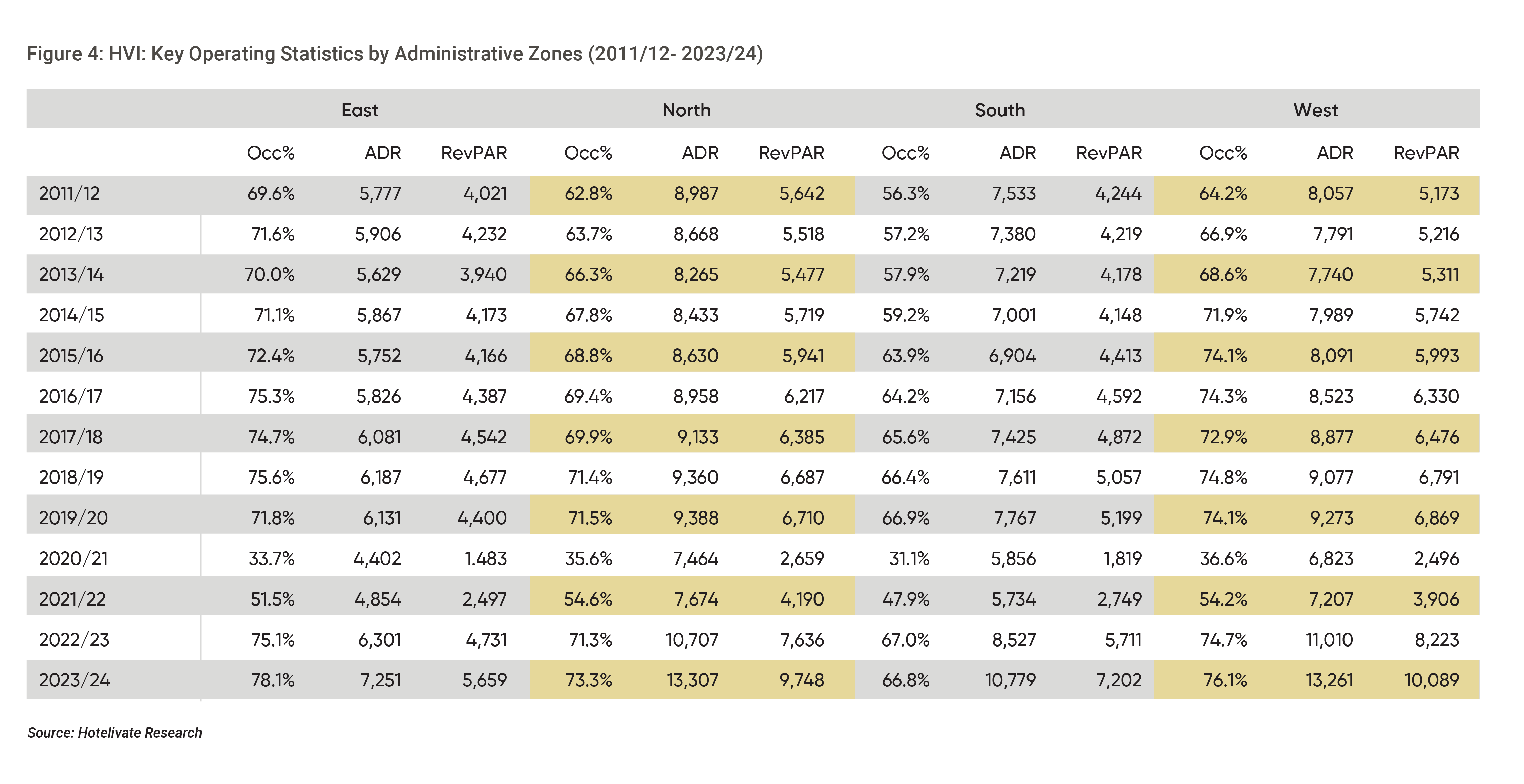

Looking at HVI from the lenses of City Tiers (Figure 3) and Administrative Zones (Figure 4) reveal interesting trends. The highest growth between 2022/23 and 2023/24 was reported by South India (26%) followed by North India (24%) and West India (20%). In terms of RevPAR though, North India saw a sharper increase (28%) followed by South India (26%) and West India (23%). Expectedly, Tier 1 cities continue to witness the sharpest growth in their performance (26%) while Tier 2 and Tier 3 markets see a similar growth (~22%). Moreover, as mentioned earlier, the performance levels of Tier 2 and Tier 3 markets are starting to converge to similar levels.

In summary, we believe the Hotel Valuation Index (HVI) offers a reliable evaluation of the hotel industry’s performance over time. Stable-state assets not only exhibit resilience but also stand to gain significantly during industry recoveries. By capitalising on the efficiencies gained during the global pandemic and adapting to evolving consumer behaviour, these hotels have achieved record-breaking results. This underscores the importance for hotel owners to exercise patience, allowing their assets to stabilise and leverage economic resilience for consistent, higher returns. Moreover, it is essential for owners to invest in renovations and refurbishments to ensure their properties are well-maintained and continue to deliver superior returns. Hotels within the HVI sample set are likely to experience moderate rate growth while maintaining stable occupancy levels. Effective asset management, strategic sales and marketing, and talent development remain critical areas of focus to sustain performance and maximise returns during this period.

For more information, please contact Manav Thadani at [email protected]