The Southeast Asia Story

At the recently concluded 9th edition of THINC Indonesia, hosted by Hotelivate, industry experts highlighted Southeast Asia as a market with immense potential and complexity. The region’s rich cultural diversity and evolving demographics indicate rapid growth in the coming years. Understanding these trends and opportunities is essential for unlocking the market’s potential in the near future.

The Consumer is Changing

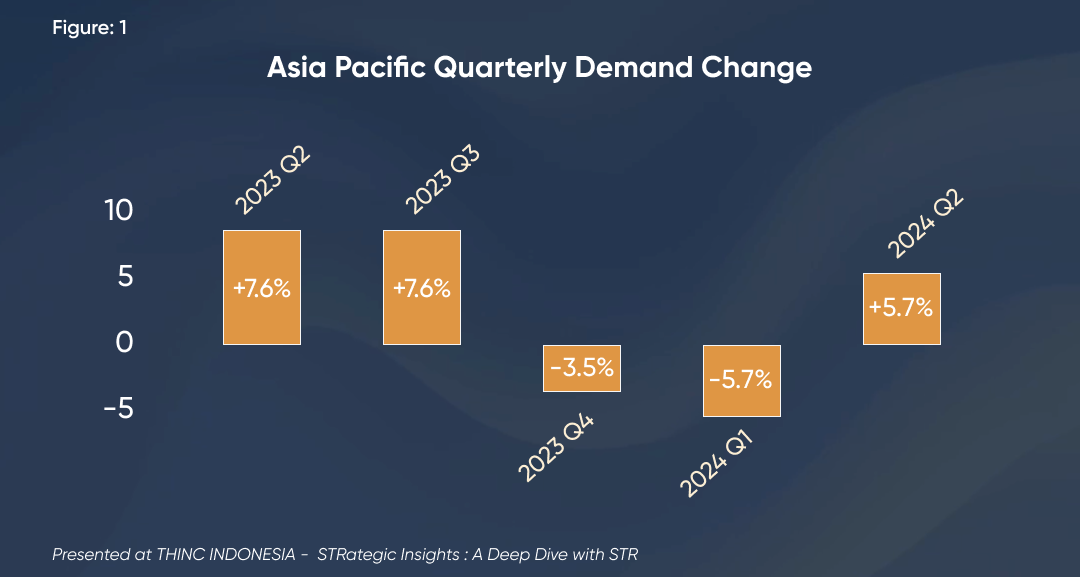

Although the tourism sector faced some turbulence in the last year, the previous quarter has shown a strong resurgence.

The Consumer profile of the southeast Asian Travel sector is changing with a rise in Bleisure (business + leisure) and wellness travel. Additionally, outbound travel from China is on the rise due to various policy reforms making travel easier for the Chinese citizen. Although the total number of outbound trips in 2024 is projected to fall short of 2019 levels by nearly 25 million, the shift from group travel to FITs has helped narrow the gap in travel spending. Interestingly, Chinese tourists are spending less on shopping and more on hotels, food & beverage and experiences. South Korea and Japan currently attract most of China’s outbound demand, thanks to low airfares, with Indonesia also climbing in popularity. As Indonesia’s second largest source market, India’s outbound travel has surpassed 2019 levels but remains modest compared to the nation’s potential. A key opportunity for many countries lies in enhancing short-haul connectivity within Asia.

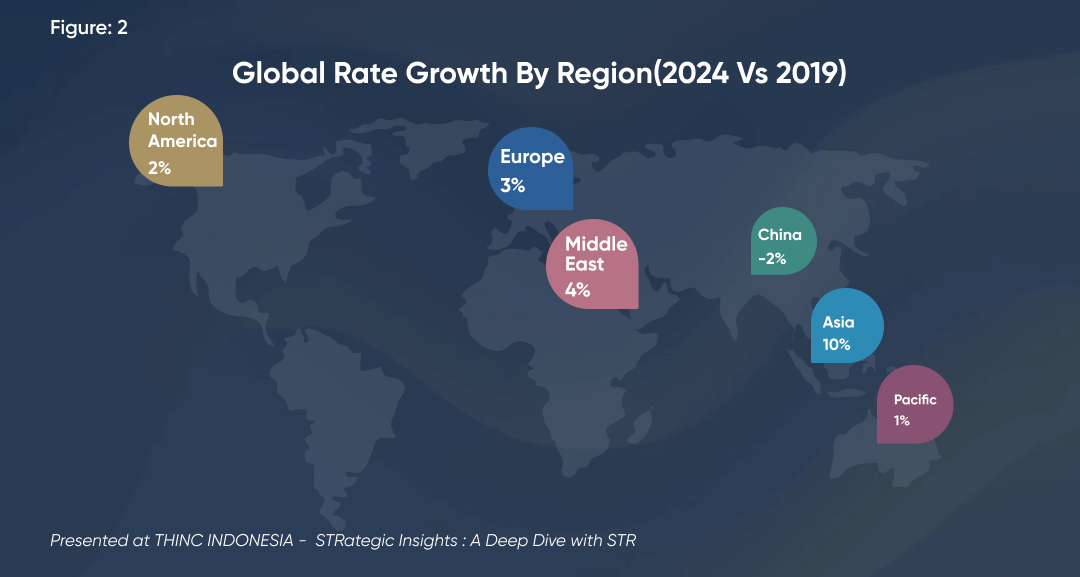

The Asia-Pacific region (excluding China) is experiencing the highest ADR growth rates globally. Furthermore, alternative accommodations are gaining popularity, catering to new demand segments like corporate and medium-term (less than 30 days) travellers. With increasing disposable income and a growing desire for leisure tourism, the Asia-Pacific region accounted for 25% of the top 20 countries driving global outbound tourism demand in 2023.

Technology Trends

Exciting innovations are emerging in Property Management Systems (PMS), particularly as companies and assets increasingly adopt cloud-based software. The PMS space has seen numerous acquisitions, attracting significant interest from private equity firms. Another area of heightened investor interest is travel retail, where New Distribution Capabilities are driving increased recognition and investment.

Despite these advancements, the travel industry lags behind other consumer-facing sectors in adopting AI. Historically, technology adoption in the hospitality industry has been hindered by the sector’s “people-first” approach and the high cost of implementing new technology has slowed its progress. Digital adoption can minimise productivity loss that occurs when humans switch tasks, thereby optimising team efficiency. However, the rapidly declining cost of data storage is enabling new travel technology companies to build scalable solutions. AI is poised to disrupt existing technology, presenting both challenges and opportunities for business models. The travel industry will need to adopt new technologies to meet evolving traveller expectations.

Spotlight on Indonesia

Indonesia’s tourism sector is experiencing a robust recovery, driven by several key trends and opportunities. The government has set an ambitious investment target of US$3 billion in the tourism sector, supported by ten Special Economic Zones dedicated to tourism and the creative economy. Political stability, consistent GDP growth, and an expanding middle class are fostering confidence in the Indonesian market.

Although foreign tourist arrivals have yet to reach pre-2019 levels, the country has seen growth in both occupancy rates and Average Daily Rates, underscoring the potential of domestic tourism. The potential for recovery and growth of foreign tourism is immense, however, connectivity to regions beyond Jakarta and Bali remains limited and must be improved to attract further interest.

Unlike other Southeast Asian markets, rate growth in Indonesia is not confined to major cities. Bali and Jakarta have been leading the pack with 14% and 11% year-on-year ADR growth, respectively, but other markets such as Java are not far behind. Notably, luxury hotel ADRs in Bali have surged from US$300–400 before the pandemic to nearly US$2,000 today.

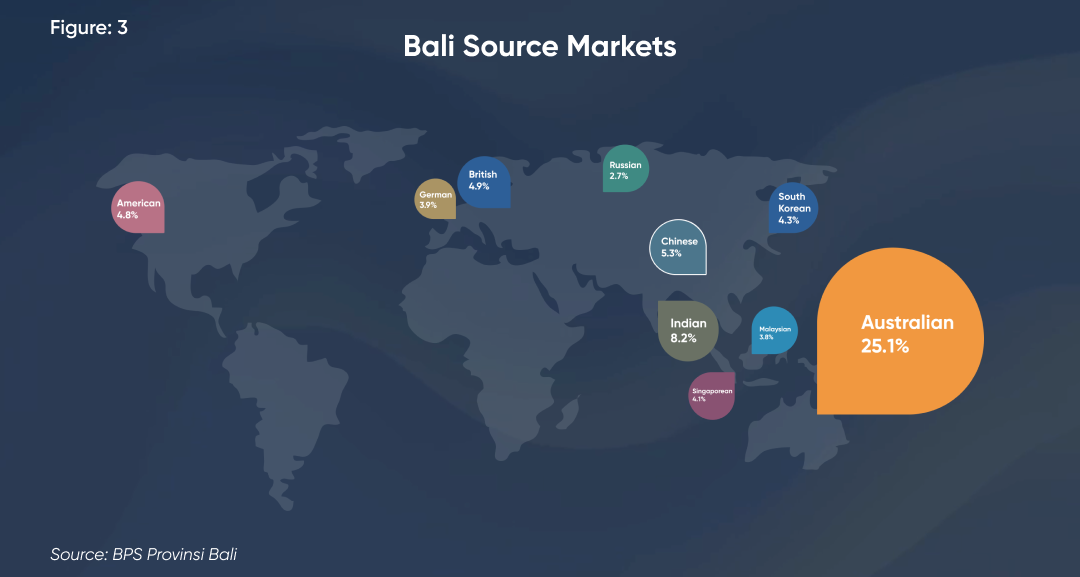

The size of Indonesia’s middle class is projected to triple, growing from 45 million in 2021 to 135 million by 2030. This demographic is expected to take 5.6 trips per year, 40% more frequent than other travellers, with a significant portion traveling for leisure. India and China are becoming increasingly important source markets for Indonesia, contributing significantly to its tourism sector. The increase in disposable income among Chinese and Indian travellers is driving this trend. This indicates a rising interest in both domestic and outbound international travel among Indonesians.

However, the expansion of the Indonesian hospitality market is not without its challenges. The key challenges among these are:

Environmental Degradation: The rise in tourism is putting immense pressure on Indonesia’s delicate ecosystems, making them highly vulnerable to damage. Globally, resource scarcity is becoming an increasing concern, particularly in Southeast Asia’s tourist hotspots. While many hospitality developments are adopting sustainable practices, there is a pressing need to expand these efforts as tourism continues to grow. Future properties must focus on regenerative development and adaptive resource management, with an emphasis on using recycled and biogenic materials.

Preservation of Local Heritage: The rapid development of new hotels and tourist facilities is causing traditional tourist destinations in the region to lose their unique identity and cultural heritage. Preserving this heritage, which is a major draw for tourists, is essential.

The Southeast Asian market offers tremendous opportunities and potential in the hospitality sector. Following a successful conference filled with valuable insights into this vibrant region, we now turn our attention to another promising hospitality market: the Middle East. The inaugural edition of THINC Middle East will take place in Dubai on the 12th and 13th of February 2025.

For more information, please reach out to us at [email protected]