Retired but Dependent No More – The Rise of Geriatric Care Facilities in India

As per India’s population census of 2011, the country is home to ~104 million senior citizens (aged 60 and above). By 2026, this number is expected to grow to ~173 million. Life Expectancy in India merely 20 years ago was 62.09 years which, by 2019, had increased to 68.7 years. Owing to stellar scientific breakthroughs in healthcare and the resultant increase in life expectancy in the country, senior citizens, particularly in urban households, find themselves not only active but also able of an independent lifestyle. For many such people, depending on their children in their own old age is no longer the preferred option. Senior Living communities, therefore, are fast gaining popularity in a society that has shied away from the concept of ‘old-age homes’ for years.

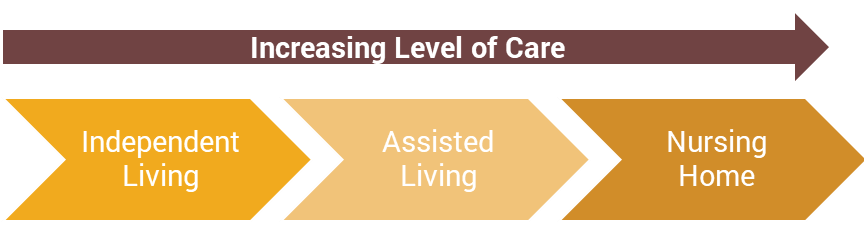

Senior Living is a generic term encompassing residential communities created specifically for senior citizens and ranging across various levels of care offerings.

- Independent Living typically consists of residential facilities for elders who are able-bodied and do not require assistance with their daily routines

- Assisted Living describes a housing facility for elders who require help with their activities of daily living (ADL) due to mental or physical disabilities or simply age

- Nursing Homes are facilities for elders who require a higher degree of intervention from professional caregivers, many a time medically trained, to be able to carry out their activities of daily living

In urban India, with nuclear families on the rise, elder family members oftentimes face loneliness, neglect or both as their adult children are busy balancing their work and personal lives while the grandchildren, if any, juggle their own education and extra-curricular activities. Adult children find themselves unable, and not always unwilling, to extend additional support to their parents and in such cases, while the elders’ basic needs of shelter, food, clothing and medical attention are certainly met, their desire for attention, conversation, emotional connect and social life remain unfulfilled. Geriatric Care facilities essentially fill this gap and help elders live sustainable lives amongst people like themselves with almost all their physical, social and spiritual needs met in a professional and kind manner. Geriatric Care or Senior Living communities are increasingly becoming a more acceptable concept rather than taboo in our society as both elders and their adult children realise the need and importance of such offerings.

Typical users of such facilities in India currently are the Gen-X who are now above the age of 55, are retired or nearing the end of their professional years and are physically and financially able to live by themselves. For many of this set of consumers, retirement homes become their primary home with them almost only leaving the community to travel.

As these fairly able-bodied and independent elders look for retirement homes in India, communities that are focused around providing quality accommodation along with adequate medical attention, state-of-the-art recreational and wellness facilities in terms of daily activities such as yoga and meditation centres, dance studios, gymnasiums and fitness centres, sports facilities, swimming pools, etc. extending up to salons and spas as well as food and beverage offerings including a three-meal restaurant and one or two specialty outlets and cake shops have mushroomed across the length and breadth of the country over the last two decades.

Geographically, it has been observed that while Nursing Homes prefer to be located within cities and close to full-fledged multi-specialty hospitals, thereby making emergency medical care as well as regular visitation by family members easier, Independent Living communities and Assisted Living centres are more commonly situated on the outskirts of cities or at getaway locations yet in the vicinity of quality medical facilities. Detailed conversations with operators of such facilities reveal that this location strategy is the result of most residents wanting to live in quieter settings, away from the hustle and bustle of city life, breathing quality air and surrounded by nature.

Geriatric Care facilities in the Western World, where the concept is more common and largely accepted, are increasingly developing into hybrid facilities where residents transition with age from one care level to another i.e. as the necessity for care and help increases with increasing age for some residents, the same facility offers the option for residents to shift from basic independent living to the assisted living model by adding a part-time caregiver and on to a nursing home setup as the next step, all within the same community.

Hotelivate research indicates that as of 2018, India had an existing supply of nearly 5,000 senior living units with about a third more in the active pipeline. Overall, the southern part of India appears to have more such facilities as compared to the northern part. These units, primarily in the Independent and Assisted Living spaces, work on two types of Business Models. The most preferred option for both consumers and developers is the freehold/ outright sale model wherein the unit is sold at comparable prices to the consumer with merely a maintenance fee component (generally ranging from ₹3 per square foot to ₹30 per square foot) that remains payable at a monthly, quarterly or annual basis through the length of ownership. These properties are then eligible to be passed down to the family members of the initial geriatric owners for use in their own old age. Some developers also offer owners the option of buying back the units at a later stage at the market price, in order to resell the units. The alternative business model is to offer units on long leases of ~30 or 60 years post which the unit can either be transferred to the adult children of the initial owner by repaying the lease amount as per market rate or released back to the developer for leasing again.

In countries where Geriatric Care is a more developed segment, another available business model is the monthly rental one which offers residents the flexibility to ‘pay-as-you-go’ and does not tie them down with a physical asset. This becomes a more affordable option thereby giving the system the advantage of appealing to a larger target audience. Geriatric Care is certainly an upcoming concept in India, which appears to be more popular under the freehold model at present and while this model does come with the benefits of allowing ownership and building asset value for oneself, the downside is the heavy upfront payment and illiquidity of the asset in the long run, making this an expensive proposition. While some existing facilities offered monthly rentals for a short period during the lockdown in India, Hotelivate believes that as Geriatric Care facilities in the country become more popular, the rental model will also become prevalent.

Depending on the positioning of the facility, ranging from 3-star to luxury, types and extent of services offered and location, these units are priced from ₹30-40 lakh on the lower-end up to ₹2 crore on the higher-end. Units available are typically in the one, two- and three-bedroom categories with a half bedroom that can be used as a study, puja room or help’s room sometimes available. In terms of size, these apartments range from ~380 square feet for the smaller one-bedroom specification all the way to 3,500 square feet for the 3.5-bedroom units. Additional services such as housekeeping, laundry, meals, caregivers, etc. are also offered at these communities, many a times by specialised operators, wherein total expenditure per day would amount to ~₹2,000 to ₹2,500 per resident.

It is important to remember that while Geriatric Care facilities apart from Nursing Homes, broadly resemble residential establishments, such facilities require an additional investment of space and money in the setting up of essential services and service offerings focused on elder care that must be maintained throughout the operation of the facility. Having said that, from a pure ROI perspective, while Hotels, with their volatile performance cycles, aspire to garner IRRs in the range of 12% – 15% for their developers, Independent and Assisted Living facilities appear to have the potential, in some cases, to achieve higher IRRs north of 25%. The COVID-19 pandemic has fuelled demand for this segment as both elders and adult children have realised the necessity of having professional medical care in such times.

For more information, please contact Shailee Sharma at [email protected]