The Hotel Volatility Index 2019

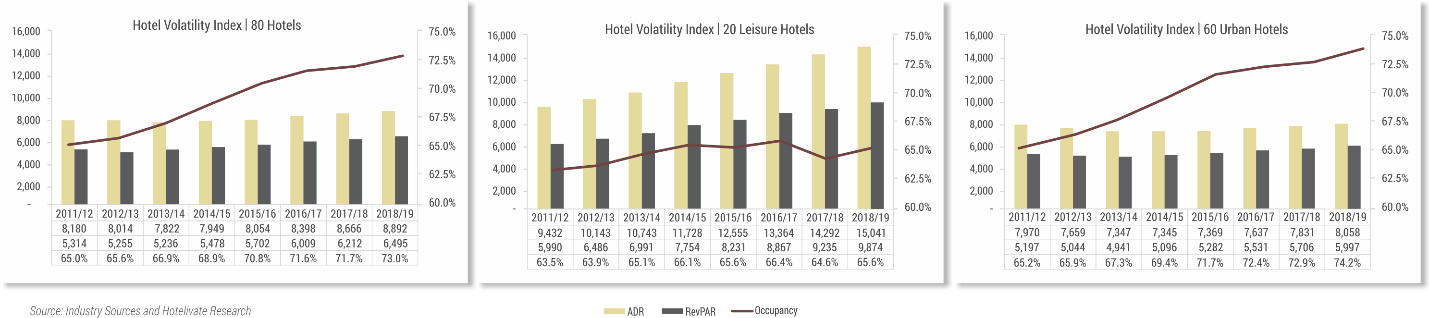

Figure 1, below, illustrates the occupancy, average rate and RevPAR performance of the index between 2011/12 and 2018/19, further categorized by location.

FIGURE 1: HOTEL VOLATILITY INDEX | URBAN AND LEISURE LOCATIONS

Source: Industry Sources and Hotelivate Research

The HVI recorded an occupancy of 73% at an average rate of Rs. 8,892 in 2018/19, resulting in a RevPAR of Rs. 6,495. In line with the nationwide trends, all three metrics grew over the previous year, as hotels continued to reap the benefits of the current industry up-cycle, albeit moderately. This also indicates a favorable demand situation that is enabling existing hotels to improve their performance despite the influx of new rooms. Notably, leisure hotels in the index consistently adopted a rate strategy, with the ADR witnessing a year-on-year increase since 2011/12, with some fluctuation in occupancy. A reverse trend can be observed for urban hotels that adopted a volume strategy and grew occupancies steadily over the last eight years, compromising on the average rate to adjust to market dynamics.

Specifically, leisure hotels in the HVI witnessed an increase of near 7% in RevPAR in 2018/19, driven by a 5.2% increase in average rate over last year. Occupancy of these hotels also recorded a growth of one percentage point during this period. Comparing the performance to that of the urban hotels in the HVI, the RevPAR of leisure properties was 65% higher in 2018/19. Moreover, in the last five years, this sample set of 20 leisure hotels grew their RevPAR at a CAGR of 6.2%. Largely resilient to global uncertainties and maintaining a stable momentum overall, domestic tourism has been a key contributor towards the healthy performance of this segment. According to WTTC’s most recent India Annual Research Report, domestic travel spending accounted for 87% of the direct Travel & Tourism GDP in the country in 2018. In terms of leisure vs business travel expenditure, the former (inbound and domestic) generated 95% of the direct Travel & Tourism GDP. Also, the government’s keen focus on improving India’s tourism bodes well for leisure markets, especially with the Prime Minister urging the people to visit at least 15 domestic tourist destinations by 2022. Inbound tourism is also on a growth trajectory, aided by favorable policies and developments, such as e-visa, expansion of the visa-on-arrival facility, the Incredible India 2.0 campaign and better regional connectivity. All these trends are significant, as they merit the opportunity to invest in leisure destinations in India.

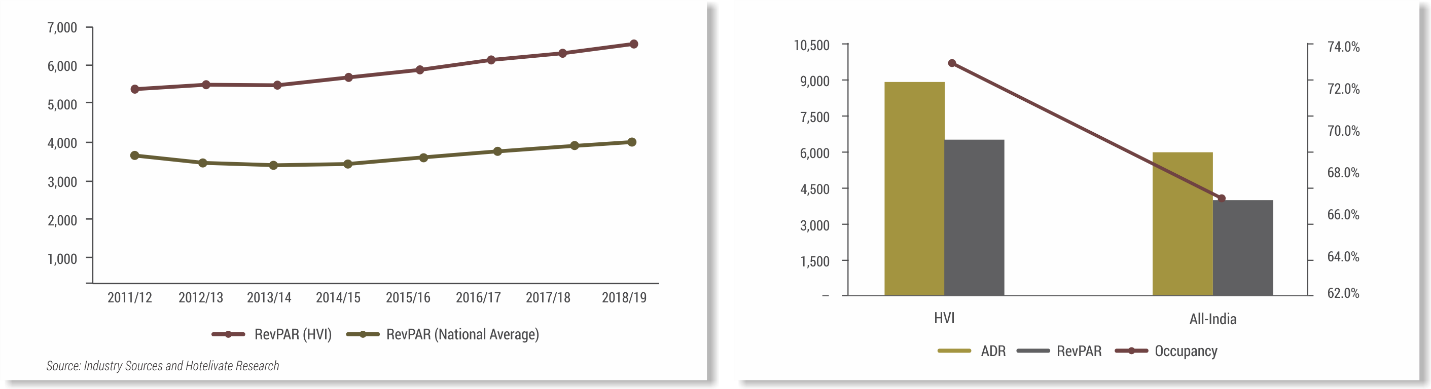

FIGURE 2: HVI vs NATIONAL AVERAGE | 2018/19

Source: Industry Sources and Hotelivate Research

However, it is disappointing to note that approximately only 31% of the new supply is anticipated to enter leisure hotel markets in the country over the next five years. In the past, operating hotels in leisure destinations was challenging owing to issues of seasonality, inaccessibility, and lack of skilled manpower. These have now been overcome to a large extent, as some domestic and international hotel chains took the leap and established a presence in these markets, contributing to their overall development. Furthermore, better air connectivity to Tier-II and Tier-III cities, increasing M.I.C.E tourism, spiritual tourism, heritage tourism and wildlife tourism, as well as weekend travel and staycations are creating a more enabling environment for leisure hotels in India. Even so, many diverse locations remain untapped, and Hotelivate recommends developers and operators to begin looking at this segment more actively, going forward.

Comparing the performance of the index to the national average in Figure 2, we observe that the RevPAR of these 80 stabilized hotels (Rs. 6,495) was 63% higher than that of the All-India sample set (Rs. 3,981) in 2018/19. Moreover, it is interesting that the gap between the RevPAR of the HVI and the national average has been widening each year since 2011/12. This validates our argument for using the index as an additional performance benchmark for stabilized hotels. An increase or a decrease in the HVI’s performance points directly towards the organic growth/decline in demand. In contrast, the nationwide average, and that of individual hotel markets, is impacted by the new supply coming in each year. When new hotels open, they temporarily skew the market metrics by pulling down the occupancy and/or average rate, and thus, relying solely on the All-India performance or that of a local competitive set can be misleading for a hotel.

To conclude, the HVI serves a similar purpose for the hotel industry as the same-store performance tracked by retail companies, and even some international hotel chains. Investors prefer to see an increase in same-store performance, as it is a more accurate gauge of the current and likely future performance of a company/industry. The HVI recorded an annual growth in occupancy since 2011/12, including the last downcycle that ended in 2015/16. This shows that demand is robust and future increases can be expected. Also, with the current up-cycle having a few years left, we forecast an upward trend in the industry performance in the short to medium term.

For more information, please contact Manav Thadani on [email protected] or Juie Mobar on [email protected]