Chennai – On the Path to Revival

C hennai, one of the most important commercial hubs in South India, has witnessed a promising improvement in RevPAR over the last four years. Despite being an important centre for the automobile & ancillary, manufacturing, and services sectors (IT/ITeS and financial institutions), the city’s hotel market performance had lagged behind that of other metropolitan cities in India for many years. While 2017/18 recorded a marginal decline in marketwide occupancy for the first time since 2013/14, it also witnessed the market’s first positive growth in average rate since 2008/09. Moreover, the slump in occupancy is optical at best as it is the weighted output after the addition of nearly one thousand new hotel rooms during the fiscal. That being said, with limited supply slated to open in the next five years, performance of the hotel market has a more promising future.

Hotel Market’s Supply and Demand Equation

Chennai has the fourth largest branded inventory in India, with a total of 9,211 existing rooms in the branded space and another 1,100 in the pipeline. The city ties with Pune in having the highest rate of active development in the country at 89%. Interesting to note, of these 1,100 rooms, 62% have recently commenced operations in 2018/19 and are ‘proposed supply’ only when viewed from last year’s fiscal closing point of view.

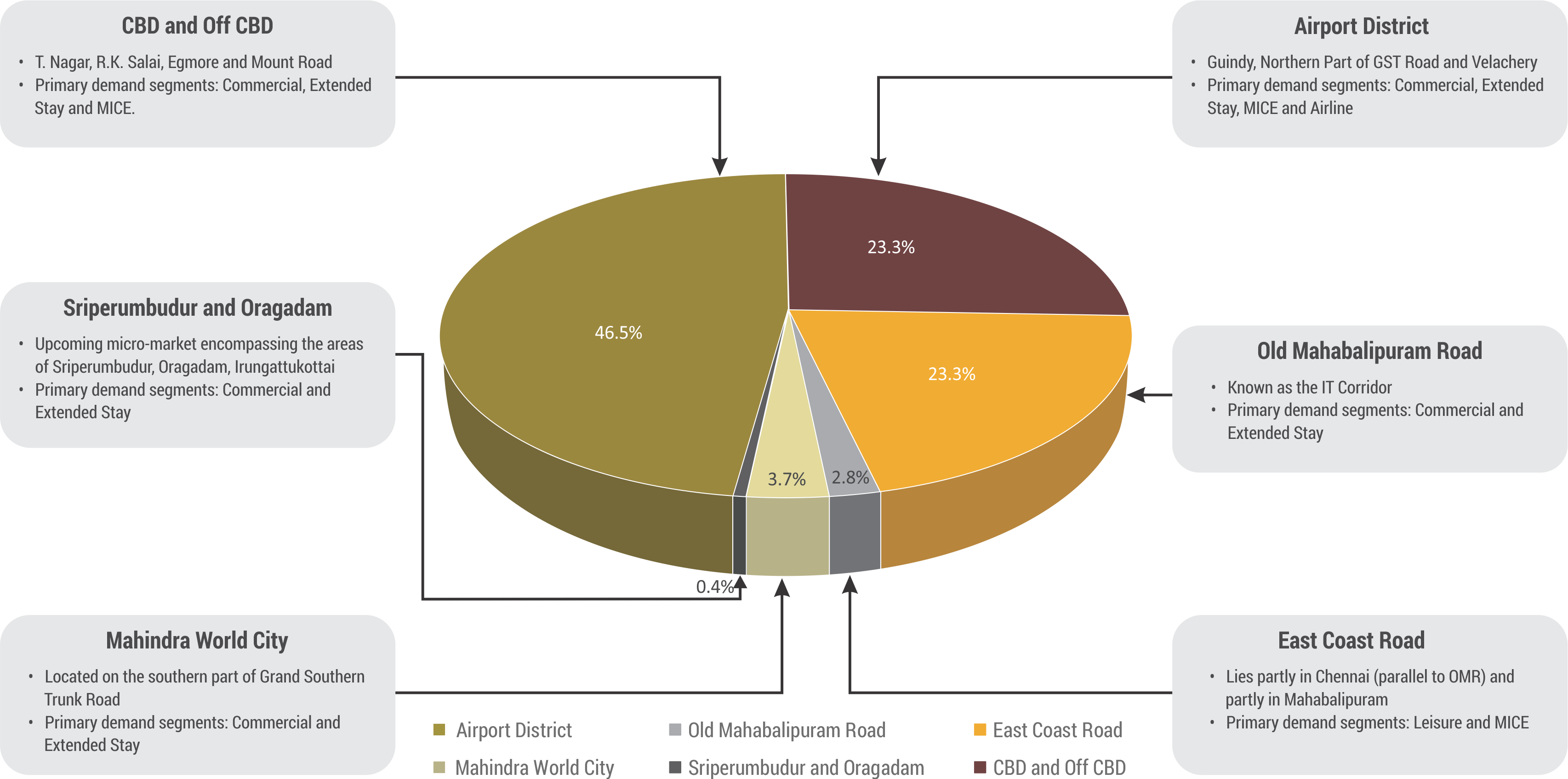

Furthermore, like other metros in the country, Chennai now has distinct micro-markets, with each of them having unique characteristics of supply and demand. Figure 1 depicts the percentage split of Chennai’s branded inventory into the various micro-markets.

Figure 1: Chennai | Branded Inventory

The OMR stretch has been under immense supply pressure over the past few years and is likely to remain so in the short term. Demand in OMR is primarily IT/ITeS, with mid to senior level executives staying in these hotels. The Extended Stay demand is driven by project related business, training programs, and advent of new IT offices. However, because of the low spending power of this segment, OMR hotels face stiff competition from serviced apartments and guest houses in the unbranded space.

2017/18 saw the addition of 813 more rooms in the micro-market, resulting in a decline in occupancy by 5%. The bulk of new supply was in the Upper Midscale space, and this helped the marketwide average rate to increase by 4% during the same period. Going forth, with another 200 rooms slated to open in the coming months, the micro-market is likely to struggle during the next fiscal, as new hotels begin to ramp up in performance and establish themselves in the market. It may take another 12 to 18 months for all the new supply to be adequately absorbed.

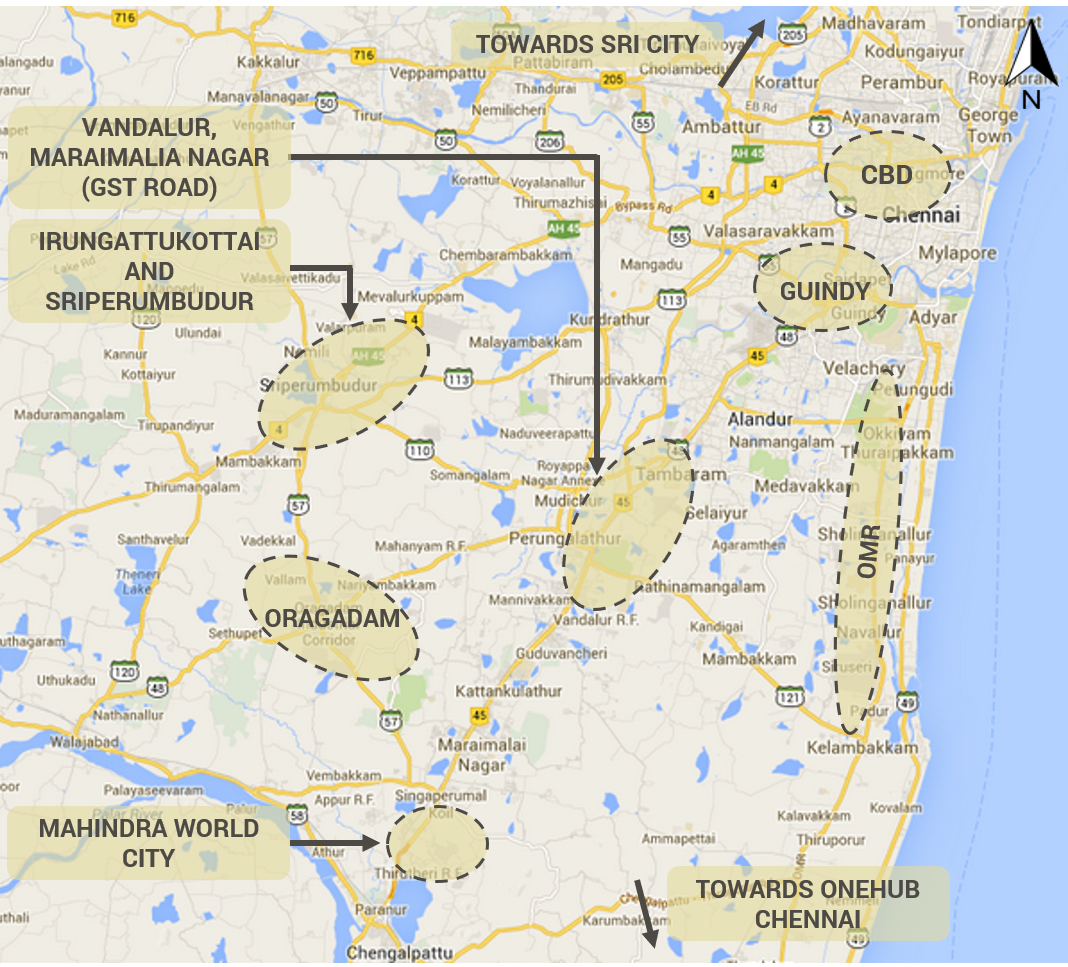

Figure 2: Micro-Markets and their location vis-à-vis each other

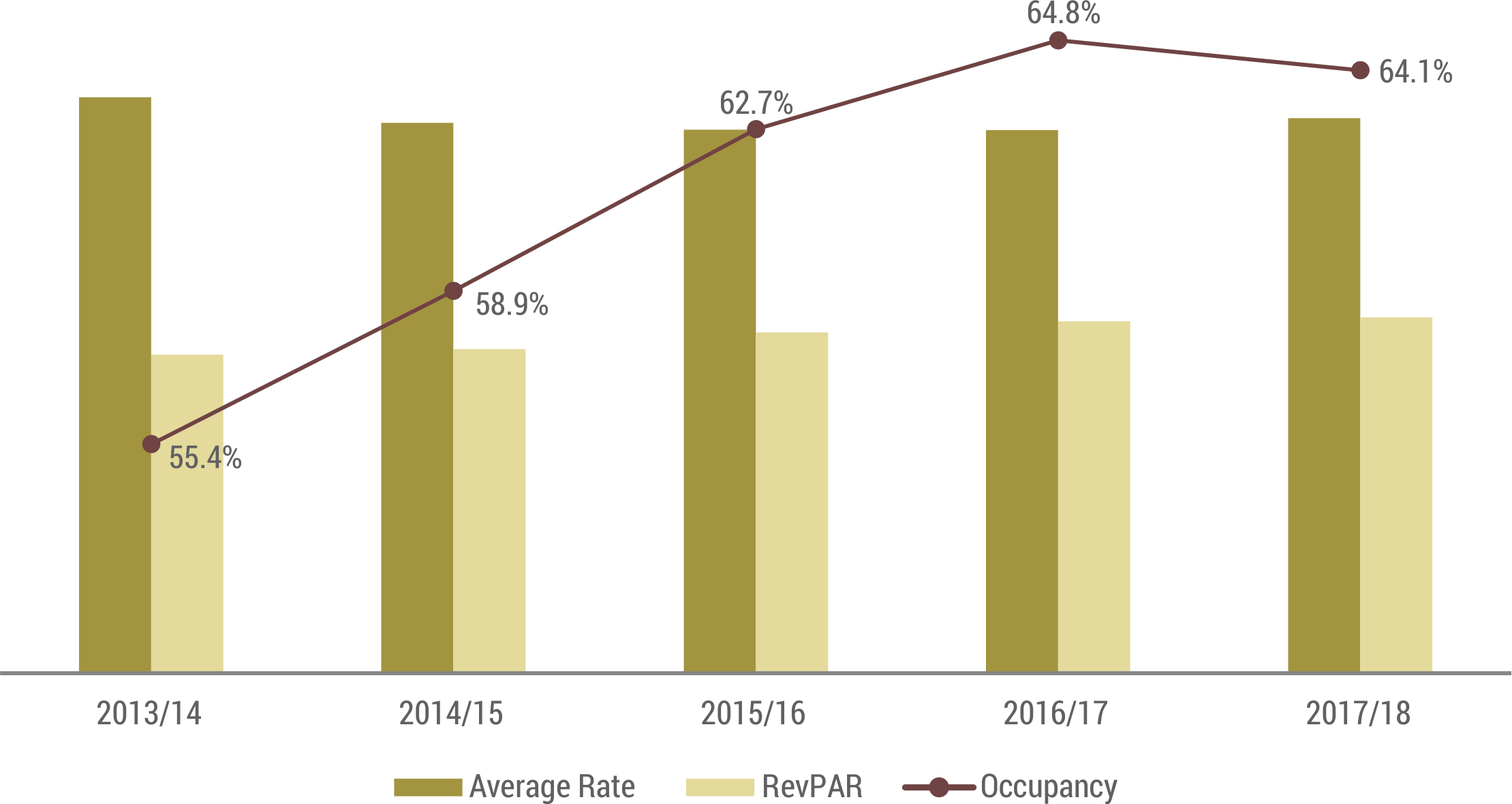

Figure 3: Hotel Market Performance

Over the last fiscal, the OMR and Guindy micro-markets were principally responsible for the overall drop in occupancy for the Chennai hotel market, displaying a decline of 4.7% and 2.8% respectively. for OMR, this can be attributed to an increase in supply by 38%, while for Guindy (which witnessed a meagre increase in supply), this was because hotels collectively pushed up rates by 5.4%, unperturbed by the consequent displacement of business to neighbouring micro-markets.

In 2017/18 the overall Chennai hotel market displayed an average rate growth of 2.2%, for the first time in little less than a decade. Over the past four years, while the city had seen a year-on-year increase in occupancy (with the exception of 2017/18), average rates remained under pressure. In fact, improving average rates has been an ongoing challenge, primarily due to the nature of demand in the city and hotels preferring to take the easier route of dropping rates to fill rooms.

Moreover, several external forces such as the floods of 2015 and Cyclone Vardah in 2016 also hindered hotel performance, especially average rates, since these tragedies hit during peak season and hotels were forced to adopt a volume strategy to fill rooms. Looking at five years of historical data, occupancy across the city has grown at a CAGR of 3.7%, while average rates depicted a negative CAGR of 1.8%, over the same period.

Hotelivate’s Outlook

Performance of the Chennai hotel market will now improve. Despite the fall in occupancy, which seems to be a conscious decision by hotels to improve rates, the market is on an upward growth trajectory. Although average rates are growing slower than the desirable pace, decision makers are cognizant of the fact that the leveraging the average rate route will be beneficial in the long run. The city is likely to witness an improvement across all operating parameters in the current fiscal, indicating that the needle is moving in the right direction for the city.

For more information, please contact [email protected]